Leading Primary Supply in Q3/2024

Primary Supply Leadership

DKRA Consulting’s Q3/2024 market report reveals that primary apartment supply in Ho Chi Minh City and its surrounding areas reached over 15,000 units, a 15% increase compared to the same period last year. The Eastern area of HCMC continues to lead, accounting for approximately 96.8% of the total primary supply.

Notably, high-end apartments (Grade A) dominate, representing over 36% of the total primary supply. Affordable housing projects are becoming increasingly rare. Overall demand in the primary market maintained its recovery momentum, tripling compared to Q3/2023, primarily concentrated in projects within Binh Duong (now part of Eastern HCMC).

Primary selling prices continued to rise, averaging 12-18% higher than the previous year. Secondary market prices increased by 7-15%, with liquidity showing further improvement.

According to Mr. Dinh Minh Tuan, Director of Batdongsan Southern Region, the strong price growth in Eastern HCMC stems from two key factors: a high proportion of luxury supply and superior infrastructure development.

Since 2024, approximately 80% of new launches in the East have been high-end properties. This has elevated the area’s average prices above the regional benchmark. However, this trend poses a potential supply-demand imbalance, as most new projects cater to the luxury segment while mid-range and affordable options—where demand is high—are increasingly scarce.

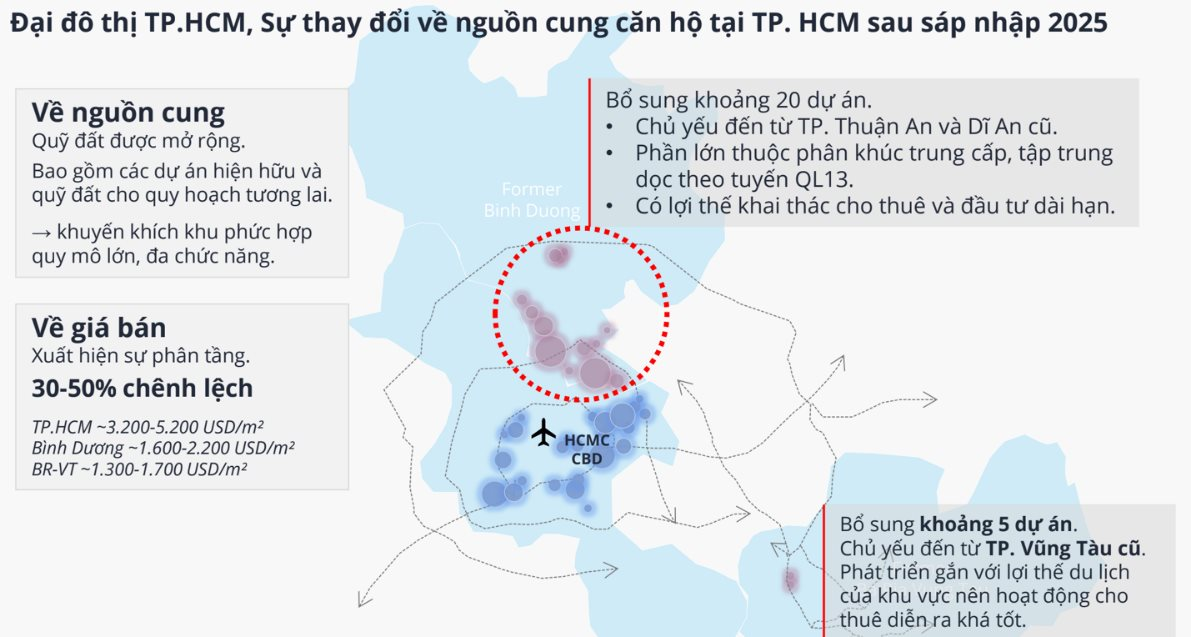

Post-merger, HCMC’s real estate supply increases.

Similarly, Dat Xanh Services data shows that HCMC’s housing market continues its upward price trend across all segments. The East—designated as the new urban center—leads with a 15-30% increase since the year’s start. Post-merger, average apartment prices in HCMC (former area) range from VND 35-150 million/m², with the East peaking at VND 85-150 million.

Amid HCMC’s market segmentation, the East sustains stable demand, vibrant transactions, and strong liquidity, especially in mid-to-high-end segments. Several projects maintain robust demand during this period.

