The Vietnam F&B Market Report for the first half of 2025, jointly released by iPOS.vn and Nestlé Vietnam on October 10, reveals a fiercely competitive and volatile landscape in the food and beverage (F&B) industry. A staggering 50,000 establishments have ceased operations, painting a grim picture of the sector’s challenges.

Revenue Falls Short Despite Major Shopping Seasons

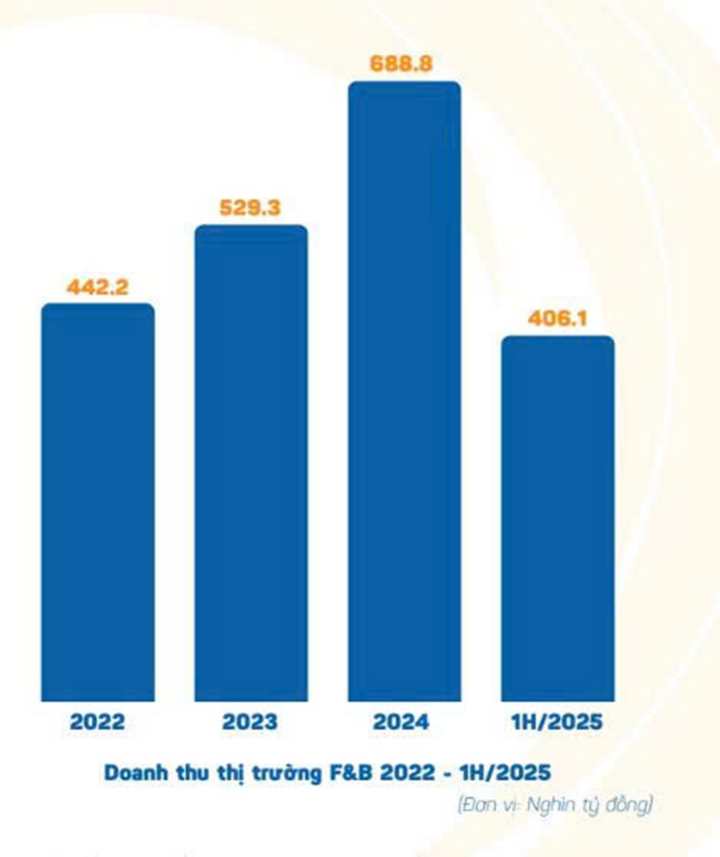

The report indicates that the F&B market’s revenue for the first half of 2025 reached over VND 406 trillion, a marginal increase from the VND 403.9 trillion recorded in the same period in 2024. This growth falls below expectations, as 2024-end surveys predicted a 10% revenue surge for 2025.

F&B revenue in the first half of 2024 compared to the last three years. (Source: iPOS.vn)

“Despite coinciding with major spending periods like the Lunar New Year and the April 30 – May 1 holidays, the first half of 2024 saw revenue fall short of expectations, reflecting the market’s sluggish recovery,” the report states.

Escalating input costs are cited as the primary reason for the F&B sector’s underwhelming revenue growth in the first half of 2025. Rising costs for rent, raw materials, and labor have significantly squeezed profit margins. Specifically, pork prices rose by 12.75%, food costs by 4.15%, and housing, electricity, water, and fuel expenses by 5.73%. Facing these cost pressures, many establishments have scaled back promotions and discounts, leading to a slowdown in overall market revenue growth.

While overall industry revenue has fallen short of expectations, business growth remains uneven. Approximately 34.77% of businesses reported stable revenue, and 19.21% achieved growth exceeding 5% compared to the same period last year.

Conversely, 17.9% of businesses experienced significant declines, up from 14.3% in 2024.

However, there is a silver lining: Vietnamese consumers are not cutting back on F&B spending.

A mid-2025 survey reveals that while Vietnamese consumers are adopting a cautious approach to F&B spending, over 54% plan to maintain their current expenditure levels, while only 38% intend to reduce spending.

This consumer resilience has boosted business confidence for the second half of the year. Approximately 67.7% of businesses plan to expand in the latter half of the year, while 32.3% will maintain their current operations. This indicates that businesses have weathered the crisis and are ready to reinvest.

However, given current consumption patterns, researchers predict that F&B industry growth in the second half of the year will likely reach a maximum of 9.6% compared to the first half.

