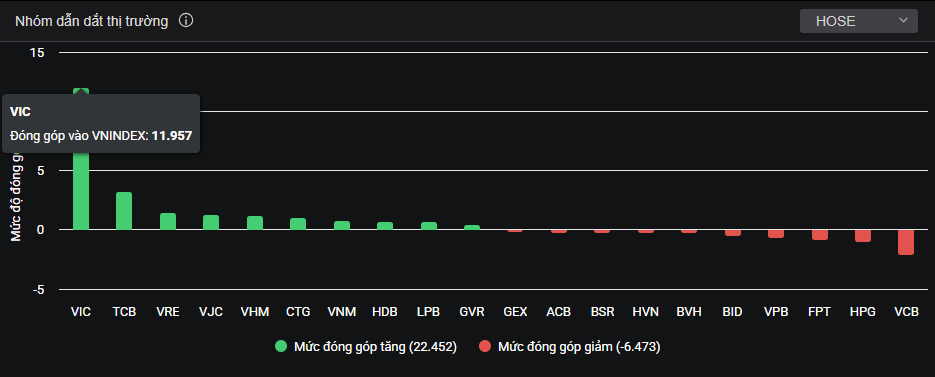

The VN-Index reached a new peak at 1,765 points, driven by strong inflows into large-cap stocks, which were today’s primary market movers. VIC contributed nearly 12 points, surging 7% to VND 205,400 per share—a record high for Vingroup. This propelled the conglomerate’s market capitalization close to VND 800 trillion, adding over VND 100 trillion in just two consecutive sessions of VIC hitting its ceiling.

Other Vingroup affiliates, including VHM, VRE, and VPL, also saw gains, with VRE climbing 6.6% to VND 43,000 per share, nearly reaching its upper limit.

VIC boosted the VN-Index by nearly 12 points, surging 7% to VND 205,400 per share.

The VN-Index’s consecutive highs were significantly supported by Vingroup stocks. The VN30 basket also saw VJC hit its ceiling at VND 142,600 per unit. With two stocks at their upper limits, the VN30-Index surged over 31 points, surpassing the 2,000-point milestone for the first time in Vietnamese stock market history, closing at 2,012 points. Large-caps like CTG, VNM, HDB, LPB, and GVR also contributed to the rally.

Despite the indices hitting new highs, the market remained “green on the outside, red on the inside,” with declining stocks outnumbering gainers on HoSE. The steel sector continued to weigh heavily, led by HPG’s 2.03% drop, the session’s biggest drag. Banking stocks such as VPB, ACB, MBB, and BID also saw mild corrections, highlighting sector divergence.

Red dominated sectors like industrials, construction, materials, energy, and insurance.

At the close, the VN-Index rose 17.57 points (1.01%) to 1,765.12. The HNX-Index gained 1.73 points (0.63%) to 275.35, and the UPCoM-Index added over 1 point to 112.7. Liquidity rebounded strongly, with HoSE trading volume exceeding VND 44.5 trillion.

Foreign investors remained net sellers, offloading nearly VND 1.16 trillion, primarily in HPG, VRE, VHM, MBB, and MSN.

Where Are Oil & Gas Stocks Amid a Soaring Market?

Following the Vietnamese stock market’s ascent to new heights and its official upgrade to secondary emerging market status, investor focus is shifting towards stocks with unique narratives, particularly within the energy sector. However, several energy stocks are currently lagging significantly behind the broader market’s momentum.

Top 100 Most Powerful Women in Asia: VinFast Chairwoman, Vinamilk CEO, Viettel Global Leader, and ‘Sugar Queen’ Make the List

Fortune Magazine (U.S.) has unveiled its 2025 list of “Asia’s 100 Most Powerful Women,” featuring four prominent Vietnamese female leaders. These trailblazers hold key positions within major corporations, significantly impacting Vietnam’s economy while steadily establishing their presence on the global stage.

Historic Stock Market Peak: Is a Major Wave Following the Upgrade?

The VN-Index has just experienced its most robust weekly gain in history, consistently reaching new highs following the market upgrade catalyst. However, analysts caution that the rally is primarily driven by a handful of blue-chip stocks, with market liquidity showing signs of divergence. After the initial reaction to the upgrade news, the market is expected to refocus on fundamental factors.