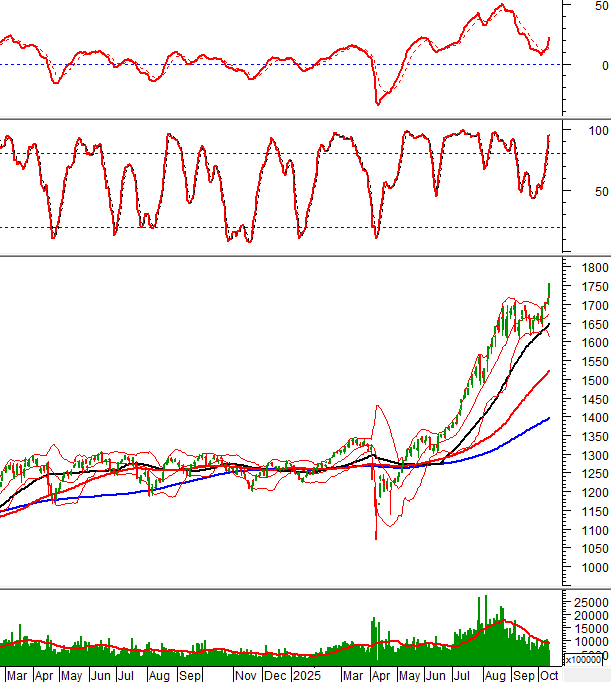

Technical Signals of VN-Index

During the morning trading session on October 13, 2025, the VN-Index continued its upward trend, reaching an all-time high. With no significant resistance levels above, the growth outlook remains highly positive.

As the previous peak from September 2025 (equivalent to the 1,700–1,711 point range) has been completely breached, it will now act as strong support rather than resistance.

Additionally, the index is closely following the Upper Band of the Bollinger Bands, and this band is beginning to expand again.

Technical Signals of HNX-Index

During the morning trading session on October 13, 2025, the HNX-Index also resumed its growth, testing the Middle Band of the Bollinger Bands.

Trading volume is expected to surpass the 20-day average by the end of the session.

KBC – Kinh Bac City Development Holding Corporation

During the morning trading session on October 13, 2025, KBC shares continued to rise, accompanied by trading volumes exceeding the 20-session average, reflecting investor optimism.

Furthermore, KBC successfully broke through the upper edge of the Falling Wedge pattern, while the Stochastic Oscillator moved out of the oversold region after generating a buy signal within it.

If these positive technical signals persist and KBC crosses above the 50-day SMA in the coming period, the potential price target is the previous peak from September 2025 (equivalent to the 42,000–43,300 range).

TCB – Vietnam Technological and Commercial Joint Stock Bank

During the morning trading session on October 13, 2025, TCB shares rose, forming a Three White Soldiers candlestick pattern. Trading volumes have consistently exceeded the 20-day average in recent sessions, indicating increased investor activity.

Moreover, TCB continues to follow the Upper Band of the Bollinger Bands, while the MACD indicator keeps rising after generating a buy signal. This suggests that positive momentum remains intact.

Currently, TCB is retesting the neckline (equivalent to the 40,500–41,500 range) of a Rounding Bottom pattern in formation. If the stock maintains its recovery and successfully breaks above the neckline in upcoming sessions, the potential price target will be the 46,400–47,000 range.

(*) Note: The analysis in this article is based on real-time data as of the end of the morning session. Therefore, the signals and conclusions are for reference only and may change by the end of the afternoon session.

Technical Analysis Department, Vietstock Advisory Division

– 12:06 October 13, 2025

VN-Index Surges in Q3/2025, Boosting Open-Ended Funds

Q3/2025 marked a remarkable milestone for Vietnam’s stock market as the VN-Index surged over 20% in just three months, recording one of the most robust recoveries since the COVID-19 pandemic. This growth not only reflects an improved market sentiment but also delivers exceptional returns for many open-ended funds, particularly equity-focused portfolios.

Post-Upgrade Surge: Stock Shares Attract Major Investment

After a period of subdued anticipation awaiting the market upgrade results, the stock market surged dramatically during the week of October 6–10. The official announcement of FTSE’s upgrade to emerging market status (on October 8) unlocked psychological barriers and fueled a robust rally in both indices and liquidity.

Market Pulse 13/10: Blue-Chip Stocks Steady the Beat, VN-Index Stays in the Green

The upward momentum was well-sustained across key indices during the morning session, largely driven by strong contributions from blue-chip stocks. At the midday break, the VN-Index climbed over 7 points (+0.42%), reaching 1,754.91, while the HNX-Index also rose by 0.38%, settling at 274.66. However, the overall market breadth remained less optimistic, with sellers dominating as 446 stocks declined compared to 221 that advanced.

Expert Insights: Major Capital Inflows Signal VN-Index’s Potential to Surge by 20–30%

Experts advise investors against chasing prices at all costs. Instead, they recommend adopting a phased investment strategy, gradually allocating funds over time.