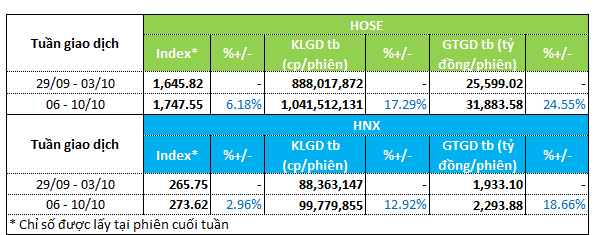

Specifically, the VN-Index surged by over 6%, officially surpassing the 1,700-point milestone. The HNX-Index rose nearly 3%, reaching 273.6 points.

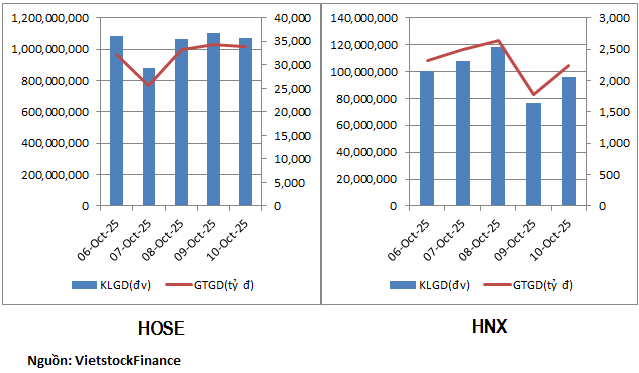

In terms of liquidity, trading volume and value both rebounded. On the HOSE, trading volume increased by more than 17%, exceeding 1 billion units per session. Trading value also rose by nearly 25%, reaching 32 trillion VND per session. On the HNX, trading volume grew by 13% to 100 million units per session, while trading value increased by nearly 20% to 2.3 trillion VND per session.

|

Overview of Liquidity for the Week of October 6–10

|

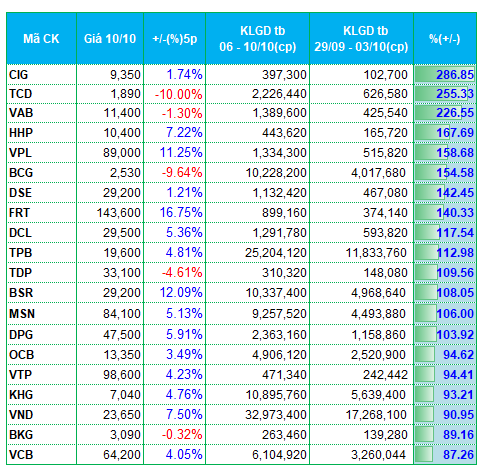

With the market regaining momentum, investor attention turned to securities stocks. Several representatives from this group saw significant liquidity increases. DSE recorded a trading volume surge of over 140%, reaching 1.1 million units per session. VND also saw a rise of more than 90%, boosting its trading volume to nearly 33 million units per session.

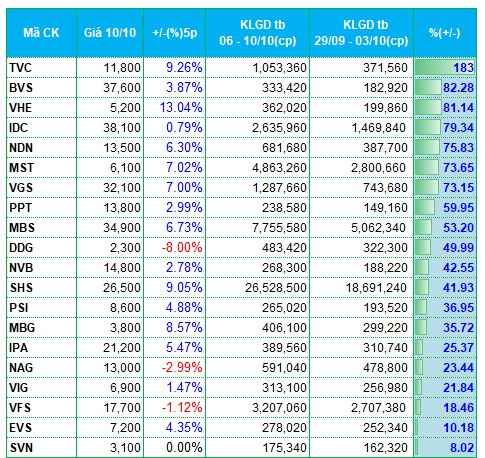

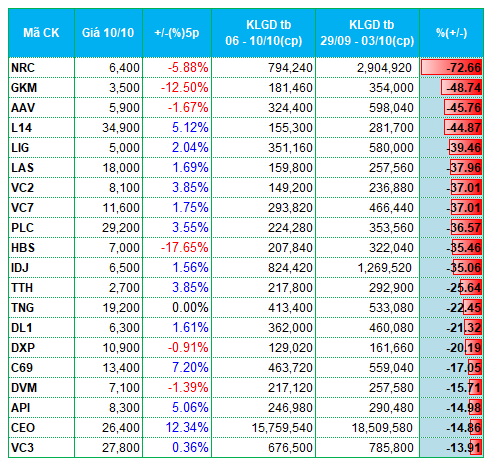

On the HNX, securities stocks dominated the list of stocks with increased liquidity. Notable examples include BVS, MBS, SHS, PSI, VIG, VFS, and EVS. Most securities stocks also experienced price increases.

FTSE’s market upgrade decision opens up positive long-term prospects for the stock market. The securities group, which directly benefits from market growth, quickly attracted funds following the announcement.

Additionally, banking stocks saw modest inflows. VAB, TPB, OCB, VCB, and NVB were among those with notable liquidity increases.

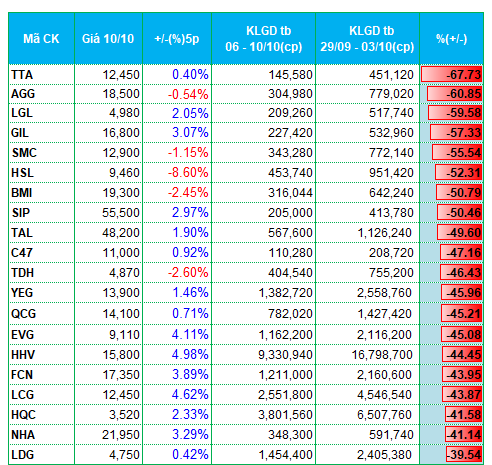

On the decline, real estate and construction stocks were the focus of outflows. Nearly half of the stocks with significant liquidity decreases were from the real estate sector. These included AGG, LGL, SIP, TAL, TDH, QCG, EVG, HQC, NHA, LDG, NRC, AAV, L14, IDJ, API, CEO, and VC3.

The construction sector also had several representatives, such as C47, HHV, FCN, LCG, LIG, and C69.

|

Top 20 Stocks with Highest Liquidity Increases/Decreases on HOSE

|

|

Top 20 Stocks with Highest Liquidity Increases/Decreases on HNX

|

The list of stocks with the highest liquidity increases/decreases is based on average trading volumes exceeding 100,000 units per session.

– 19:28 13/10/2025

Market Pulse 13/10: Blue-Chip Stocks Steady the Beat, VN-Index Stays in the Green

The upward momentum was well-sustained across key indices during the morning session, largely driven by strong contributions from blue-chip stocks. At the midday break, the VN-Index climbed over 7 points (+0.42%), reaching 1,754.91, while the HNX-Index also rose by 0.38%, settling at 274.66. However, the overall market breadth remained less optimistic, with sellers dominating as 446 stocks declined compared to 221 that advanced.

Nearly 1 Billion Bank Shares Set to Change Hands

Vietnam Thuong Tin Commercial Joint Stock Bank is advancing the transfer of over 821 million VBB shares from the Upcom market to HoSE, with completion expected no later than the first quarter of 2026.