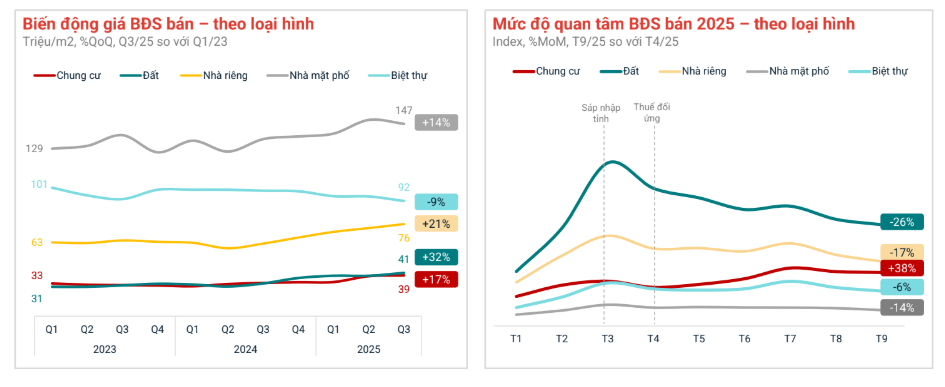

At the “Q3/2025 Real Estate Market Overview” event hosted by Batdongsan.com.vn, Ms. Nguyễn Thị Ngọc Thương, Director of the Hai Phong Branch at Batdongsan.com.vn, stated: “The Hai Phong real estate market is undergoing significant changes. Previously, land plots were the primary focus for investment and speculation, but interest in this segment has yet to recover.”

Instead, land investors in Hai Phong are shifting their attention to other segments, notably condominiums, which are now leading market trends and experiencing a resurgence in demand.

Ms. Nguyễn Thị Ngọc Thương – Director of Hai Phong Branch, Batdongsan.com.vn

According to Batdongsan.com.vn data, interest in condominiums in Hai Phong surged by 38% over five months (April to September 2025), reflecting a shift from speculative investments to properties catering to genuine residential needs and rental opportunities.

Ms. Thương elaborated on the condominium supply landscape in Hai Phong: “Our analysis combines data from both commercial and social housing segments to provide a comprehensive market overview.

Hai Phong leads the nation in social housing development, with robust projects supplying a substantial number of units. This has diversified the market, offering a range of price points to cater to various buyer segments.”

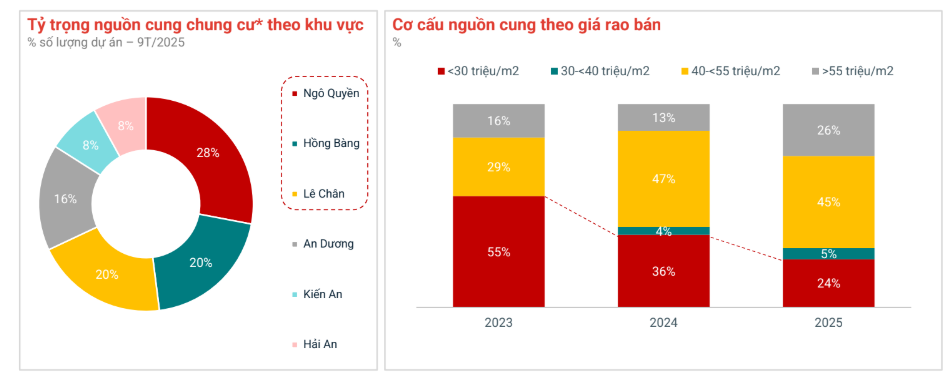

Most condominium projects are concentrated in the city center, with Ngô Quyền District accounting for 28% of the total supply, and Hồng Bàng and Lê Chân Districts contributing an additional 20%. An Dương District is also emerging as a new hotspot.

Condominium supply is primarily in the city center, with a growing focus on mid-to-high-end segments.

Regarding condominium prices (including social and commercial housing), Ms. Thương noted: “Prices are categorized into four groups, reflecting variations in quality and location.

The sub-30 million VND/m² group includes social housing and affordable projects; the 30–40 million VND/m² group targets mid-range buyers; the 40–55 million VND/m² group represents near-luxury properties; and the above-55 million VND/m² group caters to luxury and high-end buyers.”

Over the past three years (2023–2025), the market has increasingly focused on mid-to-high-end segments. “I anticipate growing demand for luxury real estate in Hai Phong,” Ms. Thương predicted.

