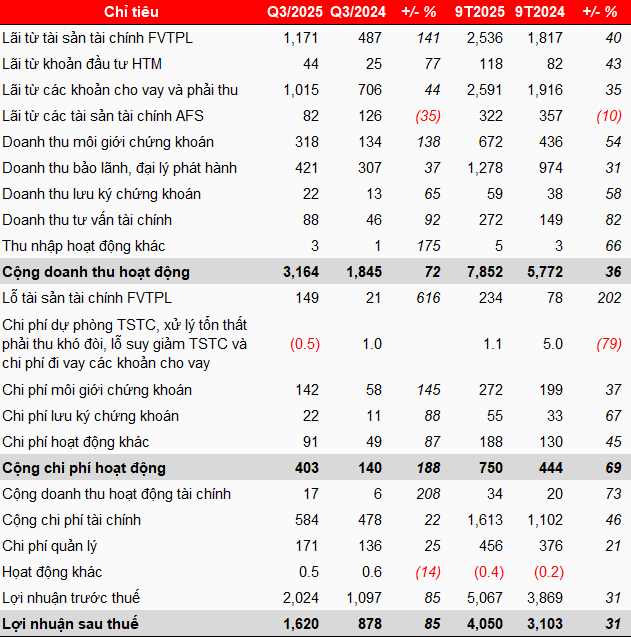

TCBS’s proprietary trading activities generated over VND 1.022 trillion in profit during Q3, a 2.2-fold increase year-over-year. This surge was primarily driven by significant gains from the sale of financial assets measured at fair value through profit or loss (FVTPL), particularly in listed equities and unlisted bonds.

Another notable performance came from brokerage services, which contributed more than VND 176 billion in profit, a 2.3-fold increase compared to the same period last year. The lending segment also saw robust growth, recording nearly VND 1.015 trillion in revenue, a 44% year-over-year increase.

Some pressure emerged as financial activities incurred a loss of over VND 566 billion, higher than the nearly VND 472 billion loss in the same period last year, mainly due to increased interest expenses and a 25% rise in management costs to nearly VND 171 billion.

Ultimately, TCBS reported pre-tax and post-tax profits of over VND 2.024 trillion and nearly VND 1.620 trillion, respectively, marking an 85% year-over-year increase. This result also boosted the cumulative profit for the first nine months to over VND 5.067 trillion before tax and more than VND 4.050 trillion after tax, a 31% increase year-over-year.

For 2025, TCBS aims for a pre-tax profit of VND 5.765 trillion, a 20% increase compared to 2024. Thus, after the first nine months, the company has achieved 88% of its full-year profit target.

|

TCBS’s Q3 and 9-month 2025 business results

Unit: Billion VND

Source: VietstockFinance

|

By the end of Q3/2025, TCBS’s total assets reached nearly VND 81.773 trillion, a 54% increase since the beginning of the year. The largest components were loans, totaling nearly VND 41.713 trillion (up 61%), and available-for-sale financial assets (AFS) of nearly VND 27.079 trillion (up 53%), primarily consisting of bonds, certificates of deposit, and unlisted equities.

Cash and cash equivalents also saw a significant increase, rising from nearly VND 2.865 trillion to almost VND 5.292 trillion, an 85% increase.

On the funding side, TCBS had short-term borrowings of nearly VND 30.375 trillion, with notable loans from VPBank (VND 4,000 billion), MSB (VND 2,500 billion), and VIB (VND 2,975 billion). The company also had a syndicated USD loan (with Cathay United Bank as the agent), with a converted outstanding balance of nearly VND 5.870 trillion at the end of Q3.

Shareholders’ equity increased significantly from over VND 19.613 trillion to more than VND 23.113 trillion. The company executed two notable capital increases in the first nine months, including a private placement of over 118.8 million shares and a high-profile initial public offering (IPO) of 231.15 million shares.

Post-IPO, the ownership structure includes two major shareholders: the parent bank Techcombank with 79.82% and Chairman Nguyễn Xuân Minh with 5.34%. The structure also includes 89 foreign shareholders holding a combined 6.38% of the capital.

Following the IPO, over 2.31 billion TCBS shares are expected to officially list on HOSE from October 21st, with a reference price of VND 46,800 per share.

– 16:05 13/10/2025

Sonadezi Invests Over VND 167 Billion to Acquire Office Building from Affiliated Company

Sonadezi has officially approved the acquisition of an office building within Bien Hoa 1 Industrial Park from Sonadezi Giang Dien, with the transaction valued at approximately VND 167.3 billion.

Hue Holds Over 1,500 Residential Units in Real Estate Project Inventories

The real estate market in Hue City witnessed a significant surge in inventory during Q3/2025, with 1,512 residential units across various projects remaining unsold—a notable increase of 380 units compared to the previous quarter. Despite this, authorities have noted positive signs of recovery in the market.

VPBank Empowers Rikkeisoft’s Global Acceleration

On October 10, 2025, Rikkeisoft JSC and Vietnam Prosperity Joint Stock Commercial Bank (VPBank, HOSE: VPB) officially signed a Memorandum of Understanding (MOU). This agreement marks a comprehensive partnership between a rapidly growing technology company and a leading commercial bank in Vietnam, with VPBank serving as a financial springboard to propel Rikkeisoft’s global expansion.