Recently, Sonadezi Joint Stock Company (Sonadezi, Stock Code: SNZ, UPCoM) announced a resolution approving a related-party transaction.

Accordingly, Sonadezi has signed a contract to acquire an office building located at No. 1, Road 1, Bien Hoa 1 Industrial Zone, Tran Bien Ward, Dong Nai Province, with a transaction value of nearly VND 167.3 billion.

The transferor is Sonadezi Giang Dien Joint Stock Company (Stock Code: SZG, UPCoM), an affiliate of Sonadezi with a 46.45% ownership stake.

Additionally, Ms. Nguyen Thi Hanh, a member of Sonadezi’s Board of Directors, currently serves as the Chairwoman of Sonadezi Giang Dien’s Board of Directors.

Illustrative image

In another development, on October 8, 2025, Sonadezi finalized its shareholder list for the 2024 cash dividend payment at a rate of 13%, meaning shareholders holding one share will receive VND 1,300 in dividends. The payment is scheduled for October 23, 2025.

With approximately 376.5 million SNZ shares outstanding, Sonadezi is expected to allocate over VND 489.4 billion for this 2024 dividend payment.

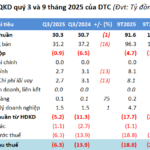

Regarding business performance, according to the audited consolidated financial report for the first half of 2025, Sonadezi generated net revenue of over VND 3,703.5 billion, a 29.7% increase compared to the same period in 2024. After deducting costs, gross profit reached nearly VND 1,817 billion, up 44.7%.

During the period, the company also earned nearly VND 69.4 billion in financial revenue, a 33.7% decrease year-over-year. Meanwhile, selling expenses decreased by 2.5% to VND 61.6 billion.

Conversely, financial expenses rose by 56.7% to nearly VND 91.7 billion, and administrative expenses increased from nearly VND 210.7 billion to nearly VND 256.8 billion.

As a result, after tax and fee deductions, Sonadezi reported a net profit of nearly VND 1,295.8 billion, a 48.3% increase compared to the first half of 2024.

For 2025, Sonadezi set a business target of achieving after-tax profit of over VND 1,403.6 billion. Thus, by the end of the first two quarters, the company has completed 92.3% of its planned profit.

As of June 30, 2025, Sonadezi’s total assets increased by 4% from the beginning of the year to nearly VND 21,954 billion. Of this, inventory stood at over VND 2,210.4 billion, accounting for 10.1% of total assets, and long-term work in progress was recorded at over VND 5,245.7 billion, representing 23.9% of total assets.

On the liabilities side, total payables reached over VND 10,368.1 billion, a slight increase of VND 166 billion from the beginning of the year. Short-term and long-term loans totaled nearly VND 3,855.9 billion, making up 37.2% of total liabilities.

Q3/2025 Financial Report: Sunshine Group Achieves Nearly 80 Trillion VND in Assets, Leading Industry Financial Performance

Sunshine Group Joint Stock Company (HNX: KSF) has released its Q3 2025 Consolidated Financial Report, revealing robust growth across its entire system.

AgriS Hosts Strategic Dialogue with Financial Institutions and Professional Investors

On October 10, 2025, in Ho Chi Minh City, AgriS (Thanh Thanh Cong – Bien Hoa Joint Stock Company, HOSE: SBT) successfully hosted the AgriS Stakeholder Meeting 2025. The event brought together over 130 professional investors and leading financial institutions, including securities companies, investment funds, banks, financial media outlets, and domestic and international partners.