Q3/2025 Financial Reports Released by October 13, 2025

Key Financial Highlights from Q3/2025 Reports

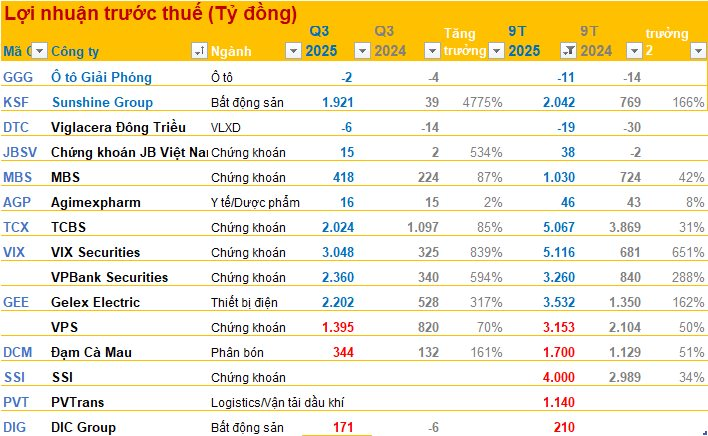

Giaiphong Automobile (GGG) reported a pre-tax loss of nearly VND 2 billion in Q3/2025, with a cumulative nine-month loss of VND 11 billion. The company’s accumulated losses reached nearly VND 357 billion, with negative equity of VND 62 billion.

Sunshine Group Corporation (Stock Code: KSF) announced its Q3/2025 Consolidated Financial Report, with net revenue reaching over VND 4,233 billion, nearly 26 times higher than the same period last year. Pre-tax profit hit nearly VND 1,921 billion, almost 49 times higher.

Cumulative nine-month net revenue reached VND 4,882 billion, showing stable growth compared to the same period. Pre-tax profit was VND 2,042 billion, while after-tax profit reached VND 1,591 billion, marking the highest level in the Group’s history.

SmartInvest Securities released its Q3/2025 Financial Report, with operating revenue of VND 230 billion, up 143% year-on-year, and pre-tax profit of VND 140 billion, a 600% increase. Cumulatively, the company profited VND 201 billion in nine months, up 121%.

Becamex IJC (IJC) reported Q3/2025 net revenue 3.5 times higher than the same period, with pre-tax profit reaching VND 299 billion, triple the previous year. Cumulative nine-month pre-tax profit was VND 464 billion, up 93%.

Agimexpharm (AGP) recorded flat Q3 revenue compared to the same period, with pre-tax profit of VND 16 billion, up 2%. Cumulative nine-month pre-tax profit reached VND 46 billion, an 8% increase.

TCBS reported Q3 pre-tax profit of VND 2,024 billion, nearly double the same period last year.

TCBS Reports Significant Profits in First Nine Months, Achieving 88% of Annual Plan

Technological Commercial Joint Stock Bank Securities (TCBS, HOSE: TCX) has released its Q3/2025 financial report, revealing a remarkable net profit of nearly VND 1.62 trillion, an 85% surge compared to the same period last year. This impressive performance has propelled the company’s nine-month cumulative profit to over VND 4.05 trillion, marking a 31% year-on-year growth. TCBS’s core operations, including proprietary trading, brokerage, and lending, have all demonstrated robust growth, solidifying its position as a leading player in the industry.