Illustrative Image

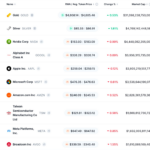

The United States has unveiled a new round of sanctions targeting over 50 individuals, companies, and vessels allegedly involved in the export of Iranian crude oil and liquefied petroleum gas (LPG), with a combined value reaching billions of dollars.

According to the U.S. Department of the Treasury, these measures focus on nearly two dozen vessels from a “shadow fleet,” a crude oil port in China, a small-scale refinery (teapot), and several companies based in Hong Kong, Panama, and the United Arab Emirates (UAE).

This latest action is part of the Trump administration’s maximum pressure campaign aimed at compelling Chinese businesses to halt energy imports from Iran. Washington asserts that Tehran’s continued oil exports serve as a critical financial lifeline, enabling its nuclear enrichment program and support for regional armed groups.

Oil exports are the backbone of Iran’s economy. However, prolonged U.S. sanctions have severely restricted the country’s access to the international financial system, placing significant strain on its state budget and trade activities.

Since the onset of his second term, President Trump has declared the goal of “reducing Iran’s oil exports to zero.” Over time, Washington has sanctioned several small Chinese refineries—major buyers of Iranian crude through intermediaries—while also targeting shipping companies and energy conglomerates accused of facilitating these shipments.

Compared to the previous Biden administration, these measures are seen as more aggressive. Analysts suggest this reflects a tougher stance by Washington in curbing the flow of Iranian energy to China.

U.S. Treasury Secretary Scott Bessent stated, “The Treasury Department is disrupting Iran’s revenue streams by targeting key nodes in its energy export network. Under President Trump, we are resolute in dismantling Iran’s ability to fund actions that threaten U.S. security.”

Source: Reuters

Russia’s Oil Dilemma: Record 16-Month Exports Amid Plummeting Revenues—What’s Driving the Paradox?

Russia’s oil export activities indicate that U.S. efforts to curb Russian crude oil exports have yet to yield the intended impact.