I. MARKET TRENDS IN WARRANTS

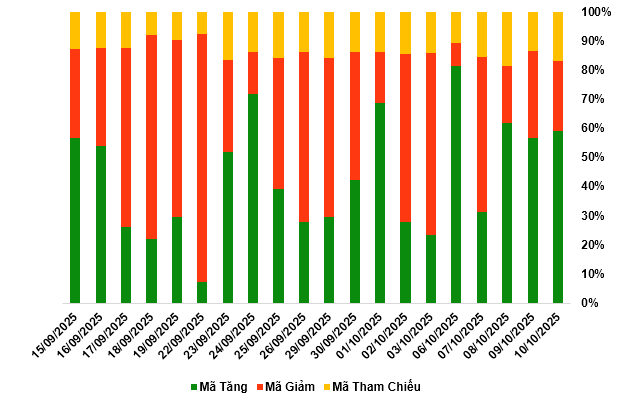

By the close of trading on October 10, 2025, the market recorded 164 gainers, 67 decliners, and 47 unchanged stocks.

Market Breadth Over the Last 20 Sessions. Unit: Percentage

Source: VietstockFinance

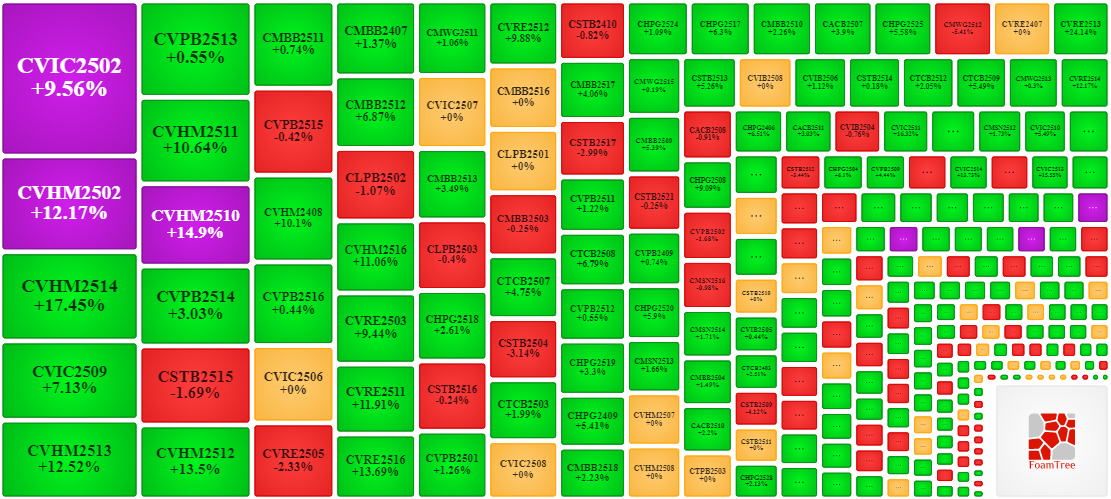

During the October 10, 2025 session, buyers regained control, driving prices higher for most warrant codes. Notably, the top gainers included CVIC2502, CVHM2502, CVPB2513, and CMBB2511.

Source: VietstockFinance

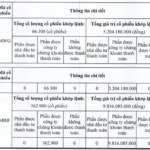

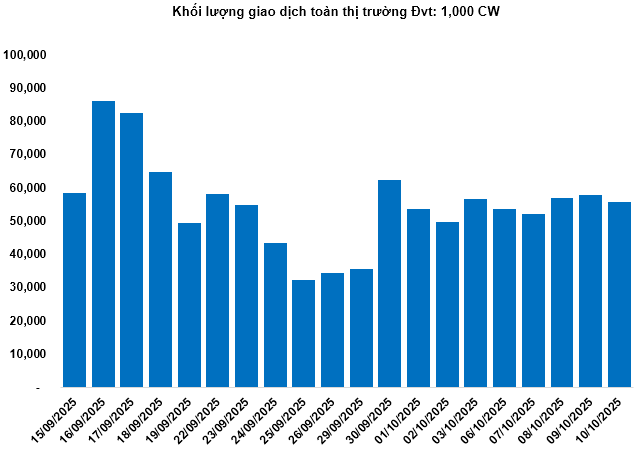

Total market volume on October 10 reached 55.77 million CW, down 3.33%; trading value hit 141.09 billion VND, a 9.94% decrease from October 9. CVNM2512 led in volume with 2.24 million CW, while CVRE2513 topped trading value at 6.25 billion VND.

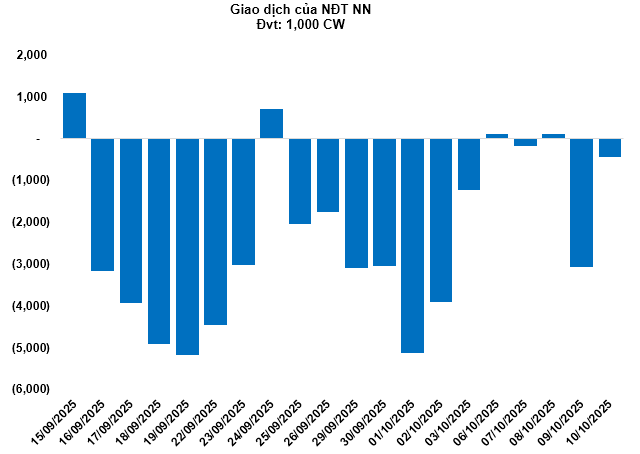

Foreign investors continued net selling on October 10, totaling 448,600 CW. CVNM2407 and CVNM2518 saw the highest net outflows. For the week, foreign net selling exceeded 3.47 million CW.

