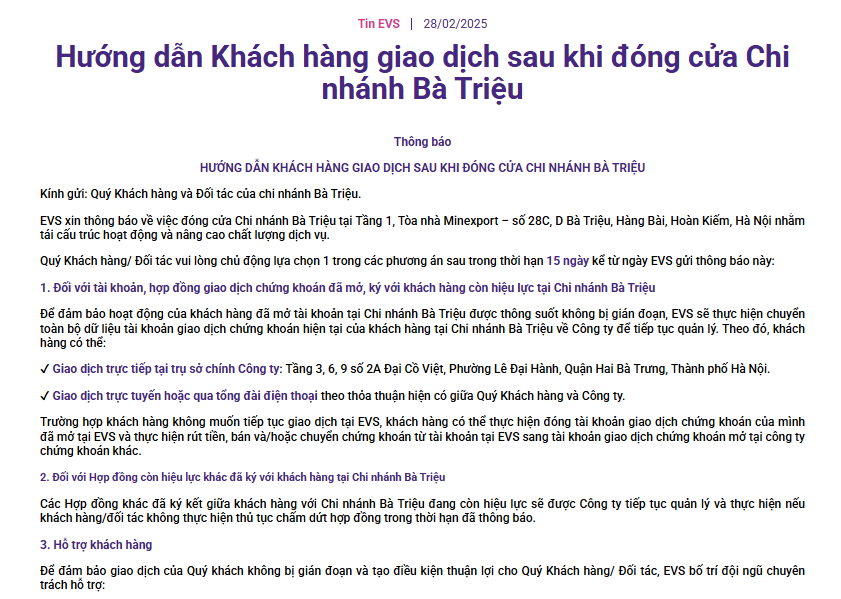

In reality, the closure of the Ba Trieu branch was approved by the EVS Board of Directors in February 2025. At that time, the company also posted a notice on its website guiding customers on transactions after the branch closure.

The closure was subsequently approved by the State Securities Commission (SSC) in April 2025. By May 2025, the Vietnam Securities Depository and Clearing Corporation (VSDC) decided to revoke the branch’s securities depository operation certificate.

Source: EVS Website

|

The Ba Trieu branch was established with the approval of the EVS Board of Directors on October 17, 2018. On December 10 of the same year, the SSC approved its establishment, with its headquarters located at 1st floor, Minexport Building, 28C-D Ba Trieu Street, Hang Bai Ward, Hoan Kiem District, Hanoi. This address was maintained until recently (new address in Cua Nam Ward after merger).

With the decision to cease operations at the Ba Trieu branch, EVS now operates two remaining branches: Nguyen Trai Branch (2nd floor, VNT Tower, 19 Nguyen Trai Street, Khuong Dinh Ward, Hanoi) and Saigon Branch (4th floor, Bitexco Nam Long Office Building, 63A Vo Van Tan Street, Xuan Hoa Ward, Ho Chi Minh City), along with its head office (3rd, 6th, 9th floors, 2A Dai Co Viet Street, Hai Ba Trung District, Hanoi).

In other notable developments, EVS Ba Trieu was recently fined over VND 20 million by the Hanoi Tax Department for violations related to VAT, PIT, and business license fees.

As for EVS, the securities company has been embroiled in issues related to the CLACH2125002 bond issued by Cam Lam Investment Company. As of September 30, Cam Lam has yet to pay the principal and interest on this bond.

In terms of business performance, EVS faced a challenging Q2 2025, with revenue declining 40% year-on-year to nearly VND 39 billion. The company even reported an after-tax loss of nearly VND 8 billion, compared to a profit of over VND 17 billion in the same period last year.

According to EVS, market volatility in Q2 2025 led to reduced trading volumes, impacting brokerage and margin revenue. Additionally, proprietary trading revenue declined, and stock price decreases resulted in higher revaluation losses for financial assets compared to the same period last year.

The poor Q2 results dragged down the first-half performance, with EVS reporting an after-tax profit of only VND 2.5 billion, a 92% drop compared to the first half of 2024.

– 08:08 14/10/2025

Finance Ministry Announces Licensing for Crypto Asset Services

As of now, no company has submitted an application to provide cryptocurrency services, according to Deputy Minister of Finance Nguyen Duc Chi. However, several businesses have expressed interest and engaged in preliminary technical discussions with regulators to fully understand the requirements and conditions, paving the way for formal proposals in the near future.

IR AWARDS: October 2025 Disclosure Schedule Highlights

In October, several key events will shape the stock market landscape. Notable highlights include the release of the PMI, the Q3/2025 Socio-Economic Report, the maturity of 41I1FA00, the deadline for Q3 Financial Statements, and the outcome of the FOMC (Fed) meeting.

“Contrarian Chairman Akio Toyoda Proves His Point on Hybrid Vehicles: Major Automakers Scaling Back on Electric Cars, the Rise of Hybrids Begins.”

The pursuit of electric vehicle dreams is no longer a priority for some automakers, with Honda being a notable example of a company that has officially stepped back from this ambitious goal.