According to data from the General Statistics Office (Ministry of Finance), in the first 9 months of 2025, Vietnam’s total import-export turnover reached $680.66 billion, a 17.3% increase compared to the same period last year. The trade balance recorded a surplus of $16.82 billion.

On average, Vietnam’s monthly import-export turnover stood at $75.63 billion. Notably, if this pace is maintained in Q4 2025, the total annual turnover could surpass $900 billion, setting a new record in Vietnam’s foreign trade history. The trade surplus is projected to exceed $20 billion.

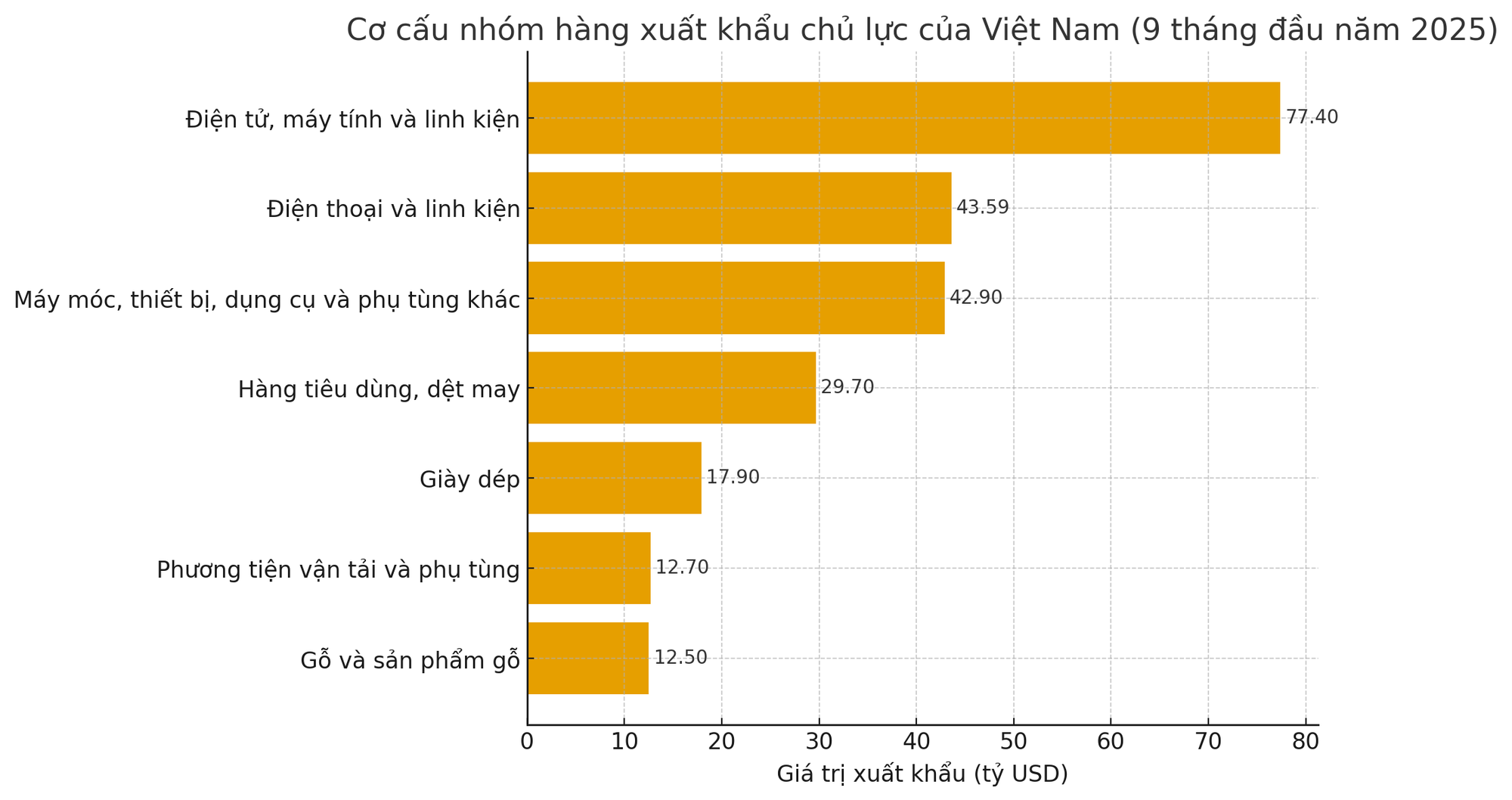

During the first 9 months of 2025, Vietnam’s export turnover reached $348.74 billion. There were 32 products with export turnover exceeding $1 billion, accounting for 93.1% of total exports. Remarkably, 7 products achieved exports over $10 billion, contributing 67.9% to the total export turnover. These “star” products are pivotal in driving the economy toward this record milestone.

Leading the 9-month export turnover in 2025 was the electronics, computers, and components group, with $77.4 billion, up 45.9% year-on-year, reflecting strong demand from major markets and expanded production by FDI enterprises. This group remains the flagship export category, commanding the highest share in the export structure.

In second place were telephones and components, reaching $43.59 billion, a 4.1% increase.

According to the World Bank (WB), electronics, computers, components, and telephones continue to be the backbone of Vietnam’s exports, accounting for over 34% of the country’s total export turnover.

This impressive performance is attributed to robust FDI inflows into high-tech, semiconductor, and smart device sectors, with global giants like Samsung, LG, Foxconn, Amkor, and Hana Micron playing a significant role in shaping Vietnam’s position in the global technology supply chain.

The next billion-dollar export group was machinery, equipment, tools, and spare parts, with $42.9 billion, up 13.5%.

In the consumer goods sector, textiles and garments reached $29.7 billion (up 8.6%), while footwear maintained its traditional export strength at $17.9 billion, a 7.4% increase.

Notably, transport vehicles and parts saw double-digit growth, hitting $12.7 billion (up 13.3%), and wood and wood products reached nearly $12.5 billion, up 6.8%, further contributing to Vietnam’s export growth momentum.

The Ministry of Industry and Trade attributes Vietnam’s robust export growth not only to the recovery of key sectors but also to favorable factors such as increased demand in major export markets, the government’s flexible policies in stabilizing exchange rates, controlling logistics costs, and boosting domestic production.

Additionally, the strategy to diversify markets and supply chains has helped Vietnamese goods maintain competitiveness, especially as major economies adjust trade policies and restore production.

As 2025 approaches its final months, the export outlook remains positive, with Vietnamese businesses proactively leveraging opportunities from free trade agreements and the global shift of orders to Vietnam.

Surplus Balance of Payments, Yet Exchange Rates Remain in Turbulent Waters

The balance of payments has shown cyclical improvements, yet pressures on the exchange rate persist due to heightened demand for the US dollar—particularly for debt servicing and capital outflows. The currency outlook for late 2025 will hinge significantly on trade surpluses, remittance inflows, and the global trade environment.

Emerging Real Estate Hotspots: Hà Nam, Hưng Yên, Vĩnh Phúc Attract Major Players Like Sun Group, Phú Mỹ Hưng, Bim Group in a Wave of Investment

Amidst Hanoi’s constrained land availability and escalating property prices, neighboring provinces such as Hà Nam, Hưng Yên, and Vĩnh Phúc have emerged as vibrant real estate markets. These satellite regions are witnessing a surge in housing supply, robust buyer demand, and competitive pricing, positioning them as attractive alternatives for both investors and homebuyers.