Following FTSE Russell’s official confirmation of Vietnam’s upgrade from Frontier Market to Secondary Emerging Market status, J.P. Morgan, one of the world’s leading investment banks, has released a positive assessment of Vietnam’s stock market.

The upgrade is scheduled to take effect in September 2026, with a preliminary review in March 2026 to evaluate Vietnam’s compliance with market access criteria and trading infrastructure reforms. J.P. Morgan’s report suggests that this upgrade will unlock a significant influx of passive capital into Vietnam.

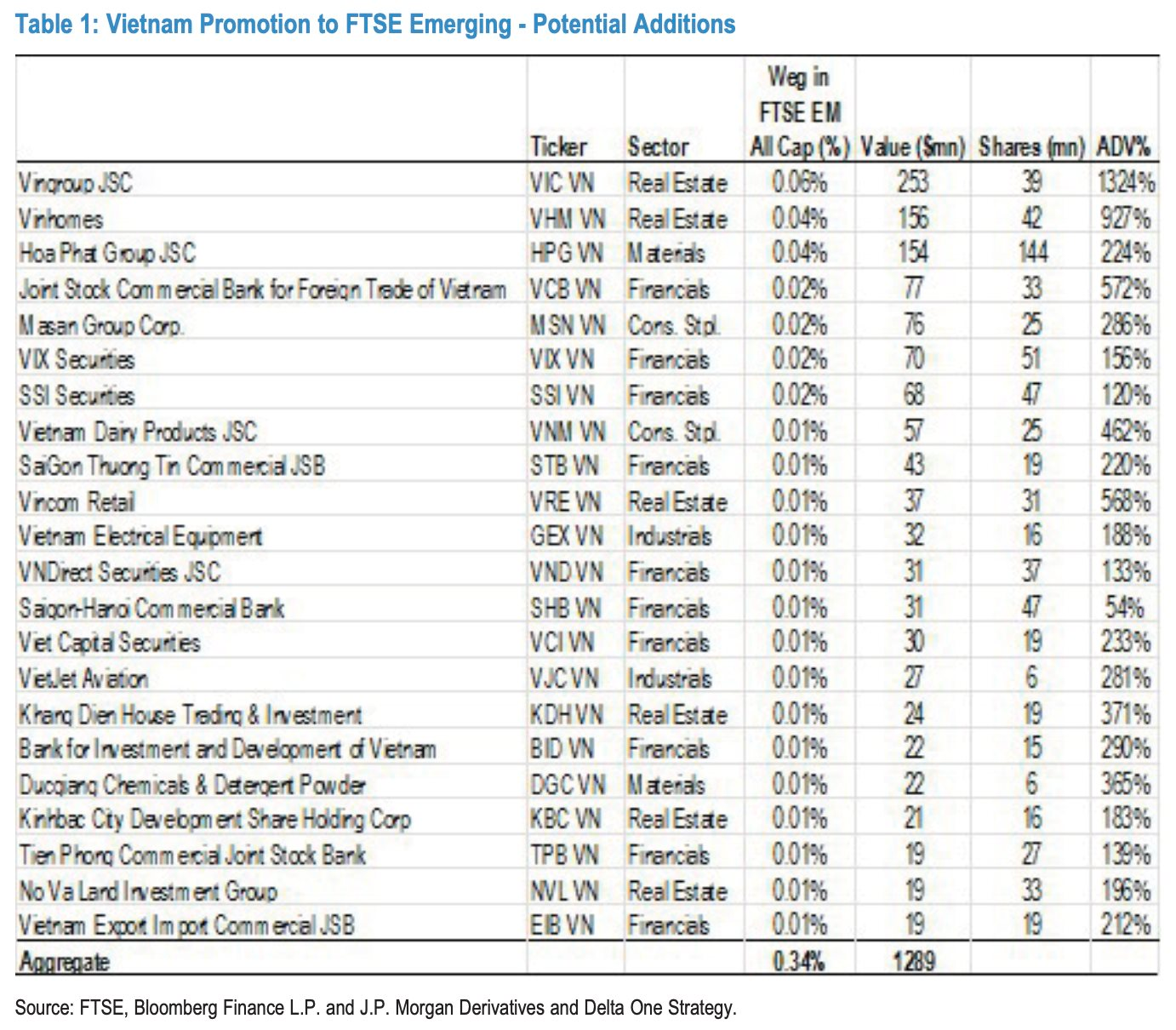

According to J.P. Morgan’s estimates, global index funds could inject approximately $1.3 billion into Vietnam’s stock market, representing a 0.34% weighting in the FTSE Emerging Market All Cap Index. Based on current market capitalization, around 22 Vietnamese stocks are expected to be included in this index.

