Vietnam’s stock market concluded a remarkable week with the VN-Index reaching an all-time high. The upgrade of Vietnam’s market status and the launch of the VN100 futures contract fueled investor optimism, propelling the VN-Index nearly 100 points higher in just one week, accompanied by a surge in trading volume.

Looking ahead to the next week, most experts anticipate continued market momentum, led by large-cap stocks. However, investors are advised against chasing prices indiscriminately and should instead adopt a phased investment strategy.

Market Poised for Further Growth

Mr. Đinh Việt Bách – Securities Analyst at Pinetree noted that the VN-Index experienced an exhilarating week, marked by two significant events: Vietnam’s stock market upgrade and the introduction of the VN100 futures contract.

Riding this wave of positivity, the VN-Index gained nearly 50 points in the final two sessions (Thursday and Friday) as Q3 earnings reports began to surface. Over the week, the index climbed over 100 points compared to the previous week. Notably, Vingroup stocks (VIC, VHM, VRE, VPL) contributed more than 45 points to the index’s rise. Weekly trading volume averaged 35 trillion VND per session, slightly lower than the peak levels seen in July and August.

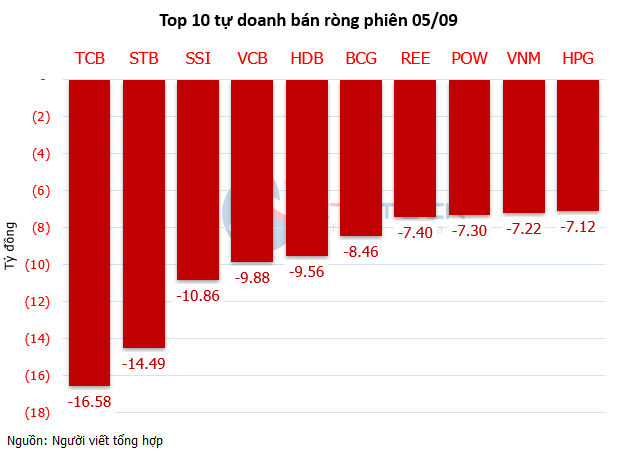

This indicates that capital flow remains concentrated in blue-chip stocks, leading to a phenomenon where “the index rises, but portfolios don’t” for many investors. Positively, capital returned to the Banking sector in the final two sessions, significantly bolstering the index’s upward trajectory. The Real Estate sector also showed signs of recovery, despite ongoing credit tightening for second and third home purchases aimed at controlling prices.

For the upcoming week, experts predict the market could continue its upward momentum, aiming for new highs. While last week’s gains were primarily driven by Vingroup stocks, signs of broader sector participation emerged toward the end of the week. As Q3 earnings are released, positive results could serve as a crucial catalyst to sustain the market’s rise.

Additionally, next week marks the derivatives expiration, increasing the likelihood of index support through blue-chip stock manipulation ahead of expiration. Experts expect Vingroup and Banking stocks to maintain their leadership roles, while capital may rotate into Securities, Real Estate, Steel, and Public Investment sectors, fostering a more sustainable uptrend.

VN-Index Has Potential for 20–30% Further Growth

Mr. Nguyễn Minh Hoàng – Director of Securities Analysis at VFS believes the VN-Index’s breakout above the 1,300-point historical peak, following a prolonged accumulation phase from April to September 2025, is a highly positive technical signal. This breakout, accompanied by a surge in trading volume, confirms the trend’s strength according to Dow Theory.

The strong participation of blue-chip stocks reflects substantial capital betting on the market’s long-term growth potential, rather than short-term euphoria. The clear upgrade roadmap has catalyzed smarter capital allocation.

Addressing concerns about a post-rally correction, Mr. Hoàng argues that “buy the rumor, sell the news” doesn’t fully apply here. In technical analysis, a trend continues until a clear reversal signal emerges.

The VN-Index’s successful conquest of its historical peak establishes a new price level and initiates a fresh growth cycle. A technical correction after the strongest weekly gain in history is “entirely normal and necessary.” Instead of fearing a sell-off, investors should view corrections as opportunities to rebalance portfolios and increase exposure to leading stocks with strong fundamentals,” he advises.

According to Mr. Hoàng, trading volumes exceeding 30 trillion VND per session indicate the return of institutional capital. It’s unlikely that this is merely a short-term retail investor reaction, given the concentration in blue-chip stocks like VPB (5.704 trillion VND), VHM (5.008 trillion VND), and CTG (3.562 trillion VND).

He emphasizes that, per Dow Theory, trading volume must confirm the trend. The combination of record-breaking volume and price surpassing historical highs demonstrates a sustainable uptrend. “August 2025’s record volume of 1.4 billion shares per session will soon be surpassed as foreign capital inflows accelerate post-upgrade. This signals the beginning of a new era for Vietnam’s stock market,” he predicts.

Mr. Hoàng notes that the uptrend’s durability depends on the synergy of three pillars: Liquidity, Corporate Earnings, and Macro Factors.

“The market is currently in the second phase of the uptrend cycle—the breakout phase (‘Public Participation’ in Dow Theory). During this phase, ample liquidity is crucial. Foreign capital inflows driven by the upgrade will remain the primary engine for the next 6–12 months,” he analyzes.

Simultaneously, corporate earnings are the core growth driver. Q3 reports and Q4 outlooks will test the current rally’s sustainability. If earnings growth aligns, market valuations remain attractive even at higher price levels.

Lastly, stable monetary policy and macroeconomic conditions continue to support businesses and investors. Low interest rates maintain reasonable capital costs, fostering long-term capital flows and bolstering foreign investor confidence.

Despite the VN-Index’s P/E ratio exceeding 16, Mr. Hoàng believes there’s room for growth compared to newly upgraded FTSE Emerging Markets with P/E ratios of 18–20. “A 20–30% upside for the index is entirely feasible, especially if Q3 earnings are positive, making valuations attractive again,” he assesses.

However, he advises investors against indiscriminate buying, recommending a phased investment strategy (Pyramid Strategy) during corrections. Most importantly, maintain discipline and set clear stop-loss points for each position. The market always rewards patient and disciplined investors.

Vietstock Weekly 13-17/10/2025: Reaching New Heights

The VN-Index has set a new all-time high, marked by a powerful Big White Candle pattern, signaling strong investor optimism. However, trading volume must consistently rise above the 20-week average to support a more sustainable upward trend moving forward.

Vietnamese Billionaire Pham Nhat Vuong Sets Unprecedented National Record, Securing Top 3 Global Position

Billionaire Pham Nhat Vuong is the first Vietnamese individual to achieve this remarkable milestone.