According to preliminary statistics from the General Department of Customs, Vietnam’s coal imports in September reached nearly 4 million tons, valued at over $457 million.

In the first nine months of the year, the country imported more than 50 million tons of coal, worth $5.2 billion, a slight increase in volume but a 16% decrease in value compared to the same period in 2024, due to a 20% drop in average import prices.

The decline in prices coupled with increased import volumes indicates that domestic coal consumption remains high, particularly as thermal power continues to dominate the national energy system.

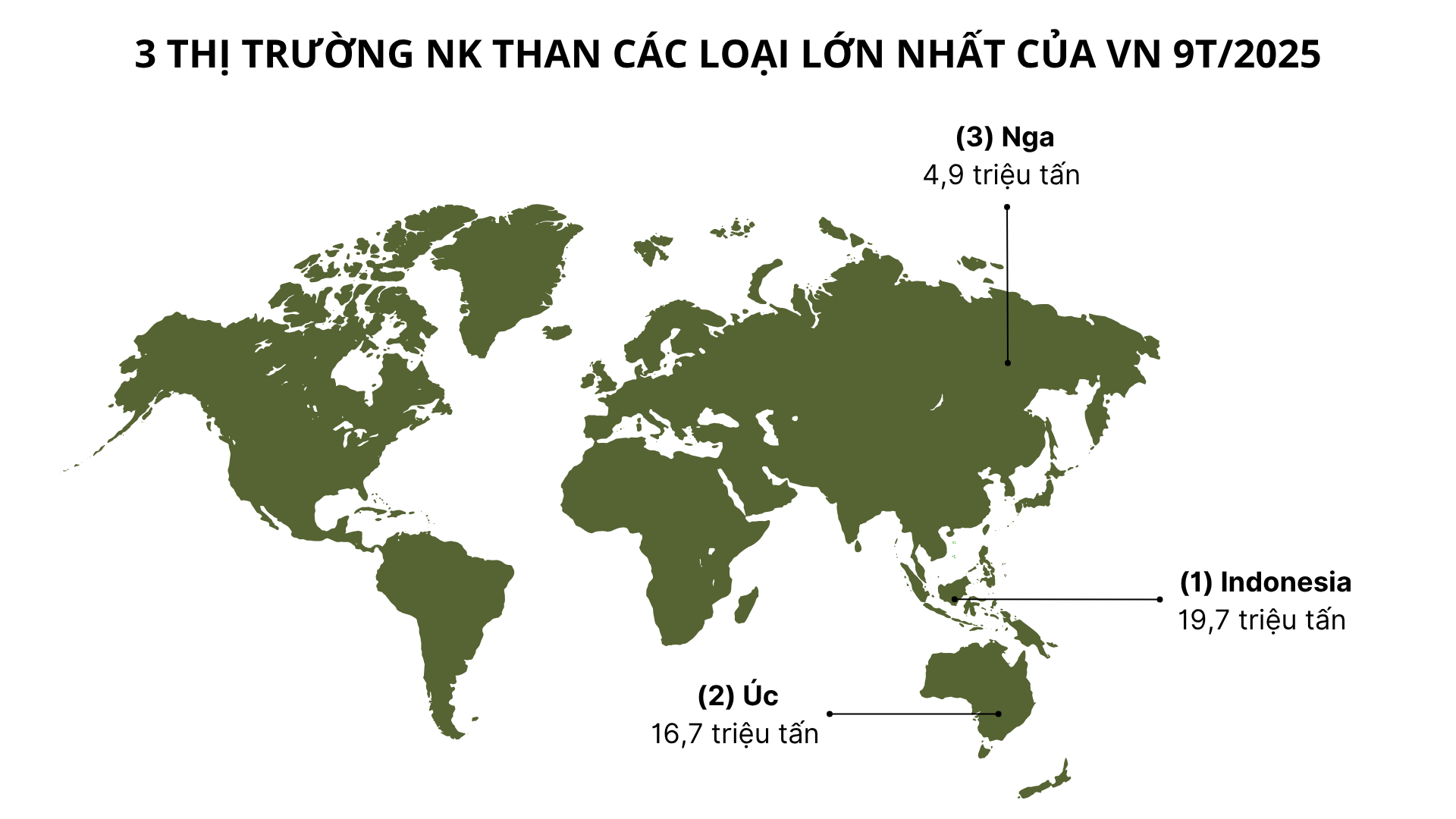

Indonesia is Vietnam’s largest coal supplier in the first nine months, providing over 19 million tons valued at more than $1.6 billion, a decrease in both volume and value compared to the same period last year. The average price stands at $82 per ton, lower than the general market rate.

Australia is the second-largest supplier, exporting over 16 million tons to Vietnam, worth more than $2 billion, a 21% increase in volume but a 5% decrease in value year-on-year. The average import price dropped by over 21%.

Russia ranks as the third-largest supplier in the first nine months, with nearly 5 million tons valued at over $644 million, an 8% increase in volume but a 19% decrease in value. The decline in value is attributed to a nearly 26% drop in average import prices, equivalent to $129 per ton.

Vietnam is among the top five coal-consuming economies in Southeast Asia. Despite being a long-standing coal producer, Vietnam must import coal due to domestic supply failing to meet quality demands.

Additionally, as easily accessible domestic reserves deplete, many mines are forced to dig deeper, increasing costs and reducing efficiency. Meanwhile, importing cheaper coal allows businesses to maintain supply flexibility and reduce production costs.

Imported coal is currently subject to a Most-Favored Nation (MFN) tariff rate of approximately 3-5%. The specific MFN rate depends on the type of coal and corresponding tariff code.

Vietnam’s demand for primary energy imports is rapidly increasing, making expanded cooperation with major energy markets like Russia crucial and highly promising.

