VPBank’s subsidiary plans to raise over VND 12.7 trillion by offering 375 million VPX shares at VND 33,900 per share. At this price, VPBankS is valued at approximately VND 63.6 trillion, equivalent to nearly USD 2.4 billion.

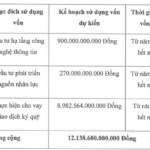

Regarding capital allocation, 68% (over VND 8.6 trillion) will bolster margin lending activities, 30% (over VND 3.8 trillion) will be allocated to securities investment and proprietary trading, and the remaining 2% (over VND 254 billion) will support advance payment for securities sales. Disbursement is expected from Q4/2025 to 2026.

If the IPO succeeds, VPBankS’s chartered capital will increase from VND 15 trillion to VND 18.75 trillion, making it one of the largest securities firms in Vietnam by chartered capital.

Investors can register and deposit from October 10–31, 2025. Payment for allocated shares will be accepted from November 3–7, 2025. Allocation results will be announced on November 1–2, 2025.

To boost IPO demand, VPBankS has launched attractive incentives, including luxury gifts (a VND 2 billion Mercedes, a VND 300 million diamond, and an iPhone 17), 10 free VPB shares for purchasing a minimum of 5,000 VPX shares, and a 1.2% transaction value reward for successful investor referrals.

Notably, VPBankS offers the Prosperity Balance program, allowing investors to pay 100% of the VPX share purchase value, including a 10% deposit to VPBankS.

TCBS Reports Significant Profits in First Nine Months, Achieving 88% of Annual Plan

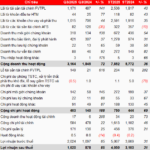

Technological Commercial Joint Stock Bank Securities (TCBS, HOSE: TCX) has released its Q3/2025 financial report, revealing a remarkable net profit of nearly VND 1.62 trillion, an 85% surge compared to the same period last year. This impressive performance has propelled the company’s nine-month cumulative profit to over VND 4.05 trillion, marking a 31% year-on-year growth. TCBS’s core operations, including proprietary trading, brokerage, and lending, have all demonstrated robust growth, solidifying its position as a leading player in the industry.

VPS Announces Minimum IPO Price of VND 60,000 per Share

Late in the afternoon on October 13th, the Board of Directors of VPS Securities JSC (VCK) passed a resolution approving changes to their previously announced IPO plan. Notably, the minimum offering price was set at 60,000 VND per share, aiming to raise over 12.1 trillion VND.

VPBank Empowers Rikkeisoft’s Global Acceleration

On October 10, 2025, Rikkeisoft JSC and Vietnam Prosperity Joint Stock Commercial Bank (VPBank, HOSE: VPB) officially signed a Memorandum of Understanding (MOU). This agreement marks a comprehensive partnership between a rapidly growing technology company and a leading commercial bank in Vietnam, with VPBank serving as a financial springboard to propel Rikkeisoft’s global expansion.

VPS Securities Boosts Capital to VND 12,800 Billion Following Bonus Share Issuance

On October 10th, VPS successfully distributed 710 million shares to 13 shareholders, increasing its chartered capital to 12.8 trillion VND.