Nissan’s N7 electric sedan showcased at the Shanghai Auto Show, April 2025.

For international automakers, investing in China was once a no-brainer.

In the early 2000s, companies from the U.S., Europe, Japan, and South Korea flocked to the nation as it exploded into the world’s largest auto market. Despite government regulations tying global brands to local partners, these giants quickly captured market share and reaped profits.

Today, striking it rich in China is no longer a given, especially for ambitious foreign players.

In just five years, the fortunes of foreign automakers have completely flipped. As of 2020, international brands held over 60% of China’s light vehicle sales. Last year, their market share plummeted to around 35%. The rest belongs to domestic brands.

Now, global automakers face a growing dilemma: stay or go?

Indeed, several brands have exited China to cut losses. But international manufacturers aiming to maintain a stronger global presence should think twice. Chinese brands are gaining traction overseas. And for traditional competitors to challenge them internationally, there’s no better training ground than competing with them on their home turf.

Certainly, the pressure on international brands to exit China is palpable.

From the outset, they were hindered by Beijing-imposed policies. A 15% tariff restricted imports from foreign facilities. And to establish a presence in China, they needed local partners, often state-backed giants more focused on creating local jobs than being agile innovators.

No surprise, these joint ventures were soon outpaced by emerging private companies like Chery and Geely. Eventually, truly innovative EV startups—with names virtually unknown outside China, such as Xpeng, Nio, BYD, and Li Auto—climbed the sales charts and became global threats.

The “home team” is backed by a robust ecosystem featuring the world’s largest EV battery maker, CATL, and tech giants like Baidu and Xiaomi. All are collaborating with local automakers in autonomous driving, connectivity, electrification, and AI.

Chinese consumers have embraced local products, partly out of patriotism but also because domestic brands better cater to their tastes and needs.

Jeep employees clean a vehicle at a 2016 expo. The brand has since exited China.

Amid this onslaught, even popular foreign brands like Tesla are losing ground. Some companies, including Suzuki, Mitsubishi, Renault, Jeep, and Fiat, have withdrawn or significantly scaled back. Others, like Nissan and Honda, are cutting production in China. Some, such as General Motors, are repurposing underutilized Chinese plants for exports.

But surrendering in China carries significant risk. The threat intensifies as Chinese brands eventually flood global markets.

From Europe and South America to Southeast Asia and beyond, Chinese brands are gaining momentum and market share. Ambitious players like BYD are even targeting Japan and India.

Michael Dunne, a longtime China observer and CEO of Dunne Insights, was blunt at a September industry leaders panel at the Detroit Auto News Congress. “Think of China as a massive earthquake, followed by a devastating tsunami,” he said.

Industry experts like him note that established brands, operating in still somewhat isolated and protected home markets, haven’t yet felt the full force of China’s low-cost competition. When the wave truly hits, will they be ready?

Automakers staying in China—despite challenges—are adapting, leveraging valuable lessons. For instance, Nissan and General Motors initially tried selling foreign-designed EVs meant for overseas customers to Chinese consumers. But these products couldn’t compete with local offerings.

Now, Nissan and GM are relying on local partners to launch China-designed EVs, engineered by Chinese teams for Chinese buyers. So far, this localization strategy shows promise.

Nissan, whose China sales have halved since 2018, introduced a locally produced, fully electric sedan this year. Almost miraculously, its sales decline has reversed.

GM is testing something similar with a new, locally designed EV platform for its Buick Electra sub-brand.

Toyota has also succeeded with a compact, China-developed electric crossover. Numerous other brands, including Audi, Renault, Volkswagen, and Ford, are joining the fray.

These new products, leveraging local expertise, are both cost-effective and high-tech. And they’re hitting the market incredibly fast. Some foreign companies are now launching products in under 20 months—far quicker than their usual multi-year timelines.

Some even plan to build global products based on China-inspired architectures. This approach, initially dubbed “In China, for China,” may ultimately become “In China, for the World.”

When global automakers first entered China, they were the teachers, imparting technical know-how and supply chain expertise to then-nascent Chinese competitors.

Now, the students have become masters, schooling the old “metal benders” in modern methods.

It’s too early to say if this reverse technology transfer is a long-term solution for international automakers. Competing in China will likely remain an uphill battle.

But smart legacy brands will choose to keep fighting. After all, if they can successfully compete with Chinese rivals in China, they can compete anywhere.

BYD Invests Over $10 Billion to Build a Mega Electric Vehicle Factory Near the U.S., Aiming for 300,000+ Annual Capacity, Outpacing Ford’s Presence in BRICS Nation

Following its expansion in China, BYD is now setting its sights on South America, investing over $1 billion to further grow its electric vehicle empire in the region.

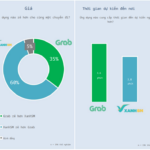

VNDIRECT Leadership: Anticipating 20-30% Profit Plan Surpass, Not Yet Time for Digital Asset Engagement

At an extraordinary shareholders’ meeting of VNDIRECT Securities (HOSE: VND) on the afternoon of October 10, CEO Nguyen Vu Long announced that the company has achieved over 90% of its 2025 profit plan after just nine months. He further forecasted a 20-30% surplus by year-end. Additionally, Chairwoman Pham Minh Huong shared notable insights regarding the company’s plans to engage in digital assets.