Under Russia’s energy strategy until 2035, there is a significant shift favoring the export of primary energy sources from Russia to the Asia-Pacific region, including Vietnam.

Specifically, Russia’s coal, oil, and gas extraction facilities are moving from Western Siberia to Eastern Siberia and the Far East, near the Vladivostok port, which connects to southern Russian routes. Oil and condensate production in Western Siberia is expected to decrease by 5%, while Eastern Siberia’s output will rise by 15% compared to 2018.

Notably, Russia’s energy export focus is gradually shifting from Eastern Europe to the Asia-Pacific region. The proportion of coal exports from Eastern Siberia is projected to increase from 17% in 2018 to 25% by 2035.

This year, Vietnam is expected to produce approximately 37 million tons of clean coal, while consumption demand reaches 50 million tons, primarily for thermal power plants. Despite a trend toward renewable energy, coal will remain a cornerstone of the national energy structure until 2030.

The Power Directorate’s Leadership: Even EVN Can’t Take It Anymore

“Sooner or later, we must factor in accurate accounting for businesses when it comes to electricity pricing. EVN [Electricity of Vietnam] cannot shoulder the burden indefinitely,” emphasized Mr. Trinh Quoc Vu, Deputy Director of the Electricity and Renewable Energy Authority (Ministry of Industry and Trade).

The Great Russian Retail Rush: Vietnam’s 5% Import Tax Advantage Makes it the 5th Largest ‘Shark’ in the World.

“Russia’s National Treasures: A Russian Extravaganza in Vietnam.

Throughout this year, Vietnam has witnessed an influx of Russia’s national treasures at incredibly attractive prices. A veritable feast of Russian culture and history has been on offer, captivating and intriguing locals and tourists alike.”

The Power Sector’s Blue Hue in Q2

In Q2 of 2025, the electricity industry witnessed a sea of green, with most businesses thriving. The hydroelectric group, in particular, shone brightly against the low base of the previous year. Thermal power plants showed some differentiation, but most were also in the green. Meanwhile, the renewable energy sector continued its growth trajectory, propelled by favorable policies.