Market liquidity increased compared to the previous session, with the order-matching trading volume of the VN-Index reaching over 1.23 billion shares, equivalent to a value of more than 38.5 trillion VND; the HNX-Index reached over 130 million shares, equivalent to a value of more than 3.2 trillion VND.

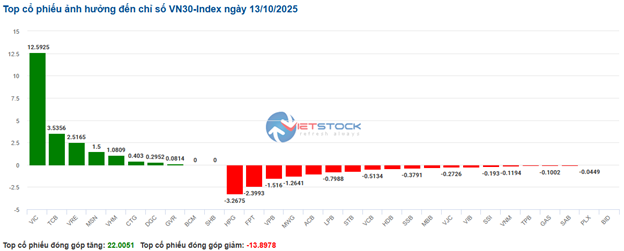

The VN-Index opened the afternoon session with a tug-of-war dynamic, but buyers gradually gained the upper hand, helping the index surge and close in positive green territory at the end of the session. In terms of influence, VIC, TCB, VRE, and VJC were the most positively impactful stocks on the VN-Index, contributing over 18.7 points of increase. Conversely, VCB, HPG, FPT, and VPB faced selling pressure, but their impact was not overly significant.

| Top 10 Stocks Most Impacting the VN-Index on October 13, 2025 (Calculated in Points) |

Similarly, the HNX-Index showed a positive trend, influenced by stocks such as KSV (+9.96%), CEO (+9.85%), SHS (+1.13%), and VIF (+4.52%).

| Top 10 Stocks Most Impacting the HNX-Index on October 13, 2025 (Calculated in Points) |

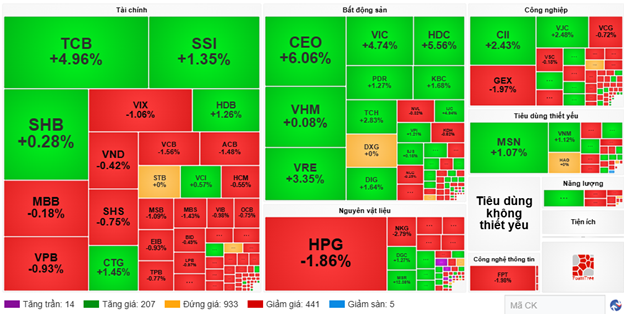

At the close, the market remained predominantly green across most sectors. The real estate sector led with a 3.81% increase, primarily driven by VIC (+6.98%), VHM (+0.98%), VRE (+6.57%), and NVL (+2.56%). Essential consumer goods and materials followed with gains of 2.25% and 0.65%, respectively. Conversely, the information technology sector saw the largest decline, dropping 2.11%, mainly due to FPT (-2.19%), CMG (-1.75%), ELC (-2.67%), and DLG (-1.43%).

In terms of foreign trading, foreign investors continued to net sell over 1.182 trillion VND on the HOSE, focusing on HPG (394.31 billion), VRE (371.99 billion), MBB (306.5 billion), and VHM (279.08 billion). On the HNX, foreign investors net bought over 72 billion VND, concentrating on CEO (139.75 billion), DTD (2.03 billion), HUT (930 million), and TIG (640 million).

| Foreign Net Buying and Selling Trends |

Morning Session: Blue-Chip Stocks Hold Steady, VN-Index Maintains Green

The upward trend continued in the main indices during the late morning session, thanks to significant contributions from blue-chip stocks. By the mid-session break, the VN-Index rose over 7 points (+0.42%), reaching 1,754.91 points; the HNX-Index also increased by 0.38%, hitting 274.66 points. However, market breadth was less positive, with sellers dominating as 446 stocks declined and 221 advanced.

In terms of influence, VIC was the most positively impactful stock, adding 8.4 points to the VN-Index. TCB also contributed 3.31 points to the index. Conversely, VCB had the most negative impact, subtracting nearly 2 points from the index.

| Top 10 Stocks Most Impacting the VN-Index in the Morning Session of October 13, 2025 (Calculated in Points) |

Sector performance was mixed. In the green, real estate led the market with a notable 2.27% increase, driven by strong demand for stocks like VHM (+4.74%), VRE (+3.35%), KBC (+1.68%), KSF (+3.33%), PDR (+1.27%), TCH (+2.83%), and CEO (+6.06%).

Additionally, the materials and finance sectors traded actively, with buying pressure concentrated in stocks such as KSV (up to the ceiling), DGC (+1.27%), MSR (+12.36%), VIF (+4.52%), HGM (+4.37%), CSV (+2.25%); TCB (+4.96%), SSI (+1.35%), HDB (+1.26%), and CTG (+1.45%). However, several stocks saw notable declines, including HPG (-1.86%), DCM (-1.37%), DPM (-1.64%), HSG (-2.11%), NKG (-2.79%); VIX (-1.06%), VCB (-1.56%), ACB (-1.48%), MSB (-1.09%), and MBS (-1.43%).

Conversely, the information technology sector performed the worst in the morning session, with leading stocks like FPT declining 1.98% and CMG falling 1.75%.

