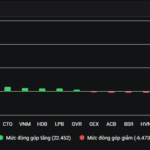

After a somewhat volatile opening, Vietnam’s stock market gained momentum as the trading session progressed, culminating in a robust close on October 13th. The VN-Index surged by nearly 18 points, reaching a new peak at 1,765 points. Trading volume saw a significant uptick, with the order-matching value on HoSE exceeding 38.5 trillion VND.

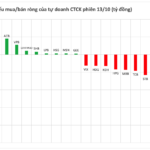

Foreign investors continued their net selling streak, offloading 1.150 trillion VND across the market today. A breakdown of their activity is as follows:

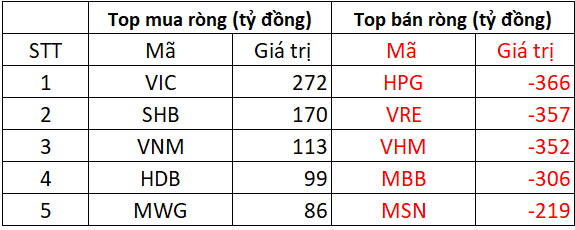

On HoSE, foreign investors net sold approximately 1.235 trillion VND

On the buying side, VIC led the market with a net purchase value of around 272 billion VND. SHB and VNM followed closely, each attracting over 100 billion VND in net buying. HDB and MWG also saw net purchases of 86-99 billion VND.

Conversely, HPG witnessed the most significant net selling, with foreign investors offloading approximately 366 billion VND. Other stocks like VRE, VHM, and MBB faced net selling ranging from 306 billion to 357 billion VND each. MSN also experienced net selling of around 219 billion VND.

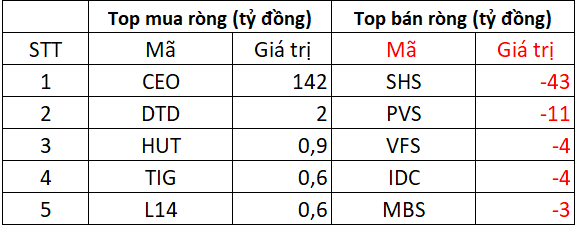

On HNX, foreign investors net bought over 75 billion VND

CEO was the most sought-after stock on HNX, with a net purchase of 142 billion VND. DTD, HUT, TIG, and L14 also saw net buying ranging from a few hundred million to 2 billion VND.

In contrast, SHS and PVS faced net selling of 43 billion and 11 billion VND, respectively. VFS, IDC, and MBS also experienced net selling of 3-4 billion VND each.

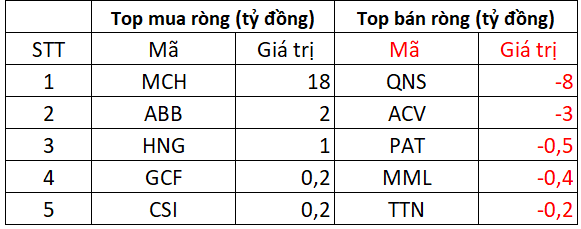

On UPCOM, foreign investors net bought 10 billion VND

MCH dominated UPCOM with a net purchase of 18 billion VND. ABB, HNG, GCF, and CSI also attracted net buying ranging from a few hundred million to 2 billion VND each.

On the selling side, QNS faced net selling of 8 billion VND, while ACV saw net selling of approximately 3 billion VND. PAT, MML, and TTN experienced minor net selling of a few hundred million VND each.

Stock Market Shatters All Records

The opening session of the week (October 13th) marked a historic milestone for Vietnam’s stock market, as the VN30-Index surpassed the 2,000-point threshold for the first time.

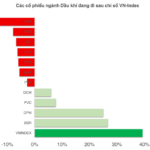

Where Are Oil & Gas Stocks Amid a Soaring Market?

Following the Vietnamese stock market’s ascent to new heights and its official upgrade to secondary emerging market status, investor focus is shifting towards stocks with unique narratives, particularly within the energy sector. However, several energy stocks are currently lagging significantly behind the broader market’s momentum.

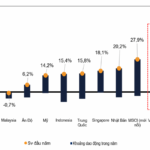

Historic Stock Market Peak: Is a Major Wave Following the Upgrade?

The VN-Index has just experienced its most robust weekly gain in history, consistently reaching new highs following the market upgrade catalyst. However, analysts caution that the rally is primarily driven by a handful of blue-chip stocks, with market liquidity showing signs of divergence. After the initial reaction to the upgrade news, the market is expected to refocus on fundamental factors.

VN-Index Hits New High Post-Upgrade: Why Are Many Investors Still Losing?

Last week, following the stock market upgrade, the VN-Index surged by over 100 points, yet many investors were left in tears.