In its latest announcement, FTSE Russell confirmed that Vietnam has fully met the criteria to be classified as a secondary emerging market according to its country classification. Consequently, the organization has upgraded Vietnam from a frontier market to a secondary emerging market, effective from September 21, 2026.

However, the upgrade remains contingent on a mid-term review in March 2026, which will assess the progress in expanding market access for foreign brokerage firms—a critical condition to attract broader participation from international investors.

Although the upgrade is not yet officially in effect, VNDirect Securities considers this decision a historic milestone for Vietnam’s capital market. This move reflects Vietnam’s strong commitment to enhancing transparency, standardizing trading processes, and aligning with international practices, thereby creating a more favorable investment environment for global capital.

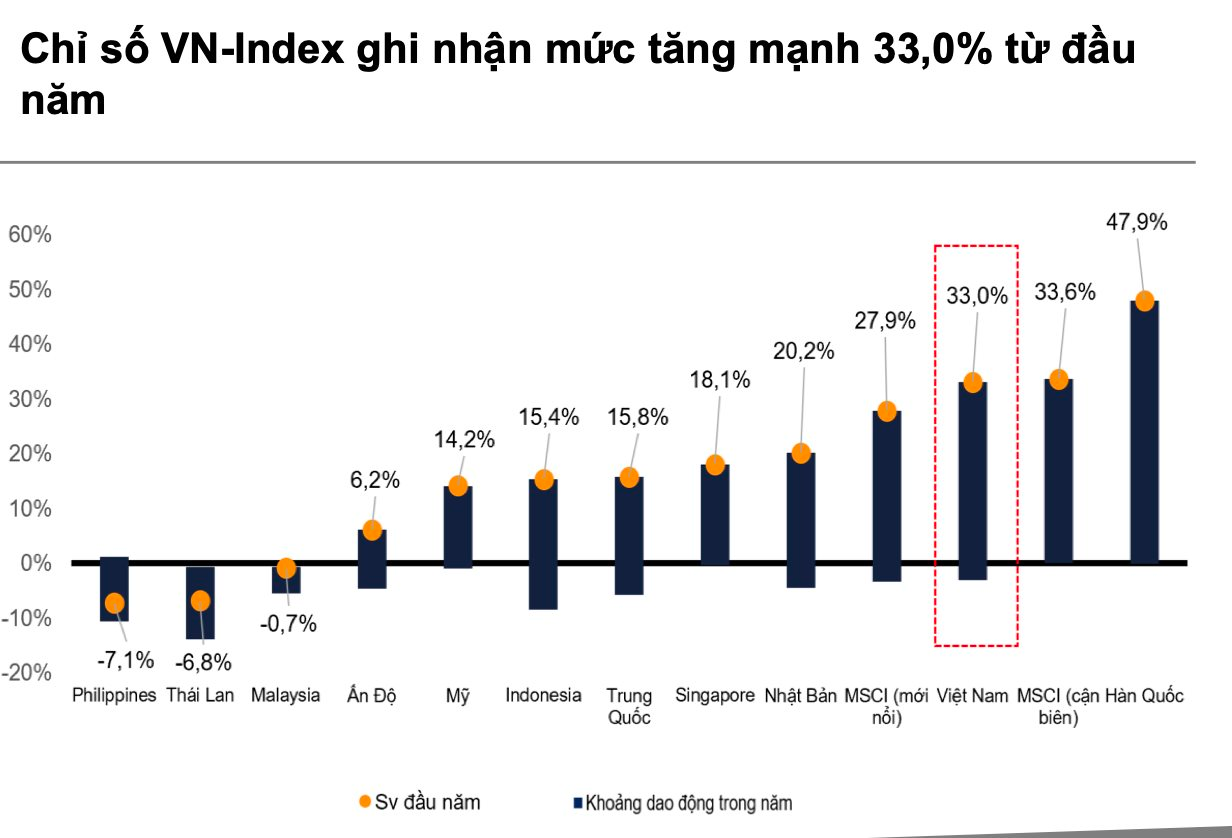

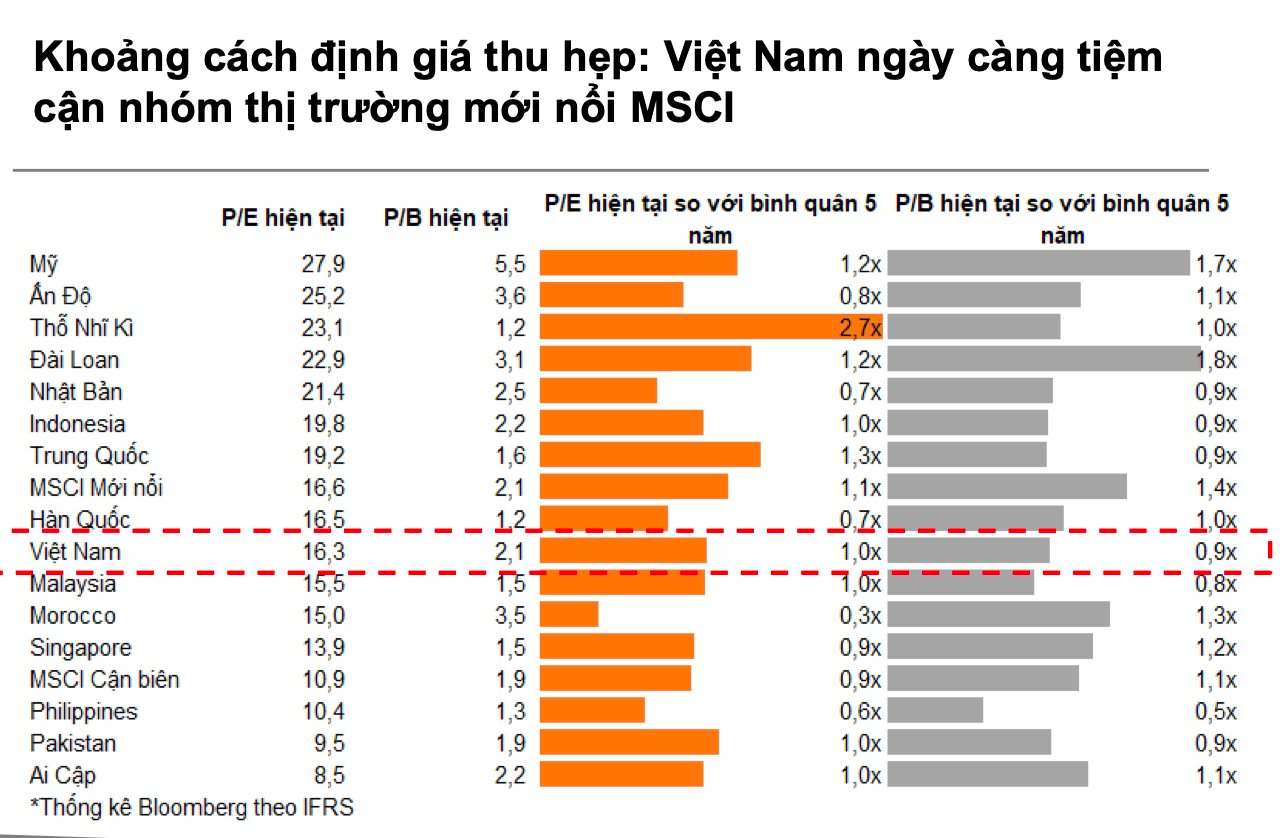

According to VNDirect, much of the optimism surrounding the upgrade has already been reflected in recent market performance. Since the beginning of the year, the VN-Index has risen by approximately 33%, bringing valuations closer to the average of other emerging markets. While foreign capital inflows are expected to increase, significant allocations may not occur immediately, with only a few active funds potentially investing ahead of the official upgrade in September 2026.

VNDirect anticipates that the market may react swiftly to FTSE’s announcement before returning its focus to fundamental factors such as third-quarter earnings, government growth support policies, macroeconomic stability, and Vietnam’s long-term growth prospects.

Analysts believe the upgrade is expected to drive foreign capital back to Vietnam’s stock market next year. VNDirect estimates that, following the official inclusion in FTSE’s secondary emerging market group, Vietnam could attract approximately $1.0–1.5 billion from open-ended funds and ETFs tracking FTSE indices.

Including active capital flows, this figure could range from $3.4 billion (HSBC’s estimate) to $6 billion (FTSE’s forecast). HSBC also notes that around 38% of Asia-focused funds and 30% of global emerging market funds already hold Vietnamese equities.