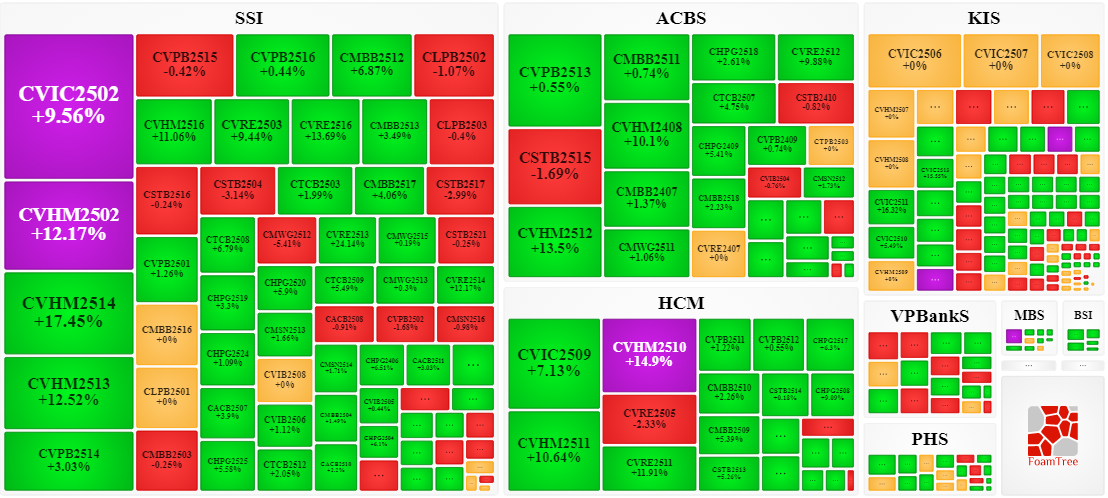

Securities firms SSI, ACBS, KIS, and HCM are the leading issuers with the most warrant codes in the market.

Source: VietstockFinance

II. MARKET STATISTICS

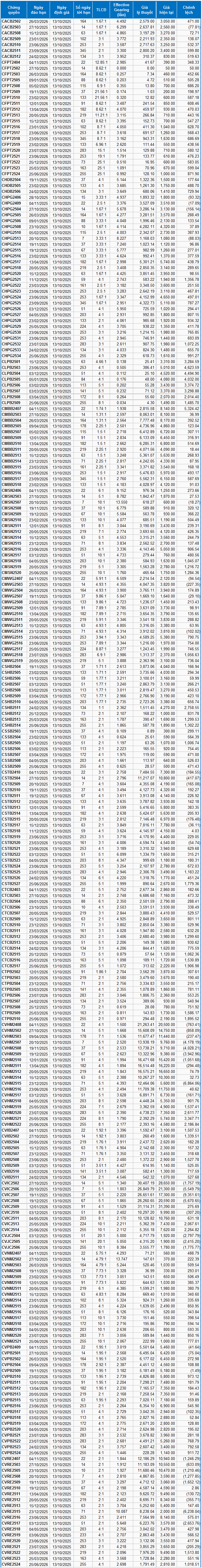

Source: VietstockFinance

III. WARRANT VALUATION

Using a valuation method effective from October 13, 2025, the fair prices of traded warrants are as follows:

Source: VietstockFinance

Note: Opportunity costs in the valuation model are adjusted for the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, adjusted for warrant maturities.

According to this valuation, CVIC2507 and CVHM2515 are the most attractively priced warrants.

Warrants with higher effective gearing exhibit greater volatility relative to their underlying assets. Currently, CVNM2502 and CMSN2507 have the highest effective gearing ratios in the market.

Economic Analysis & Market Strategy Division, Vietstock Consulting Department

– 17:58 October 12, 2025

Foreign Block Net Sells Trillions in Week of October 6-10, Contrasting with 700 Billion Dong “Buy” of a Bluechip Stock

Foreign investors maintained their selling pressure, though the intensity eased compared to previous weeks.

Market Pulse 10/10: VHM & VIC Lead the Charge, VN-Index Surges Over 31 Points

At the close of trading, the VN-Index surged by 31.08 points (+1.81%), reaching 1,747.55 points, while the HNX-Index dipped by 1.32 points (-0.48%), settling at 273.62 points. Market breadth favored the bulls, with 405 gainers outpacing 310 decliners. The VN30 basket mirrored this trend, boasting 22 advancers, 5 decliners, and 3 unchanged stocks.

Market Pulse 10/10: Widespread Green Dominance Sustained

The green hue maintained its dominance throughout the morning session. At the mid-session break, the VN-Index climbed over 15 points (+0.89%), reaching 1,731.73 points. Meanwhile, the HNX-Index experienced a slight dip, hovering just above the reference mark at 274.89 points. Market breadth favored the buyers, with 390 stocks advancing and 308 declining.