Last week’s trading session witnessed a remarkable surge in the VN-Index, soaring over 100 points, equivalent to a 6.18% increase, reaching 1,747.55 points—the most significant weekly gain in history. The primary driving force behind this rally was the Vingroup ecosystem stocks. By the end of the week, VIC skyrocketed to VND 192,000 per share, while VHM reached VND 123,000, both setting new record highs.

In contrast, most other stocks on the market only recovered by 5-8% from their recent lows. Profitability generally lagged behind the overall index, as market-wide order-matching liquidity remained weak, 16% lower than the 20-week average. This indicates that capital flow has yet to fully permeate the market.

However, there were signs of capital returning, with weekly liquidity increasing by 19.3% compared to the previous week. This was also the most broadly positive week since the beginning of the year, with all 21 industry groups posting gains. Real estate led the charge, followed by retail and steel.

A notable downside was foreign investors’ continued net selling, totaling over VND 5,046 billion. On the buying side, HPG (+VND 817 billion), GEX (+VND 506 billion), and VIC (+VND 359 billion) stood out. Conversely, VRE (-VND 895 billion), MBB (-VND 696 billion), and MSN (-VND 645 billion) faced the most significant selling pressure.

The VN-Index’s impressive weekly gain was led by blue-chip stocks, but Vietcombank Securities (VCBS) analysts noted that the momentum from large-cap stocks has not yet fully spread to the broader market. Most stocks remain in sideways trends, accumulating or retesting support levels.

Market liquidity is fragmented. In this context, VCBS advises investors to maintain or consider increasing their holdings in stocks already in their portfolios when these stocks convincingly break through resistance levels. Additionally, investors should capitalize on capital rotation by selectively investing in short-term opportunities within sectors attracting active buying liquidity.

Notable sectors at this time include banking, public investment and construction, and retail.

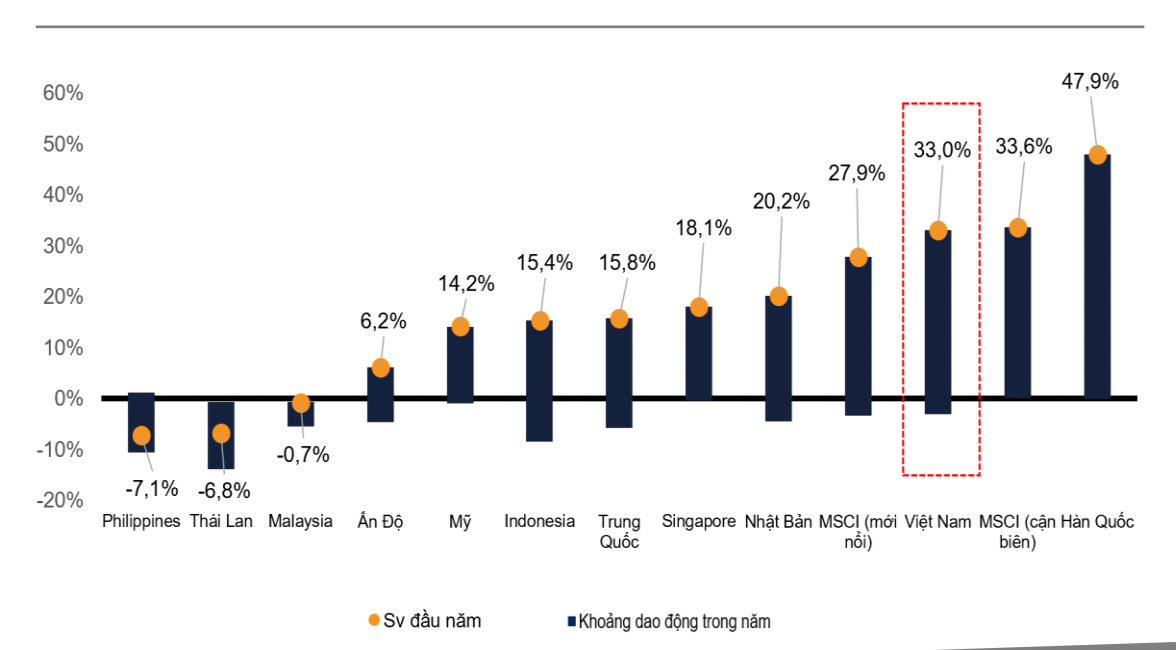

The VN-Index has surged 33% year-to-date, bringing its valuation closer to the average of other emerging markets. Source: VND.

Last week’s market highlight was FTSE Russell’s announcement that Vietnam’s stock market would be officially upgraded from frontier to secondary emerging status, effective September 21, 2026. However, VNDirect analysts believe that this upgrade was largely priced into the market’s recent performance. The VN-Index’s 33% year-to-date gain has brought its valuation closer to the average of other emerging markets.

While foreign capital inflows are expected to increase, significant allocations to Vietnam may not occur immediately, with only a few active funds potentially investing ahead of the official upgrade in September 2026.

VNDirect anticipates that after the initial reaction to the upgrade, the market will refocus on fundamentals such as Q3 earnings results, government growth support policies, macroeconomic stability, and Vietnam’s medium- to long-term economic prospects.

The VN-Index just experienced its strongest weekly gain in history, consistently setting new highs following the market upgrade catalyst.

Over the next 6-9 months, the securities firm maintains a positive outlook on the market. In the base scenario, the VN-Index could target the 1,850-1,900 range, driven by key factors such as the upgrade, the Fed’s potential monetary policy reversal with rate cuts, and promising earnings prospects for listed companies.

These factors are expected to expand valuation multiples (re-rating) and bolster investor confidence. Additionally, the upgrade milestone, coupled with Q3 GDP growth exceeding 8%, has set the stage for a potential 2025 GDP growth rate above 8%.

Experts from Saigon-Hanoi Securities view this as a transformative period for Vietnam’s economy and stock market. Investors are regaining optimism after a period of accumulation, with improved liquidity and a shift towards identifying new investment opportunities based on reasonable valuations and strong Q3 earnings expectations.

Analysts recommend that investors consider increasing their investment exposure based on the growth prospects for Q3 and year-end earnings.

J.P. Morgan Forecasts VN-Index to Hit 2,200 Points, Highlights 22 Top Money-Magnet Stocks Amid Upgrade

J.P. Morgan has revised its 12-month target for the VN-Index upward, setting a base-case scenario at 2,000 points and an optimistic scenario at 2,200 points. This adjustment reflects a potential 20–30% increase from current levels, signaling confidence in the market’s growth trajectory.

Market Pulse 13/10: Real Estate Sector Attracts Inflows, VN-Index Extends Winning Streak to 4 Consecutive Sessions

At the close of trading, the VN-Index surged by 17.57 points (+1.01%), reaching 1,765.12 points, while the HNX-Index climbed 1.73 points (+0.63%) to 275.35 points. Despite this, the overall market breadth tilted toward the red, with 409 decliners outpacing 273 advancers. In contrast, the VN30 basket was dominated by green, boasting 17 gainers, 10 losers, and 3 unchanged stocks.

Unraveling the Psychological Knots Post-Promotion

While it’s premature to declare a new bull run in Vietnam’s stock market, last week witnessed several encouraging signs. The VN-Index closed at a record high of 1,747 points, marking the first time the index surpassed the 1,700 threshold since FTSE Russell upgraded Vietnam to “Secondary Emerging Market” status on October 8th.