According to information from the Ho Chi Minh City Stock Exchange (HoSE), Mr. Le Tuan Anh has submitted a notification to the State Securities Commission (SSC), HoSE, and Southeast Asia Commercial Joint Stock Bank (SeABank, stock code: SSB) regarding the trading of shares by insiders and related individuals.

Mr. Le Tuan Anh has registered to sell 5 million SSB shares with the purpose of personal financial restructuring. The transaction is expected to take place via agreement and/or order matching methods from October 15, 2025, to November 12, 2025.

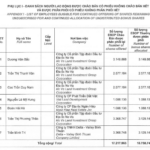

If the transaction is successful, Mr. Le Tuan Anh’s SSB shareholding will decrease from over 41.4 million shares to more than 36.4 million shares, reducing his ownership ratio from 1.456% to 1.28%.

Illustrative image

Based on the closing price of SSB shares on October 10, 2025, at VND 19,450 per share, it is estimated that Mr. Le Tuan Anh will earn approximately VND 97 billion if the registered share sale is completed.

Mr. Le Tuan Anh is the son of Ms. Nguyen Thi Nga, Vice Chairwoman of SeABank’s Board of Directors, and the brother of Ms. Le Thu Thuy, also a Vice Chairwoman of SeABank’s Board of Directors.

Currently, Ms. Nga holds nearly 120.1 million SSB shares (4.221%), while Ms. Thuy owns over 65.6 million shares (2.307%).

Similarly, for personal financial restructuring, Mr. Le Thanh Hai, Deputy General Director of SeABank, recently registered to sell 250,000 SSB shares. The transaction is scheduled to take place from September 22, 2025, to October 21, 2025.

If the transaction is completed as registered, Mr. Le Thanh Hai’s ownership in SeABank will decrease from 821,101 shares to 571,101 shares, reducing his ownership ratio from 0.029% to 0.02% of the capital.

Previously, Ms. Hoang Tuyet Mai, Head of Corporate Governance, successfully sold 59,000 SSB shares out of the 81,645 shares she had registered. The transaction was executed via order matching on August 22, 2025. The reason for not completing the full transaction was due to unmet market conditions.

Before the transaction, Ms. Hoang Tuyet Mai held 99,145 shares, equivalent to a 0.003% stake in SeABank. After the transaction, her shareholding decreased to 40,145 shares, equivalent to a 0.001% stake.

Prime Minister’s Decision Brings Overwhelming Hope to 5,000 Workers, Leaving Many in Tears

On the afternoon of October 9th in Hanoi, the Prime Minister chaired a conference to meet with outstanding business representatives and entrepreneurs from across the nation, in celebration of Vietnam Entrepreneurs’ Day (October 13th).

Novaland CEO Bags Nearly 15 Million ESOP Shares at 74 Billion VND, Pocketing Over 158 Billion VND in Gains

As of October 2, 2025, Novaland employees have successfully subscribed and paid for over 31.53 million ESOP shares out of the planned 48.75 million shares offered. With 17.22 million shares remaining unsold, Novaland’s Board of Directors will continue offering these ESOP shares to company employees at a price of 10,000 VND per share.

Son of City Auto Chairman Fails to Purchase 2.4 Million Registered CTF Shares

Mr. Trần Lâm, a member of City Auto’s Board of Directors and son of Chairman Trần Ngọc Dân, failed to purchase the 2.4 million CTF shares he had previously registered to acquire.

SeABank Secures Full Disbursement of $80 Million from FMO and Proparco

On October 2, 2025, the French Development Finance Institution (Proparco) and the Dutch Entrepreneurial Development Bank (FMO) fully disbursed a combined $80 million to Southeast Asia Commercial Joint Stock Bank (SeABank, HOSE: SSB). This investment, signed in March 2025, aims to advance financial inclusion for small and medium-sized enterprises (SMEs), women-led businesses, and climate change mitigation efforts.