Investors and developers are increasingly focusing on mid-to-high-end condominiums in Hai Phong. Notable developers include DOJI, Hoàng Huy, Masterise, Văn Phú Invest, BĐS HP, and N.H.O (South Korea)…

Current projects include Diamond Crown Hai Phong and Golden Crown Hai Phong by DOJILand on Lê Hồng Phong Street; The Zenith Hai Phong (Kiến An District) by HP Real Estate Trading JSC, featuring 508 units along Ring Road 2; Hoàng Huy Commerce with four high-rise towers; and Gem Park by N.H.O…

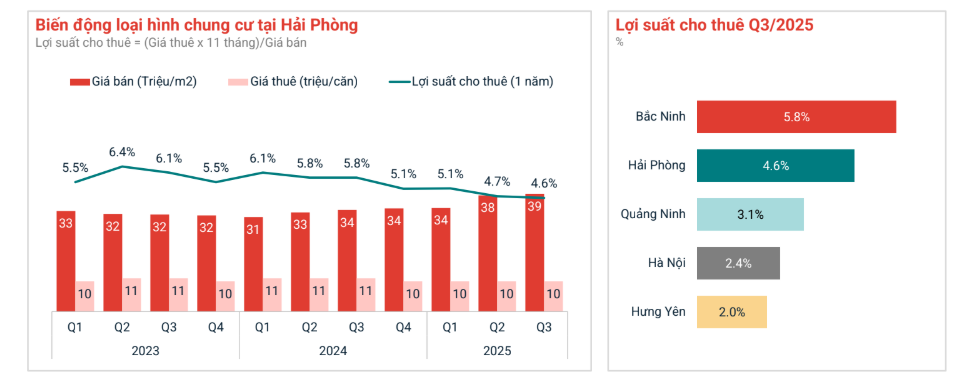

Ms. Thương noted that condominiums in Hai Phong primarily serve residential needs, but rental investment is gaining traction as a stable income source. This trend is driven by increasing demand from foreign experts, engineers, and managers in industrial zones like VSIP, Đình Vũ – Cát Hải, and Nam Cầu Kiền. Rental prices range from 14 to 15 million VND/month, depending on location and project quality.

Hai Phong Condominium Prices: What’s the Trend?

Batdongsan.com.vn data shows that average condominium prices in Hai Phong grew steadily from 2023 to Q3/2025, reaching 39 million VND/m²—a 17% increase since Q1/2023.

Top-performing districts include former Hồng Bàng (up 45.2%, averaging 2.4 billion VND/unit), former Kiến An (up 40.2%, 1.6 billion VND/unit), former An Dương (up 18%, 1.7 billion VND/unit), and former Ngô Quyền (up 17.1%, 3 billion VND/unit).

Notable projects with price increases include Gem Park (up 55%, 46 million VND/m²), Bắc Sơn Apartments (up 40%, 18 million VND/m²), Hoàng Huy Grand Tower (up 33%, 36 million VND/m²), and Sentosa Sky Park (up 20%, 40 million VND/m²).

Rental prices have remained stable over three years, averaging 14–15 million VND/month, with a 4.6% rental yield (as of Q3/2025). This outperforms Quảng Ninh (3.1%) and Hanoi (2.4%), positioning Hai Phong as one of northern Vietnam’s most profitable markets.

Despite positive trends, Hai Phong’s condominium market faces challenges. New supply, especially in mid-to-high-end segments, outpaces demand, risking localized oversupply. Additionally, rapid social housing growth in suburban areas may compete directly with mid-range buyers.

Ms. Thương emphasized: “Hai Phong isn’t ideal for short-term investors. Instead, it attracts long-term investors seeking stable rental income.”

