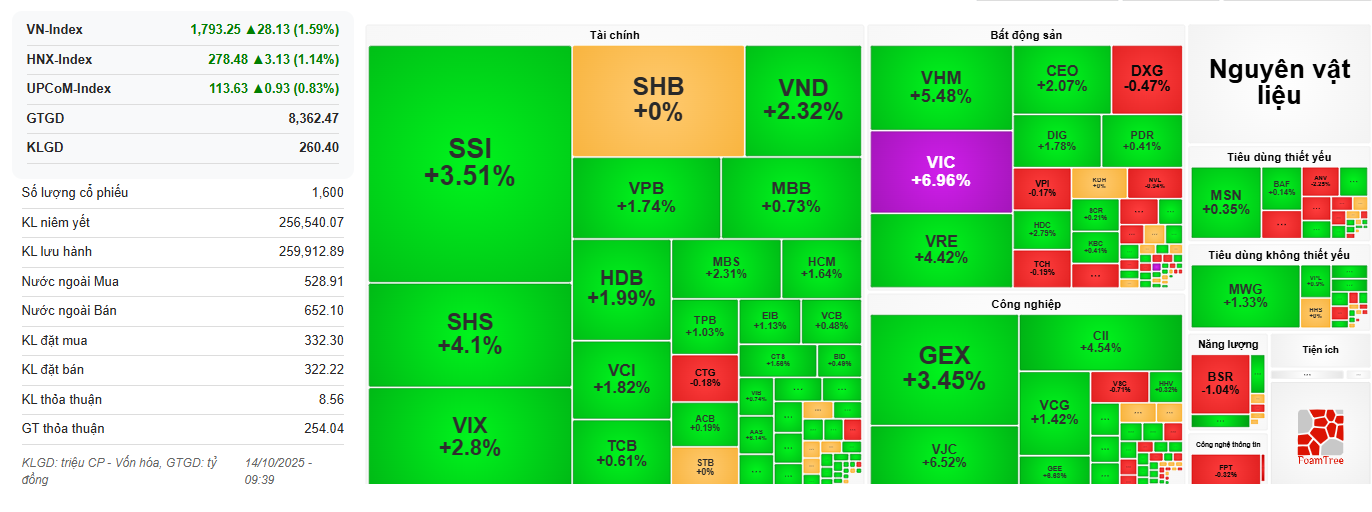

Despite the challenges, support from key stocks remains strong. VIC, VHM, SSI, and VPB maintain gains of 2-4%. GEX, GEE, and VJC hitting their ceilings positively impact the index.

Morning Session: Resilient Amid Pressure, VN-Index Closes at 1,786

VN-Index concluded the morning session at 1,786.09, up 20.97 points. Green also dominates HNX-Index and UPCoM-Index, with slight increases to 277.21 and 113.16, respectively. The upward trend is promising, potentially reaching 1,800, though green isn’t widespread.

While gains remain solid, slight pressure emerged post-9:30, narrowing the increase. The market quickly bottomed out by 10:00, paving the way for a strong rebound.

|

VN-Index gains with minor fluctuations

Source: VietstockFinance

|

Examining the market map, the number of gaining stocks barely improved since the morning opening, at 266, while declining stocks rose to 380. A total of 943 stocks remain unchanged. In this context, key stocks drive the gains.

By capitalization, Large Cap continues to rise by 1.41%, while Mid Cap and Small Cap decline by 0.39% and 0.22%, respectively.

Red stocks are more prevalent, particularly in banking (VTG, BID, STB, SHB, ACB, OCB…), food (VNM, MSN…), infrastructure (ACV, HVN…), oil and gas (BSR, PLX, PVT…), and key stocks like HPG, FPT, GAS, VGI. Despite market gains, pressures persist and even intensify.

Amid pressure from the majority, key stocks continue supporting the market, including Vingroup (VIC, VHM, VRE), banking (VCB, TCB, VPB…), securities (SSI, VIX, VND, SHS…), and aviation (VJC, HVN).

Regarding HVN, Vietnam Airlines’ stock seems unaffected by the data security breach in its online customer care platform. The company has officially addressed the issue.

Liquidity improved from yesterday, reaching nearly 28.9 trillion VND, with over 886 million shares traded.

