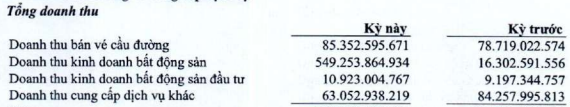

Specifically, in Q3, IJC’s consolidated net revenue reached nearly VND 672 billion, 3.6 times higher than the same period last year. Of this, revenue from real estate sales soared to over VND 549 billion, nearly 34 times higher; revenue from toll road tickets also increased by more than 8%, reaching over VND 85 billion, becoming the second-largest revenue contributor.

|

IJC’s revenue structure in Q3/2025

Source: IJC

|

At the 2025 Annual General Meeting, CEO Trinh Thanh Hung stated that the company expects to recognize revenue from sold residential properties by the end of 2025. Additionally, IJC will launch the Sunflower 2 project this year.

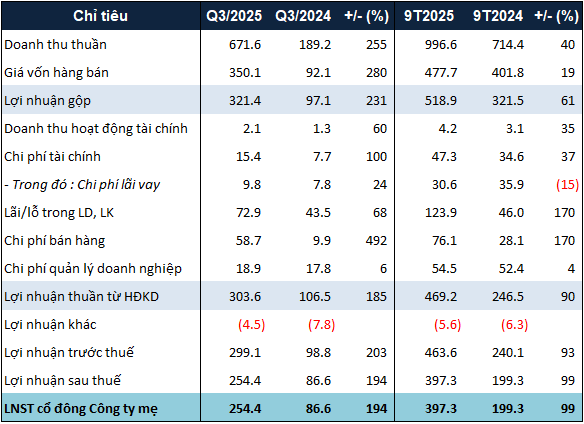

Alongside revenue growth, the company’s other expenses also increased significantly year-over-year. Most notably, financial expenses and selling expenses rose 2 times and 6 times, respectively, to VND 15 billion and nearly VND 59 billion. The financial expense increase is due to the company retaining nearly VND 6 billion in unpaid dividends, while the selling expense increase stems from VND 49 billion in brokerage commissions.

As a result, IJC recorded a net profit of over VND 254 billion in Q3/2025, 2.9 times higher than the same period last year. After nine months, the company’s net profit reached VND 397 billion, up 99%.

|

IJC’s 9-month 2025 business results. Unit: Billion VND

Source: VietstockFinance

|

Compared to the 2025 plan, IJC’s 9-month consolidated results achieved 51% of the total revenue target and 93% of the post-tax profit target.

On the balance sheet, IJC’s total assets as of September 30, 2025, were VND 8.2 trillion, up 5% from the beginning of the year. Short-term cash holdings increased 2.7 times to VND 257 billion. Inventory, the largest component, rose 13% to nearly VND 4.2 trillion.

Total liabilities increased 7% to over VND 2.8 trillion. Outstanding loans decreased slightly by 4% to over VND 1.1 trillion, primarily bank loans.

– 19:41 12/10/2025

How Developers Can Control the Sales Process and Safeguard Brand Image

Recently, social media has been abuzz with scenes of real estate agents fiercely competing for property purchase vouchers. This incident not only highlights the market’s intense demand but also exposes organizational flaws in the sales process, leading to frustration among agents, disappointed clients, and damage to the developer’s brand reputation.

“Penalty for Tri Viet Securities: Late Disclosure of Information”

The Securities and Exchange Commission Inspectorate has issued an administrative sanction decision against Tri Viet Securities for violations of information disclosure regulations.