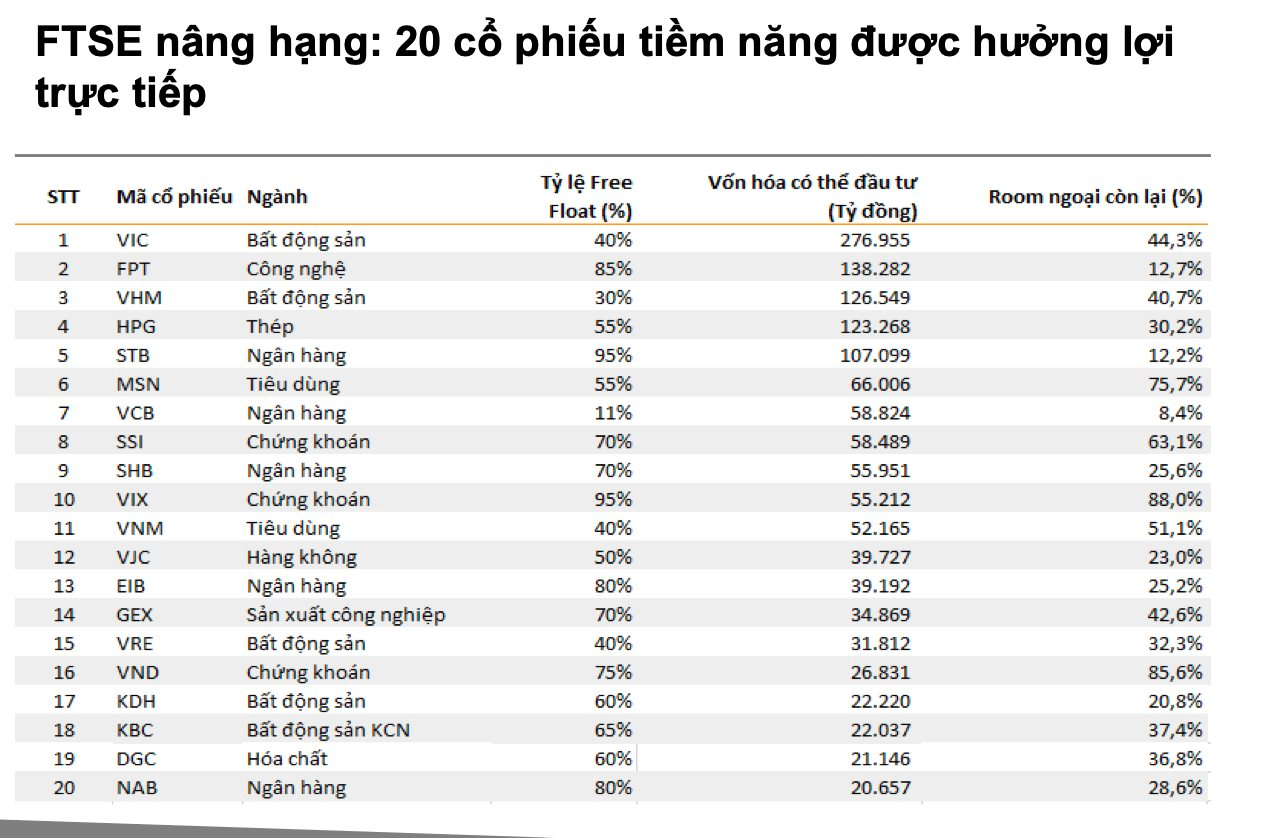

Stocks poised to directly benefit from the upgrade include VIC, VHM (real estate); VCB, STB, SHB (banking); SSI, VIX, VND (securities); MSN, VNM (consumer goods); FPT (technology); and HPG (industrial manufacturing).

To achieve the higher goal of being classified as a primary emerging market by FTSE and securing an upgrade from MSCI, Vietnam must continue advancing key reforms. These include implementing intraday trading, allowing short selling of securities not yet received, refining the legal framework for securities lending and short selling, shortening settlement cycles, and relaxing foreign ownership limits in restricted sectors.

Additionally, enhancing transparency, ensuring legal consistency, and improving market information quality are critical factors. VNDirect experts believe regulators will maintain strong reform momentum, paving the way for Vietnam’s potential MSCI upgrade to emerging market status between 2028 and 2030.

If realized, this could attract approximately $3 billion in foreign capital from open-ended funds and ETFs tracking MSCI indices—a figure significantly surpassing the expected inflows from FTSE’s secondary emerging market upgrade.

Unveiling the Billion-Dollar Livestream Shopping Empire: Navigating the Legal Gray Area

Unleash explosive revenue growth, job creation, and the shaping of new consumer trends—the livestream economy is emerging as a multi-billion-dollar empire. Yet, its unchecked growth is pushing influencers into a legal gray area, where the line between creativity and commerce grows increasingly blurred.

Government Party Congress: Striving for High Economic Growth in 2026-2030

The Government’s Party Committee for the 2025-2030 term has set an ambitious goal: by 2030, Vietnam aims to become a modern industrialized developing country with high-middle income, ranking among the top 30 global economies and 3rd in ASEAN. To achieve this, the target is to sustain high economic growth rates from 2026 to 2030 while ensuring major macroeconomic balances.

Unraveling the Psychological Knots Post-Promotion

While it’s premature to declare a new bull run in Vietnam’s stock market, last week witnessed several encouraging signs. The VN-Index closed at a record high of 1,747 points, marking the first time the index surpassed the 1,700 threshold since FTSE Russell upgraded Vietnam to “Secondary Emerging Market” status on October 8th.