At Ancarat Vietnam JSC, silver prices continue to rise, listed at VND 2,022,000 per tael (buy) and VND 2,080,000 per tael (sell) in Hanoi. Over the past year, silver prices have surged by over 82%, outpacing the increase in gold prices (over 71%).

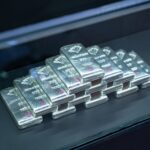

Meanwhile, 1kg 999 silver bars are priced at VND 53,036,000 per bar (buy) and VND 54,486,000 per bar (sell), updated at 8:33 AM on October 14.

Globally, silver prices soared by more than 3% to over $52 per ounce, marking a new record high. This surge is driven by concerns over U.S.-China trade tensions, political instability, and expectations of further interest rate cuts by the United States, boosting demand for safe-haven assets.

On Friday (October 10), U.S. President Donald Trump threatened to impose additional 100% tariffs on Chinese goods starting November 1, in response to Beijing’s new export controls on rare earth minerals.

However, Trump later signaled openness to negotiations ahead of a potential meeting with President Xi Jinping later this month, stating that trade relations with China “will be fine.”

Broader geopolitical concerns also support prices, with the U.S. government shutdown, political unrest in France, and leadership uncertainty in Japan weighing on sentiment.

Meanwhile, expectations that the Federal Reserve will cut interest rates by 25 basis points this month and again in December, coupled with tightening physical silver supplies in London, continue to drive the metal’s rally.

According to expert James Hyerczyk, this is the first time in over a decade that the precious metal has surpassed and held above the $49.81 per ounce threshold, a long-standing ceiling. He added that buying momentum remains strong, but silver’s next move depends heavily on new signals from the U.S. Federal Reserve (FED).

“According to CME FedWatch, traders are pricing in a 95% chance that the FED will cut rates by 0.25 percentage points at the October 29 meeting. However, the U.S. government shutdown entering its fourth week has delayed the release of key data such as the September Consumer Price Index (CPI), leaving the market short of directional information,” said James Hyerczyk.

Gold Price Today 12/10: Gold Trades Sideways After Reclaiming $4,000/oz Threshold

On the morning of October 12th, the global gold price listed on Kitco remained steady at $4,016 per ounce, unchanged from the previous morning’s opening rate.