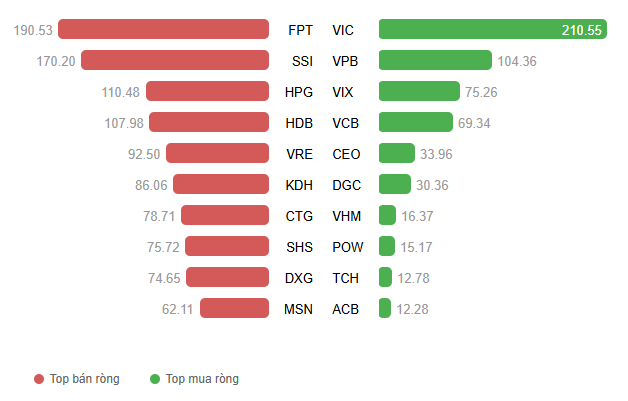

Foreign trading remains net sell, temporarily exceeding 1 trillion VND. FPT, SSI, HPG, and HDB are heavily net sold. Conversely, VIC and VPB mitigate pressure.

|

Top foreign net buy/sell stocks in the morning session of October 14

Source: VietstockFinance

|

10:30: Gains Slow, Key Stocks Actively Support the Market

After an enthusiastic start, market gains slowed. The market shows fewer gaining stocks compared to declining and unchanged ones.

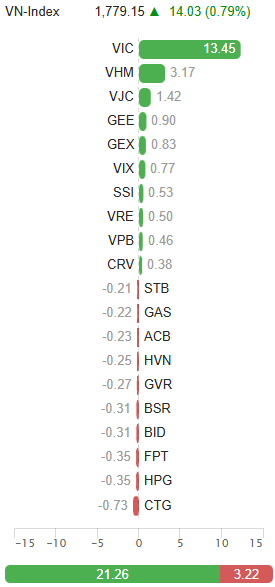

As of 10:30, VN-Index rose 14.03 points to 1,779.15, HNX-Index increased 1.7 points to 277.05, and UPCoM-Index gained 0.37 points to 113.07. However, 258 gaining stocks lag behind 347 declining and 995 unchanged stocks.

By capitalization, Large Cap impressively rose 1.01%, while Mid Cap and Small Cap declined 0.34% and 0.25%, respectively.

The market map highlights Vingroup’s trio surging, with VHM up 2.66%, VRE 2.21%, and VIC nearing its ceiling, contributing 3.17, 0.5, and 13.45 points to VN-Index. Real estate leads sector gains at 3.28%.

Beyond Vingroup, Gelex’s GEX and GEE also hit ceilings, adding 0.83 and 0.9 points to the index. In aviation, VJC’s ceiling strongly supports the market.

Additionally, banking and securities stocks trade vibrantly, with SSI, VIX, and VPB positively contributing to the index.

However, green isn’t widespread, as real estate (DXG, TCH, KBC, KDH, NVL…), banking (SHB, CTG, TPB, ACB, VCB, STB…), mining (HPG, NKG…), food (MSN, HAG, ANV, BAF…), and software (FPT) stocks decline.

|

Key stocks supporting the market

Source: VietstockFinance

|

9:30: Explosive Start, VN-Index Nears 1,800

Excitement continues in the early minutes of October 14. VN-Index opened with a nearly 30-point surge in the first 40 minutes, reaching 1,793.

Stock market dynamics at the start of October 14, 2025. Source: VietstockFinance

|

VIC remains pivotal, boosting VN-Index by nearly 12 points, while the top 10 contributing stocks added 20 points. VIC is today’s key driver, surging to nearly 220,000 VND/share by 9:35.

Other Vingroup stocks like VHM and VRE also rose over 5%.

Green dominates the market, with nearly 330 gaining and 170 declining stocks. Finance, real estate, and industrial sectors lead.

Securities stocks surged on strong buying interest, with SSI, VIX, VND, SHS, MBS, ORS… rising sharply.

– 12:04 14/10/2025

Vingroup Chairman Pham Nhat Vuong Completes Transfer of 60 Million VIC Shares to VinEnergo as Capital Contribution

Chairman Phạm Nhật Vượng has pledged over 60 million VIC shares, representing 1.55% of Vingroup’s charter capital, as capital contribution to VinEnergo.

VIC Stock Hits Record High of Over 200,000 VND/Share, VN-Index Extends Winning Streak

Vingroup’s VIC stock has shattered records, soaring to an all-time high of over 205,000 VND per share. This unprecedented surge not only marks a historic milestone for the conglomerate but also propels the market forward, adding more than 17 points to its cumulative gains.