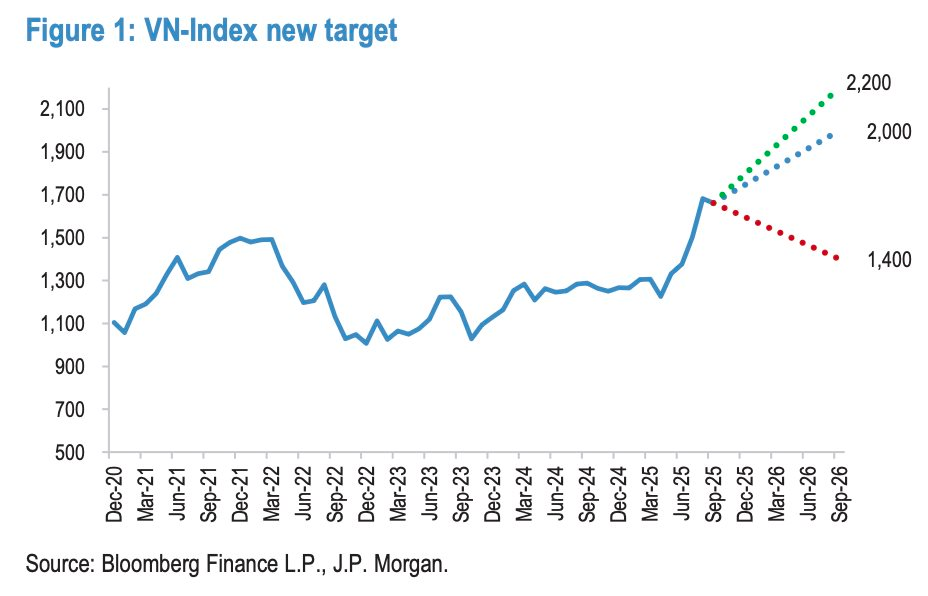

Building on this, J.P. Morgan has raised its 12-month target for the VN-Index to 2,000 points under the base scenario and 2,200 points under the optimistic scenario, reflecting a 20–30% increase from current levels. Robust macroeconomic fundamentals and strong corporate earnings growth are cited as key drivers of this positive outlook.

J.P. Morgan highlights that Vietnam’s Q3 2025 GDP grew by 8.2% year-on-year, while listed companies’ profits are projected to grow at an average annual rate of 20% between 2026 and 2027. Additionally, if the MSCI upgrade process progresses smoothly, the market could benefit from a 10% uplift through P/E re-rating.

