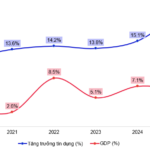

According to FiinRatings, credit growth in 2025 is expected to be widespread, but the upcoming growth will be differentiated based on capital capacity.

In the first half of 2025, the entire system’s credit increased by approximately 10% compared to the end of 2024 and around 20% year-over-year, bringing the total outstanding debt to about 17.2 trillion VND – the highest level in the past two years. The credit-to-GDP ratio continues to rise, officially estimated at around 134% by the end of 2024, and FiinRatings projects it to reach approximately 146% by the end of 2025.

The analysis team notes that from late 2025, capital requirements under Basel III standards and the removal of credit limits will create a growing divide among banks. Larger banks with substantial capital capacity will expand their market share, while smaller banks will need to regulate growth to balance capital, profitability, and asset quality.

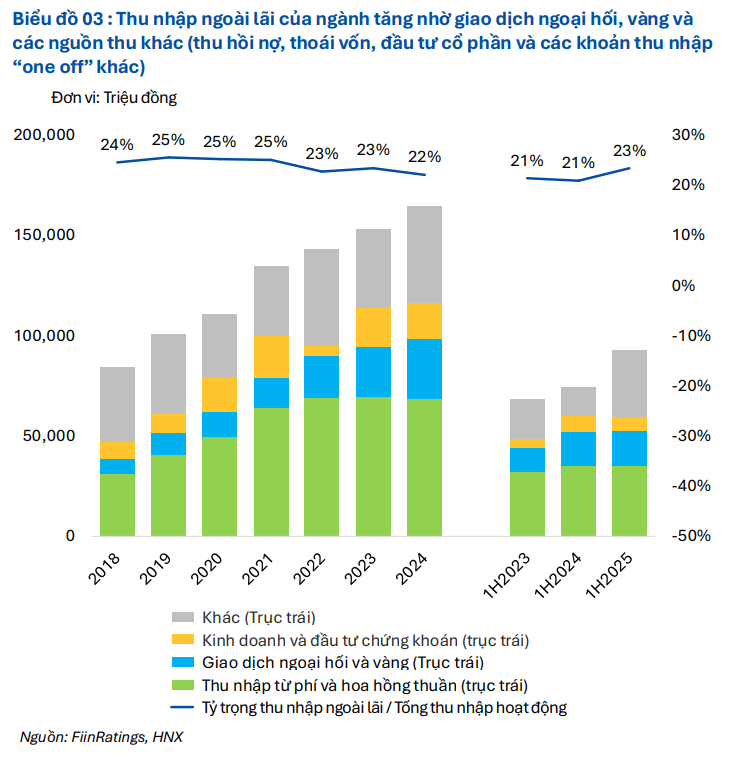

Regarding non-interest income, FiinRatings reports that it accounted for about 23% of total operating income (TOI) in the first half of 2025 (up from 22% in 2024), driven by strong growth in foreign exchange and gold transactions. Service fee income remained stable.

Meanwhile, bancassurance activities have diminished as a growth driver due to tightened consumer protection regulations and the amended Law on Credit Institutions, which prohibits cross-selling insurance with credit products. This has led some banks to withdraw from partnerships, slowing overall fee growth.

Income from foreign exchange and gold surged between 2024 and the first half of 2025, rising 18% compared to 2023 and 42% year-over-year. This growth is attributed to VND exchange rate fluctuations and the widening gap between domestic and international gold prices, prompting interventions by the State Bank of Vietnam (SBV). State-owned commercial banks (SOCBs) with strong brands and positions benefited the most.

Notably, Decree 232/2025/NĐ-CP (effective from October 10, 2025) will expand gold bar production and import rights to licensed banks and enterprises under SBV supervision. Priority will be given to organizations with large capital (over 50 trillion VND), such as SOCBs, leading joint-stock commercial banks, and select others.

Conversely, foreign exchange transactions are expected to normalize but remain stable, as the USD is projected to stabilize by the end of 2025.

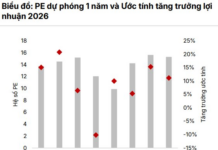

FiinRatings forecasts that the top 4 private joint-stock banks will see stabilized net interest margins (NIMs) in the second half of 2025 and 2026, supported by higher non-term deposit ratios (CASA). Return on assets (ROA) will remain above the industry median but below the 2022 peak, with non-interest income playing a larger role in profit structure.

State-owned commercial banks (SOCBs) are expected to continue improving their ROA due to scale advantages, with foreign exchange and gold transactions as key drivers. Their NIMs will remain stable but lower than those of private joint-stock banks.

For other private joint-stock banks, ROA is projected to improve further due to credit growth and recovering service fees. However, they face pressure from narrowing NIMs, making growth rates and cost control critical factors.

Skyrocketing Credit Growth Forecast Sparks Inflation Concerns: 15-Year High Predicted

As of the end of September, the economy’s credit growth has reached 13.37% compared to the beginning of the year. It is estimated that credit growth for this year could hit 19-20%, the highest level in 15 years. The State Bank of Vietnam emphasizes ongoing monitoring to ensure both economic growth and inflation control.

Credit Growth Reaches 13% by September 25, Deposits Surge to 9.74%

Interest rates for deposits and loans remain stable, while proactive and flexible exchange rate management contributes to macroeconomic stability. The insurance market continues to grow steadily, and the stock market is vibrant, with significant improvements in market liquidity.