In the October 13th fund update report, VESAF noted that after four consecutive months of growth, Vietnam’s stock market corrected in September, with the VN-Index declining by 1.2%. According to the Fund’s experts, profit-taking pressure from investors, strong net selling by foreign investors, and cautious sentiment ahead of FTSE Russell’s classification decision contributed to the index’s downturn.

VESAF reported that most sectors decreased in September, except for real estate, which rose by 11.9%, driven by a 36% surge in VIC shares. Market liquidity also significantly declined due to cautious sentiment, though it remained higher than the first-half average. Notably, foreign investors continued net selling, totaling VND 27 trillion in September, bringing the nine-month cumulative net selling to VND 104.6 trillion.

Amid the volatility, VESAF’s net asset value per unit (NAV/CCQ) dropped by 5% in one month. The Fund acknowledged that its relative performance was impacted by not holding VIC shares.

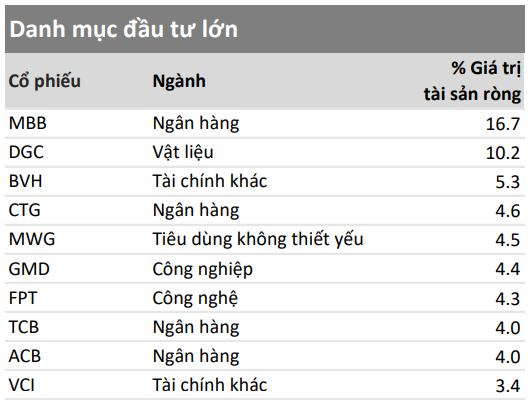

Additionally, VESAF’s portfolio faced profit-taking pressure in banking and non-banking financial services stocks. The most heavily sold sector was non-banking financial services, accounting for 10.6% of the Fund’s NAV compared to 6.2% in the benchmark index.

|

VESAF Portfolio Allocation by Sector as of September 2025

Source: VESAF

|

|

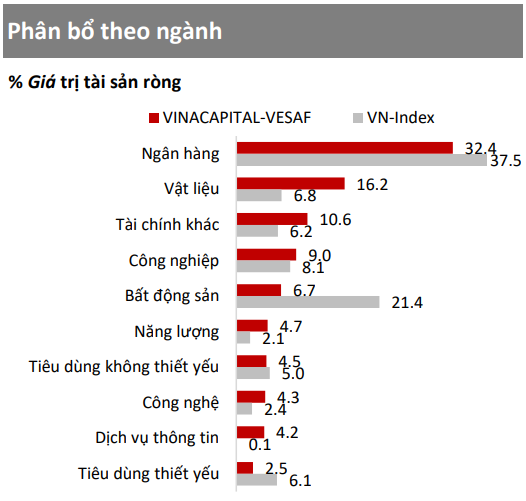

VESAF Portfolio Allocation by Stock as of September 2025

Source: VESAF

|

On the macroeconomic front, VESAF noted that despite U.S. tariff policies, Vietnam’s manufacturing sector maintained growth of 12.7% in September and 10.4% year-to-date, while exports rose by 24.7% and 16%, respectively.

However, domestic consumption remained sluggish despite a 21.5% increase in international tourist arrivals. As a result, total retail sales (excluding price factors) grew by only 7.2% in the first nine months.

Public investment disbursement was a standout, increasing by 43% year-to-date, according to the Ministry of Finance. Registered and disbursed FDI also rose by 15.2% and 8.5%, respectively, reflecting long-term investor confidence in Vietnam’s investment environment.

Regarding macroeconomic balance, the Fund noted that inflation remained well-controlled, with average CPI up 3.3% year-to-date. However, maintaining low interest rates and stable exchange rates may face greater challenges ahead, as credit growth reached 13%, deposit rates rose slightly by 10-50 basis points, and the USD/VND exchange rate increased by 3.7% since the year’s start.

In this report, despite underperforming the VN-Index, VESAF reaffirmed its strategy of focusing on companies with strong balance sheets, stable cash flows, and long-term growth potential, regardless of short-term market fluctuations.

– 13:29 14/10/2025

VN-Index Eyes the 1,800-Point Milestone

Historically, Vietnam’s bull market phases have typically endured for approximately two years, delivering cumulative returns exceeding 130% before transitioning into corrective periods.