Impressive Growth Momentum

After surpassing the 1,700-point mark earlier in September, the VN-Index entered a period of consolidation around its peak, closing the month at 1,661.7 points—a 1.2% decline from the beginning. However, over the entire third quarter, the VN-Index demonstrated remarkable growth, surging by over 285 points, equivalent to a 20.6% increase compared to the end of Q2. This performance marks one of the most robust periods in the past five years. Amid this backdrop, equity mutual funds—known for their long-term investment strategies and professional portfolio allocation—capitalized effectively on the market’s upward trend.

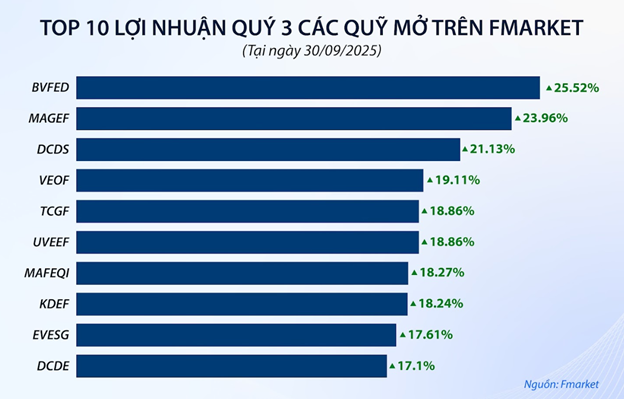

Data from Fmarket highlights the top-performing mutual funds in Q3, including: BVFED (+25.52%), MAGEF (+23.96%), DCDS (+21.13%), VINACAPITAL-VEOF (+19.11%), TCGF (+18.86%), UVEEF (+18.86%), MAFEQI (+18.27%), KDEF (+18.24%), EVESG (+17.61%), and DCDE (+17.1%).

|

In reality, the market’s year-to-date rally has been primarily driven by large-cap stocks, while fundamentally strong mid-cap stocks have yet to meet growth expectations. This divergence compelled mutual funds to maintain rigorous risk management discipline while remaining agile in leveraging opportunities within leading sectors. While technology stocks dominated fund portfolios in 2024, 2025 has seen a shift toward banking, construction materials, retail, and securities sectors.

Notably, mutual funds have demonstrated adaptability in navigating market volatility. When the U.S. imposed tariffs, funds proactively increased cash holdings and reallocated to sectors benefiting from domestic demand and fiscal policies. As trends became clearer, funds swiftly deployed capital into core stocks, sustaining performance. In August, as the market approached short-term peaks, funds strategically locked in profits from major banking stocks like MBB, ACB, TCB, VIB, and VPB, reducing equity exposure to preserve gains and prepare for new opportunities.

Over the first nine months of 2025, mutual funds maintained robust profitability. BVFED led the market with a remarkable 36.4% gain. Funds achieving strong growth during this period focused on large-cap stocks (blue-chip funds) or employed dynamic portfolio management strategies, effectively capitalizing on the VN-Index recovery. However, fund performance is not solely measured by alignment with the VN-Index; the core lies in risk management and long-term vision, with most funds delivering breakthrough returns over 3–5-year horizons.

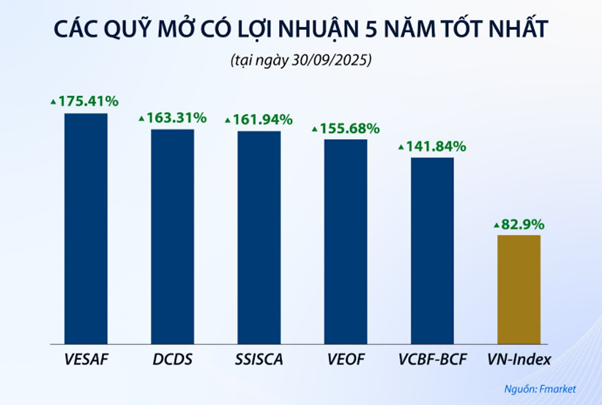

Fmarket data reveals that many mutual funds with a 5-year track record have significantly outperformed the market index. From September 2020 to September 2025, while the VN-Index rose by 82.9%, several funds achieved double the returns. Notable performers include VINACAPITAL-VESAF (+175.41%), SSISCA (+163.31%), DCDS (+161.94%), VINACAPITAL-VEOF (+155.68%), and VCBF-BCF (+141.84%).

What Opportunities Lie in the Final Quarter?

The final months of the year bring positive macroeconomic signals. Experts suggest that the Federal Reserve’s rate cuts, easing exchange rate pressures, and promising credit growth prospects will create opportunities for investors to accumulate assets at reasonable prices, targeting long-term goals.

According to Ms. Dương Kim Anh, Director of Investment at VCBF, the market still offers opportunities in stocks with strong fundamentals and long-term potential, despite short-term external pressures. This is an opportune moment for investors to hold positions patiently, awaiting improved business results and stock price recoveries.

She also highlights that sectors with strong year-to-date growth, such as banking, still have upside potential due to stable credit, improving asset quality from real estate recovery, and cost optimization through digital transformation. Banks balancing growth and risk management remain attractive investments.

With Vietnam’s stock market upgraded to Emerging Market status by FTSE, HSBC anticipates this event will attract significant long-term indirect investment from index and active funds, potentially bringing up to 10.4 billion USD in foreign capital to Vietnam’s market.

Analyzing Vietnam’s market appeal, Ms. Nguyễn Hoài Thu, Deputy CEO of VinaCapital Fund Management, identifies three key factors: “First, the upgrade to Emerging Market status may attract substantial foreign capital. Second, robust economic and corporate earnings growth persist. Third, the government’s ‘Innovation 2.0’ reform program is driving deep economic restructuring, accelerating infrastructure and real estate project approvals, and laying a solid foundation for long-term growth.”

– 13:14 13/10/2025

Post-Upgrade Surge: Stock Shares Attract Major Investment

After a period of subdued anticipation awaiting the market upgrade results, the stock market surged dramatically during the week of October 6–10. The official announcement of FTSE’s upgrade to emerging market status (on October 8) unlocked psychological barriers and fueled a robust rally in both indices and liquidity.

Market Pulse 13/10: Blue-Chip Stocks Steady the Beat, VN-Index Stays in the Green

The upward momentum was well-sustained across key indices during the morning session, largely driven by strong contributions from blue-chip stocks. At the midday break, the VN-Index climbed over 7 points (+0.42%), reaching 1,754.91, while the HNX-Index also rose by 0.38%, settling at 274.66. However, the overall market breadth remained less optimistic, with sellers dominating as 446 stocks declined compared to 221 that advanced.

Expert Insights: Major Capital Inflows Signal VN-Index’s Potential to Surge by 20–30%

Experts advise investors against chasing prices at all costs. Instead, they recommend adopting a phased investment strategy, gradually allocating funds over time.