Opportunities from the “Piles of Ashes”

Mrs. Phuong recounts her 25-year journey as an employee, filled with rich experiences. From a provincial student struggling to find her place in state-owned enterprises to becoming a senior leader at a bank, her path was anything but ordinary. She spent 17 years with the Ho Chi Minh Communist Youth Union’s enterprises, rising to Vice Director of Detesco, before moving on to Intimex, EMS, VietinBank, and Hapro Holdings.

Her foray into the paper industry began with a conversation with a hometown acquaintance—a paper engineer who had built the Hoang Ha brand over nearly two decades. When a bank asked him to rescue a debt-ridden paper mill, Mrs. Phuong joined the survey and witnessed the desolate factory in Dong Van I Industrial Zone (Ha Nam). “I asked if it could be saved, and he said, ‘With money, it can,’” she recalled.

In early 2012, at nearly 50, Mrs. Phuong decided to acquire the factory for 0 VND, taking on all its debts and restructuring it. “At the time, I thought it was simple: someone would handle production, and I’d manage administration and finance. I had always dreamed of owning a factory to provide jobs for my nieces and nephews in the countryside, who lacked university opportunities,” she shared.

After successfully reviving the first factory, Mrs. Phuong and her team planned to expand. Their second venture was another struggling paper mill in Hai Phong, burdened by bank debts of 60-70 billion VND. Unable to replace the owner due to the debt’s classification, they established Hoang Ha Hai Phong Paper JSC (now HHP GLOBAL) to execute the project. “By then, I realized I had ‘burned my boats’—my assets, career, and future were all tied to this company,” she said.

I Once Wished I Had Never Started a Business

In late 2012, with soaring bank interest rates, Mrs. Phuong accepted a long-term loan at 14% annually (despite concessions) to upgrade and revive the factory. However, environmental issues soon arose. Residents vehemently protested due to the previous owner’s reputation. Once, a careless worker’s oil-soaked rags led to a fine of nearly 200 million VND. These challenges spurred her to invest in a new, eco-friendly factory to dispel the stigma of the paper industry as a polluter.

Hoang Ha Paper Factory with a capacity of 100,000 tons/year

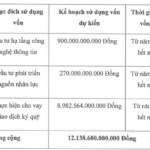

Yet, challenges persisted. The second storm, a financial abyss, loomed large. The new factory’s investment far exceeded the company’s financial capacity, and borrowing proved insufficient. “When funds were nearly depleted, I knew I couldn’t keep improvising. The only solution was an IPO,” Mrs. Phuong recalled.

Convincing major shareholders of the IPO idea was no easy feat, as they feared losing control. “By 2017, with financial pressure at its peak, I called an extraordinary shareholder meeting and presented an ultimatum: either we IPO or each contribute at least 10 billion VND and additional property as collateral. Of course, none of us had the funds or assets left. The only option was clear: IPO, with me fully responsible for its execution,” she explained.

However, the IPO wasn’t the final hurdle in her entrepreneurial journey. The third storm, mental turmoil, was the most daunting. “There were moments I wished I had never started a business, as the pressure seemed insurmountable,” Mrs. Phuong confided.

Rejecting the Backdoor Listing

During the IPO process, advisors suggested a “backdoor” listing by merging with a public company for a quicker market entry. However, as negotiations progressed, Mrs. Phuong’s financial expertise detected irregularities, leading her to halt the deal. Convinced there are no shortcuts to sustainable success, the company opted for a rigorous, by-the-book IPO. In August 2018, HHP’s shares officially listed on HNX, later moving to HoSE in 2021, making it one of the few paper companies on the stock exchange.

Vietnam’s first paper production project meeting LEED standards

“At the bell-ringing ceremony for the first trading session, I reminded myself: IPO is not the destination but the beginning of a longer journey,” she said. With capital secured, Mrs. Phuong promptly launched a new factory project adhering to the U.S. Green Building Council’s LEED standards. By late 2023, the first paper roll from HHP Paper Hai Phong in Tien Lang Industrial Park (Hai Phong) marked over a decade of her dedication to the paper industry.

Today, Mrs. Phuong has realized her initial entrepreneurial goals. Yet, for her, success transcends numbers or business milestones. True success lies in witnessing her employees grow and lead happier, more fulfilling lives.

Looking ahead, under Mrs. Phuong’s leadership, the company aims higher: achieving Net Zero emissions by 2035, 15 years ahead of Vietnam’s national commitment. According to HHP’s leadership, this is not just a social responsibility but a sustainability benchmark for the company’s growth. Resolution 68, recognizing the private sector as a key economic driver, serves as a cornerstone for this ambition.

“Starting a business felt like standing in the eye of a storm, bombarded by challenges—from public backlash and extortionists to production hurdles and financial crises. There were moments I wished I had never started, as the pressure seemed unbearable.” – Mrs. Tran Thi Thu Phuong

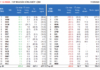

TCBS Reports Significant Profits in First Nine Months, Achieving 88% of Annual Plan

Technological Commercial Joint Stock Bank Securities (TCBS, HOSE: TCX) has released its Q3/2025 financial report, revealing a remarkable net profit of nearly VND 1.62 trillion, an 85% surge compared to the same period last year. This impressive performance has propelled the company’s nine-month cumulative profit to over VND 4.05 trillion, marking a 31% year-on-year growth. TCBS’s core operations, including proprietary trading, brokerage, and lending, have all demonstrated robust growth, solidifying its position as a leading player in the industry.

VPBank Empowers Rikkeisoft’s Global Acceleration

On October 10, 2025, Rikkeisoft JSC and Vietnam Prosperity Joint Stock Commercial Bank (VPBank, HOSE: VPB) officially signed a Memorandum of Understanding (MOU). This agreement marks a comprehensive partnership between a rapidly growing technology company and a leading commercial bank in Vietnam, with VPBank serving as a financial springboard to propel Rikkeisoft’s global expansion.