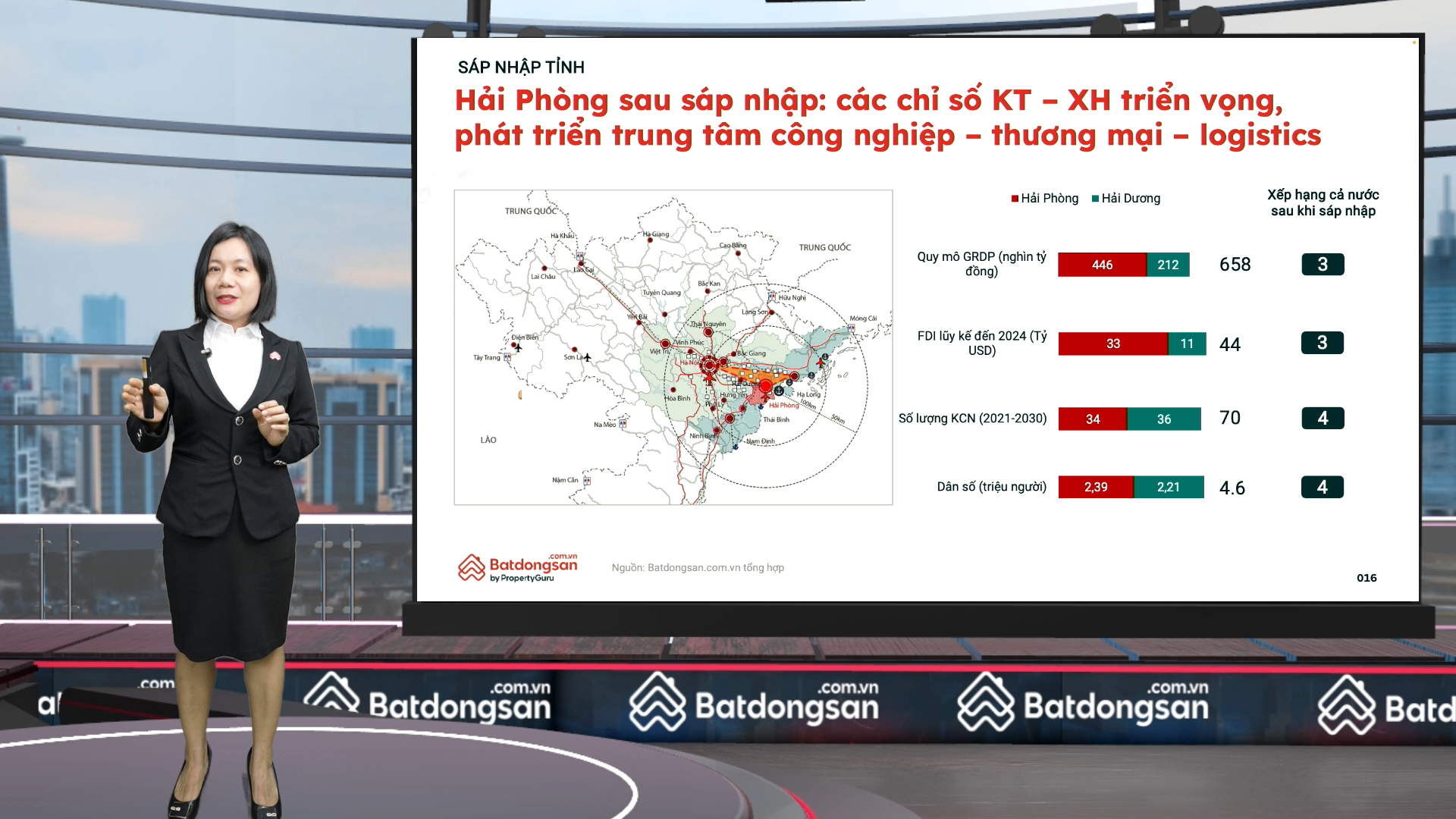

Following administrative mergers, Hai Phong’s GRDP reached approximately 658 trillion VND, ranking third nationally. Accumulated FDI by late 2024 totaled around 44 billion USD, and the post-merger population stands at 4.6 million, among Vietnam’s largest.

These mergers have created an industrial-logistics-services value chain, deepening the market for housing, commercial townhouses, and income-generating properties.

Hai Phong is developing a “2 belts – 3 corridors – 3 urban centers” model. The coastal economic belt links Lạch Huyện deep-sea ports with southern Đồ Sơn, while the industrial-services belt runs along the city’s western axis to the Văn Úc River.

Three scenic corridors along the Cấm, Lạch Tray, and Văn Úc Rivers will drive livable urban development. The three urban centers include: the historic core (Hồng Bàng – Ngô Quyền – North Cấm River), a commercial-financial hub (Hải An – Dương Kinh), and an airport urban center (Tiên Lãng). This positions Hai Phong as a northern transportation hub, integrating road, rail, water, air, and river transport.

Da Nang Invests Over $56 Million to Eradicate “Slum” Apartments

Da Nang is investing over 1.3 trillion VND to construct a 20-story social housing complex, replacing the aging Hoa Minh apartment buildings after more than two decades of use.

Prime Minister: Social Housing Should Not Be in Remote or Inconvenient Locations, Nor Limited to High-Rise Buildings

Prime Minister Pham Minh Chinh emphasized that social housing should not be limited to high-rise buildings but can also include low-rise structures. He stressed that these housing projects must not be located in remote, inaccessible areas or on marginal land, but rather in well-developed locations with adequate infrastructure.

Uniting Vision and Ambition: The Inaugural Post-Merger HCM City Party Congress

The 1st Congress of the Ho Chi Minh City Party Committee (term 2025-2030) marks a pivotal new development stage as Ho Chi Minh City, alongside Binh Duong and Ba Ria – Vung Tau, unites to form an open urban region for the first time. This strategic move aims to establish the area as a leading financial and creative hub in the region.