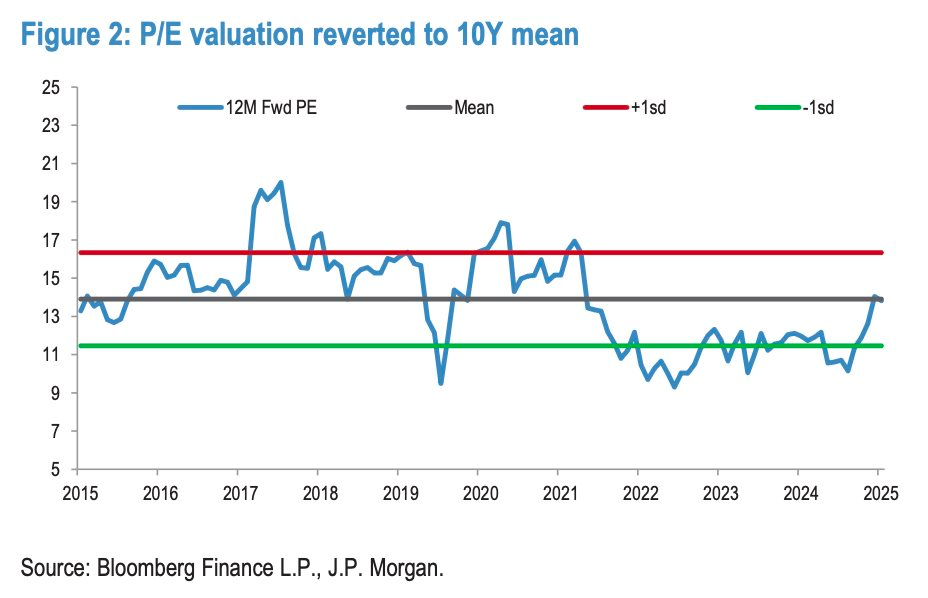

The bank notes that the VN-Index’s current valuation remains reasonable, trading at a projected P/E of 15–16.5 times over the next 12 months. While higher than the ASEAN average, this is still below the historical peaks of 2018 and 2021, reflecting long-term growth expectations and improving corporate profitability.

Furthermore, J.P. Morgan emphasizes the role of institutional and market infrastructure reforms in sustaining growth. The Vietnamese Ministry of Finance is expected to implement a Central Counterparty Clearing (CCP) model by Q1 2027 and expand products such as intraday trading and securities lending.

“These reforms not only help Vietnam meet FTSE requirements but also lay the groundwork for MSCI’s potential upgrade to Emerging Market status by 2030,” the J.P. Morgan report states.

Short-term pressures from frontier fund rebalancing and large capital raises

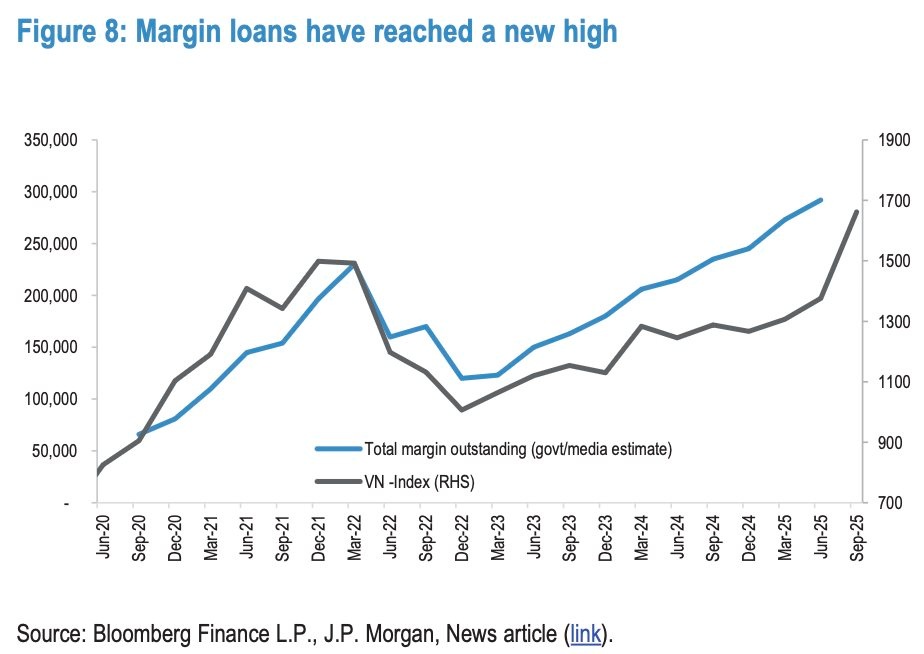

While optimistic about Vietnam’s prospects, J.P. Morgan also identifies near-term risks. Frontier funds rebalancing their portfolios ahead of the official upgrade could trigger temporary outflows. Additionally, the Vietnamese dong may face depreciation pressures due to accommodative monetary policy, and high margin debt levels increase market sensitivity to short-term fluctuations.