Over 50,000 Establishments Have Closed

From 2024 to present, 50,000 F&B establishments have closed. (Illustrative image: Hà Linh)

A notable finding in the Vietnam F&B Market Report for the first half of 2025 is the number of establishments ceasing operations. As of June 30, 2025, the country had approximately 299,900 F&B establishments, a 7.1% decrease from 2024, equivalent to over 50,000 closures.

The decline is most pronounced in the two largest cities. Both Hanoi and Ho Chi Minh City recorded reductions exceeding 11%, whereas in the first half of 2024, closures were concentrated in Ho Chi Minh City.

Compared to the same period in 2024, the number of F&B closures has surged. In early 2024, the market saw around 30,000 closures, a 3.9% decrease. However, by year-end, new openings offset closures, bringing the total to 323,010 establishments.

The “quick open, quick close, quick learn” phenomenon is widespread among small establishments. Many experimental models lasting 2–3 months fail due to insufficient financial capacity or a lack of market potential, particularly among the recently booming small-scale outlets.

According to Nguyễn Đỗ Anh Quân, Brand Director at iPOS.vn, the first half of the year typically serves as a “natural filtering” period for the market, preceding a cycle of new openings and stronger restructuring in the second half.

While small establishments are being phased out, larger chains are refocusing on portfolio restructuring. They are abandoning underperforming locations, repositioning in iconic spots, and enhancing customer experiences.

Rising raw material costs force businesses to increase product prices. (Source: iPOS.vn)

Quân cites Starbucks as an example: the company closed its Starbucks Reserve Hàn Thuyên location in Saigon in August 2024, reopening a Reserve at Bitexco and launching a new Reserve-only outlet at Diamond Plaza on Lê Duẩn. This underscores a strategy prioritizing elevated spaces and services over widespread expansion.

“The trend of closing underperforming locations to reopen in more iconic positions indicates a filtering process that is freeing up prime real estate. This creates opportunities for models with strong operational capabilities, capital, and brand power to emerge,” Quân notes.

Nearly Half of F&B Businesses Have Raised Prices

A notable trend in the first half of 2025 is the widespread price increases. The report reveals that 45.3% of businesses have raised prices, particularly in the mass and mid-range segments, where price adjustments carry the risk of customer loss. Among these, 32.5% increased prices by less than 5%, 11.3% by 5-10%, and 1.4% by over 10%.

Nearly half of F&B businesses raised product prices in the first six months of 2025. (Source: iPOS.vn)

Rising input costs are the primary driver behind price adjustments. Specifically, 35.4% of businesses cited increased raw material costs as the main reason. Additionally, 21% were impacted by macroeconomic policy changes such as electronic invoicing and business taxes, while 20% faced higher labor costs.

Rent increases also played a significant role, with 13.7% of businesses raising prices due to higher rental costs. Only 3.6% increased prices as part of a pre-planned strategy.

F&B industry experts argue that the fact that nearly half of businesses raised prices in just six months indicates a broader industry trend rather than isolated incidents.

“The F&B industry is entering a phase where pricing power reflects adaptive capacity. Businesses with strong brands, differentiated products, and loyal customer bases will have more leeway to increase prices. In contrast, those heavily reliant on price-sensitive customers will face revenue decline risks without accompanying strategies,” Quân observes.

Amid rising input costs, consumers are generally accepting higher prices but are optimizing their spending by reducing the frequency of dining out. The report predicts that growth in the latter half of the year will be driven more by higher average order values than by increased customer traffic through promotions.

The Top 10 Private Food and Beverage Companies Contributing to Vietnam’s Economy

The top 5 businesses contributed over 1,000 billion, with the leading 2 ‘powerhouses’ accounting for more than 50% of the total contributions from the list.

How to Find Gold While Sifting Through Sand: A Guide to Seizing Opportunities

Sharing his insights at the ‘Khớp lệnh’ program on November 25, 2024, Mr. Dao Hong Duong, Director of Industry and Equity Analysis at VPBank Securities Joint Stock Company (VPBankS), asserted that several sectors exhibit positive signals based on their profit growth prospects for 2025. These sectors are expected to be relatively unaffected by external factors and offer suitable valuation ranges.