Source: VietstockFinance

|

Foreign investors continued to net sell over 934 billion VND across all three exchanges. Selling pressure was concentrated in HPG, VRE, and VPB, with values of 243.87 billion, 198.96 billion, and 173.28 billion, respectively. Meanwhile, CEO (96.02 billion VND) and SHB (84.05 billion VND) led the net buying list.

| Top 10 Stocks with Strongest Foreign Net Buying and Selling in the Morning Session of October 13, 2025 |

10:30 AM: Real Estate Continues to Support the Index, VN-Index Remains in Tug-of-War

Buying interest resurfaced, helping the main indices recover and surpass the reference level. As of 10:30 AM, the VN-Index reversed, rising over 4.2 points to trade around 1,751 points. The HNX-Index increased by 1.2 points, trading around 274 points.

Most stocks in the VN30 basket faced selling pressure, though green gradually returned. On the negative side, HPG subtracted 3.26 points, FPT subtracted 2.39 points, VPB subtracted 1.51 points, and MWG subtracted 1.26 points. Conversely, stocks like VIC, TCB, VRE, and MSN maintained their green status, contributing over 20.1 points to the index.

Source: VietstockFinance

|

As of 10:30 AM, red dominated most sectors. Financial stocks continued to face selling pressure, with declines in leading bank stocks such as SSI (-0.74%), VPB (-1.87%), MBB (-0.73%), and ACB (-1.3%).

Additionally, sellers gained ground in the industrial sector, with strong divergence. Selling pressure concentrated on stocks like ACV (-1.08%), HVN (-1.38%), GMD (-0.88%), and MVN (-0.19%).

The real estate sector saw the strongest recovery, with leading stocks like VIC (+4.32%), VHM (+0.41%), VRE (+4.21%), KBC (+2.8%), and newcomer CVR, which continued its second consecutive ceiling session, supporting the sector’s index.

Compared to the opening, sellers remained dominant. Declining stocks numbered 443, while advancing stocks were 171.

Source: VietstockFinance

|

Market Open: Red Dominates Early Session, VIC, VHM, & VRE Buck the Trend

The market opened the morning session in a negative atmosphere, with red dominating most sectors. The VN30 index was the most negatively impacted, as most stocks in this group declined.

Numerous VN30 stocks fell sharply, including HPG, FPT, VPB, ACB, and HDB… Only VIC, VHM, VRE, TCB, and MSN showed green.

The information technology sector saw a sharp decline of 1.7% early in the session, with stocks like FPT (-1.98%), CMG (-1.38%), and DLG (-2.5%) leading the drop.

The finance sector was equally pessimistic, primarily due to leading bank stocks such as VCB (-1.4%), VPB (-1.71%), MBB (-1.28%), LPB (-1.16%), and ACB (-1.48%).

In contrast, the real estate sector showed divergence, with buyers gaining the upper hand. Buying pressure concentrated on the sector’s three giants: VIC (+6.04%), VHM (+1.3%), and VRE (+2.73%), while most other stocks were predominantly red or flat.

– 15:30 13/10/2025

Vietstock Daily October 14, 2025: Will the Uptrend Continue?

The VN-Index has formed a Three White Soldiers candlestick pattern, accompanied by trading volume consistently above the 20-session average, signaling prevailing market optimism. The index is closely tracking the Upper Band of the Bollinger Bands, while the MACD indicator continues its upward trajectory following a buy signal. This confluence of factors underscores a positive short-term growth outlook.

Afternoon Technical Analysis, October 13: Soaring to New Heights

The VN-Index has continued its upward trajectory, reaching an all-time high. With the previous peak from September 2025 (around 1,700–1,711 points) now decisively broken, this level shifts from resistance to a robust support zone. Meanwhile, the HNX-Index has rebounded, testing the Middle line of the Bollinger Bands.

VN-Index Surges in Q3/2025, Boosting Open-Ended Funds

Q3/2025 marked a remarkable milestone for Vietnam’s stock market as the VN-Index surged over 20% in just three months, recording one of the most robust recoveries since the COVID-19 pandemic. This growth not only reflects an improved market sentiment but also delivers exceptional returns for many open-ended funds, particularly equity-focused portfolios.

Post-Upgrade Surge: Stock Shares Attract Major Investment

After a period of subdued anticipation awaiting the market upgrade results, the stock market surged dramatically during the week of October 6–10. The official announcement of FTSE’s upgrade to emerging market status (on October 8) unlocked psychological barriers and fueled a robust rally in both indices and liquidity.

Market Pulse 13/10: Blue-Chip Stocks Steady the Beat, VN-Index Stays in the Green

The upward momentum was well-sustained across key indices during the morning session, largely driven by strong contributions from blue-chip stocks. At the midday break, the VN-Index climbed over 7 points (+0.42%), reaching 1,754.91, while the HNX-Index also rose by 0.38%, settling at 274.66. However, the overall market breadth remained less optimistic, with sellers dominating as 446 stocks declined compared to 221 that advanced.