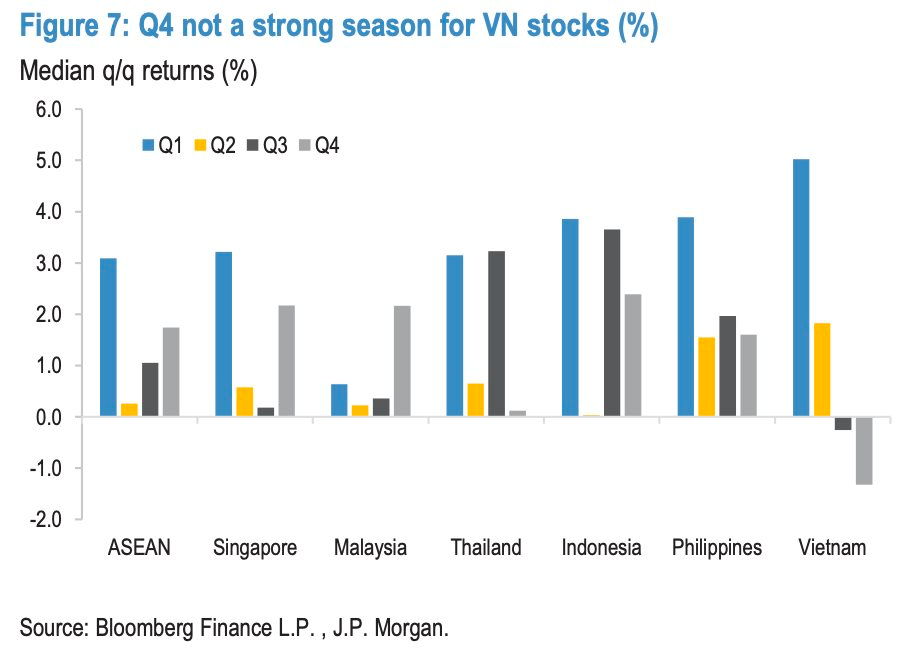

Seasonal weakness in Q4 and capital raises by major brokerages like TCBS, VPS, VPBankS, and MBS may further strain liquidity. J.P. Morgan warns that while opening the market to global brokers enhances accessibility and attracts international capital, increased competition could pressure domestic securities firms in the short term, especially as their stocks have already risen 50% year-to-date.

“Although market liberalization will boost global access and capital inflows, heightened competition may create near-term headwinds for local brokerages,” the report underscores.

In summary, J.P. Morgan views Vietnam as entering a transformative phase, with both its economy and stock market poised for significant advancement. FTSE Russell’s upgrade serves as a catalyst for a new growth cycle.

“A VN-Index target of 2,200 points is increasingly within reach if Vietnam sustains reform momentum, stabilizes its currency, and bolsters global investor confidence,” the report concludes. Earnings growth, institutional reforms, and upgrade expectations are highlighted as key long-term drivers for Vietnam’s market.

Unveiling the Billion-Dollar Livestream Shopping Empire: Navigating the Legal Gray Area

Unleash explosive revenue growth, job creation, and the shaping of new consumer trends—the livestream economy is emerging as a multi-billion-dollar empire. Yet, its unchecked growth is pushing influencers into a legal gray area, where the line between creativity and commerce grows increasingly blurred.

Government Party Congress: Striving for High Economic Growth in 2026-2030

The Government’s Party Committee for the 2025-2030 term has set an ambitious goal: by 2030, Vietnam aims to become a modern industrialized developing country with high-middle income, ranking among the top 30 global economies and 3rd in ASEAN. To achieve this, the target is to sustain high economic growth rates from 2026 to 2030 while ensuring major macroeconomic balances.

Market Pulse 13/10: Real Estate Sector Attracts Inflows, VN-Index Extends Winning Streak to 4 Consecutive Sessions

At the close of trading, the VN-Index surged by 17.57 points (+1.01%), reaching 1,765.12 points, while the HNX-Index climbed 1.73 points (+0.63%) to 275.35 points. Despite this, the overall market breadth tilted toward the red, with 409 decliners outpacing 273 advancers. In contrast, the VN30 basket was dominated by green, boasting 17 gainers, 10 losers, and 3 unchanged stocks.

Vietstock Daily October 14, 2025: Will the Uptrend Continue?

The VN-Index has formed a Three White Soldiers candlestick pattern, accompanied by trading volume consistently above the 20-session average, signaling prevailing market optimism. The index is closely tracking the Upper Band of the Bollinger Bands, while the MACD indicator continues its upward trajectory following a buy signal. This confluence of factors underscores a positive short-term growth outlook.