On October 20th, the VNDiamond and VNFinSelect indices announced changes to their constituent stocks for the Q4 periodic rebalancing. Funds are expected to finalize their portfolio adjustments by October 31, 2025.

In its latest report, BIDV Securities (BSC) provided forecasts for the anticipated constituent stocks of both indices.

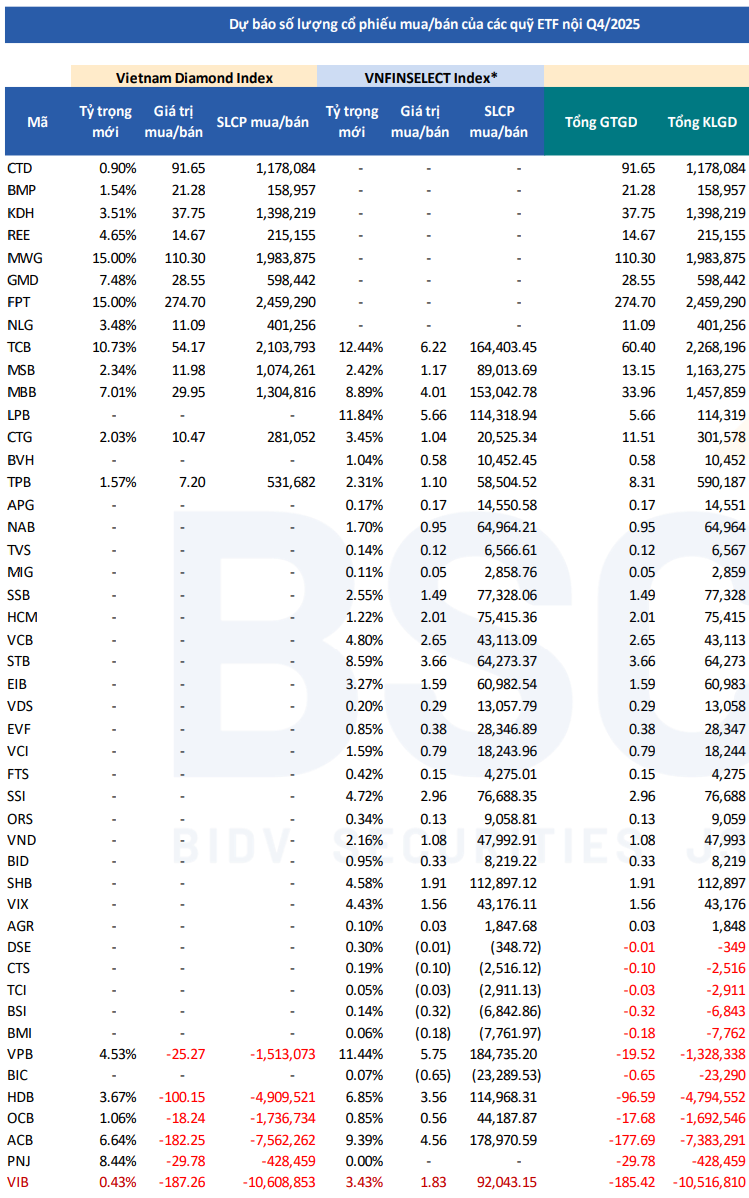

For the VNDiamond index, BSC predicts no new additions this cycle. CTD, included in the previous review, is likely to transition to the retention group, as it continues to meet the index’s quantitative criteria.

Conversely, VIB may be removed from the portfolio due to non-compliance with foreign ownership limits (FOL).

Currently, six funds track the VNDiamond index: FUEVFVND, FUEMAVND, FUEBFVND, FUEKIVND, FUEABVND, and VFCVN DIAMOND, with a combined asset size of approximately VND 14,600 billion.

BSC estimates potential purchases by these funds, including FPT (2.5 million shares), TCB (2.1 million shares), MWG (2 million shares), KDH (1.3 million shares), and MBB (1.3 million shares), among others.

Conversely, potential sales may include VIB (10.6 million shares), ACB (7.5 million shares), and HDB (4.9 million shares), among others.

For the VNFinSelect index, BSC anticipates the addition of DSC, as it meets all screening criteria, including market capitalization, liquidity, and industry standards. No stocks are expected to be removed from this index during this rebalancing. The KIM Growth VNFINSELECT fund, which tracks this index, has a total asset size exceeding VND 322 billion.

BSC forecasts potential purchases by this fund, including TCB (164,000 shares), MBB (153,000 shares), LPB (114,000 shares), SHB (112,000 shares), VPB (184,000 shares), and ACB (178,000 shares), among others.

Unveiling September’s Top Stock Picks: Three Market Titans Eyeing $1.6 Billion in Investments

In addition to the VNM ETF and Xtrackers Vietnam Swap UCITS ETF, the Fubon ETF will also conduct a portfolio review this September.

What Stocks Will the VNM ETF and FTSE ETF Seek in the 4th Quarter Restructuring of 2024?

The VTP stock is anticipated to be included in two stock index baskets: the FTSE Vietnam Index and the MarketVector Vietnam Local. This inclusion is expected to boost the stock’s visibility and liquidity, attracting more investors and potentially leading to increased trading volume and enhanced market presence. With this development, the VTP stock is poised to gain traction and prominence in the Vietnamese market and beyond.