Notably, TT AVIO by a Japanese joint venture is launching its final units in the Orion Tower. Priced from VND 33.6 million/m²—below market average—and strategically located at the Eastern HCMC gateway, the project has garnered significant interest.

Situated on Provincial Road 743C, Di An (HCMC), the project offers easy access to District 1 and District 3 (former HCMC) within 15-30 minutes. It also connects seamlessly to Thu Dau Mot, Dong Nai, and surrounding areas via key routes such as National Highway 13, National Highway 1A, Hanoi Highway, Pham Van Dong, and the Ring Road. Previous sales phases achieved 80-90% absorption rates.

Other primary supply projects like A&K Tower, Sycamore, The Emerald Garden View, Emerald Boulevard, La Pura, The Aspira, and Happy One Central are also accelerating launches in the final quarter.

Observations indicate that Q3 and Q4 mark a robust developer push. Projects near key infrastructure are gaining notable traction.

Year-End Capital Flows Shift Eastward

Experts note a pronounced capital shift toward Eastern HCMC, the emerging urban hub setting new price benchmarks.

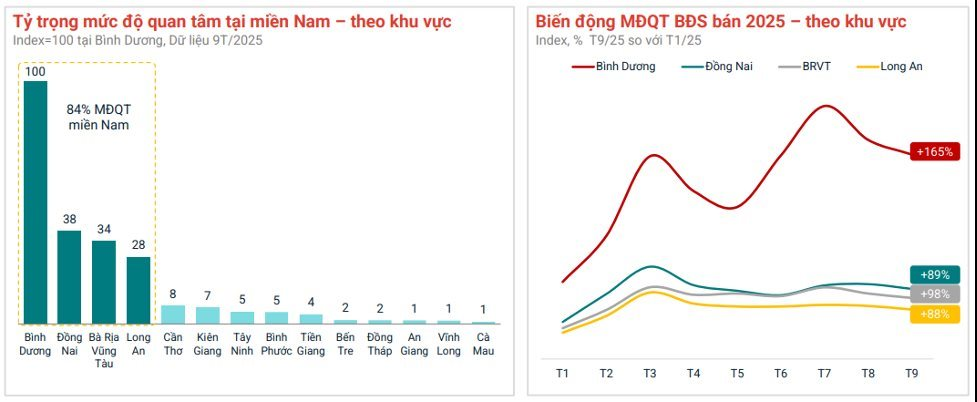

Batdongsan.com.vn’s Q3/2025 report highlights a 165% surge in interest for Binh Duong (former area) properties since the year’s start, outpacing other regions. Binh Duong captures 84% of total Southern interest and leads with an index of 100.

This momentum reflects capital migration from HCMC to areas with improving infrastructure, ample land, and price growth potential—ideal for both residential and long-term investment needs.

Soaring interest in Binh Duong (now part of HCMC). Source: Batdongsan.com.vn

Apartment interest in HCMC (former area) and Binh Duong rose by 19% and 48%, respectively, signaling a return of both end-users and investors. Conversely, Ba Ria-Vung Tau, despite slight price increases, struggles to attract new demand, underscoring satellite area disparities.

Q3 solidified market foundations and recovery momentum as confidence returned, capital flows resumed, and investment activities cautiously accelerated. In Q4, trends will favor real value assets: rising prices, growing demand, and higher rents signal genuine recovery. Capital will continue shifting southward, targeting infrastructure-rich urban centers, with apartments and infrastructure-linked housing leading.

However, caution remains essential. Investors should prioritize projects with clear legal status, reputable developers, and infrastructure-adjacent locations to mitigate price manipulation risks. The new market cycle will prioritize controlled, sustainable growth over speculative surges, emphasizing real value and long-term viability.

Exclusive Luxury Zone Emerges in Ho Chi Minh City, Setting Record Price at VND 300 Million per Square Meter

Nestled away from the bustling city center, an emerging area in Ho Chi Minh City is witnessing a surge of large-scale condominium projects, predominantly catering to the luxury segment.

“Dĩ An (Old) and Thuận An (Old) Apartments in High Demand: Investment Capital Shifts Away from Ho Chi Minh City Center”

Data from Batdongsan.com.vn reveals that due to soaring prices in central Ho Chi Minh City, investment capital is increasingly shifting toward areas with greater growth potential and more affordable pricing, such as former Thu Duc, Di An, and Thuan An districts.