Illustrative image

Ghana is projected to import approximately one million tons of rice during the 2025–2026 crop year, accounting for over half of the West African nation’s total consumption. This information is highlighted in the U.S. Department of Agriculture’s (USDA) annual report on Grains and Feed.

According to the report, Ghana’s domestic milled rice production is forecasted to increase by 18%, reaching around 900,000 tons in 2025, driven by favorable weather conditions and growing farmer participation. However, this growth remains insufficient to meet the country’s rising domestic demand.

The USDA estimates that rice consumption in Ghana will increase from 1.75 million tons to 1.8 million tons, as the population surpasses 34.6 million and dietary preferences shift increasingly toward rice. Rice is now the second most important grain in Ghana, following maize, with per capita consumption averaging 51 kg annually.

Despite government efforts to boost domestic production, Ghana’s rice market remains heavily reliant on imports, primarily from Vietnam, India, and Thailand. Imported rice currently accounts for approximately 70% of total market sales, thanks to its competitive pricing and consistent quality. Among these, Vietnamese rice is noted for its strong market competitiveness due to lower prices.

Domestically, Ghana’s rice industry faces significant challenges, including inadequate irrigation infrastructure, low mechanization, and limited processing capacity, resulting in higher production costs and inconsistent quality. These factors make it difficult for local farmers to compete with imported rice, which is preferred by urban consumers.

Rice prices in Ghana have experienced significant volatility over the past year. From March 2024 to January 2025, the average price of a 100 kg bag of rice surged by 225%, from 200 Ghanaian cedis (approximately $18.3) to 650 cedis ($59.4). By March 2025, prices had dropped to 400 cedis ($36.6) but remained double the previous year’s levels.

Ghana’s Meteorological Agency forecasts below-average rainfall and prolonged drought conditions in 2025, which could further strain domestic rice production.

The USDA warns that without robust policy interventions to improve irrigation systems, enhance mechanization, and expand processing capacity, Ghana will struggle to reduce its dependence on imports. This continued reliance exposes the nation to global rice price fluctuations and exchange rate risks in the coming years.

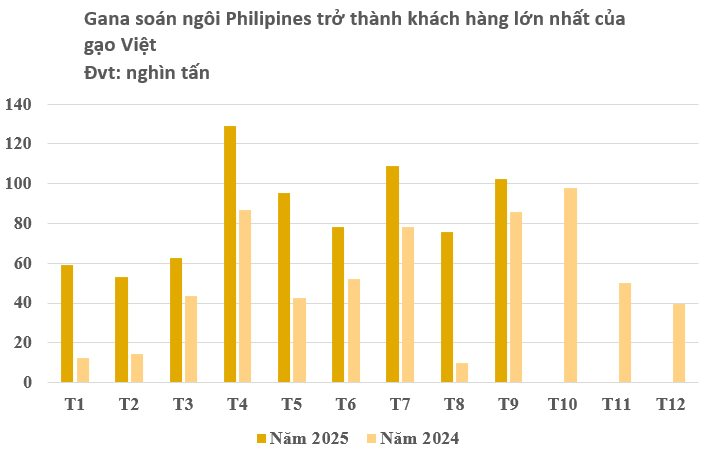

For Vietnam, as of September 30, total rice exports reached 6.825 million tons, generating $3.486 billion in revenue, representing a 2.05% decrease in volume and a 19.98% decline in value compared to the same period last year.

With the Philippines suspending imports, Ghana emerged as Vietnam’s largest rice export market in September, capturing nearly 22% of the market share, followed by Ivory Coast and Malaysia with shares of over 21% and nearly 10%, respectively.

The World’s Largest Rice Importer to Halt Imports by April 2026: Where is Vietnamese Rice Pivoting Next?

While the Philippine market is expected to halt rice imports until early 2026, Vietnamese rice continues to receive positive news from other markets.

Filipinos’ Fancy for High-Quality Vietnamese Rice

The Philippine Department of Agriculture (DA) has revealed that consumers in the country are developing a taste for high-quality rice, with a particular preference for imports from Vietnam.