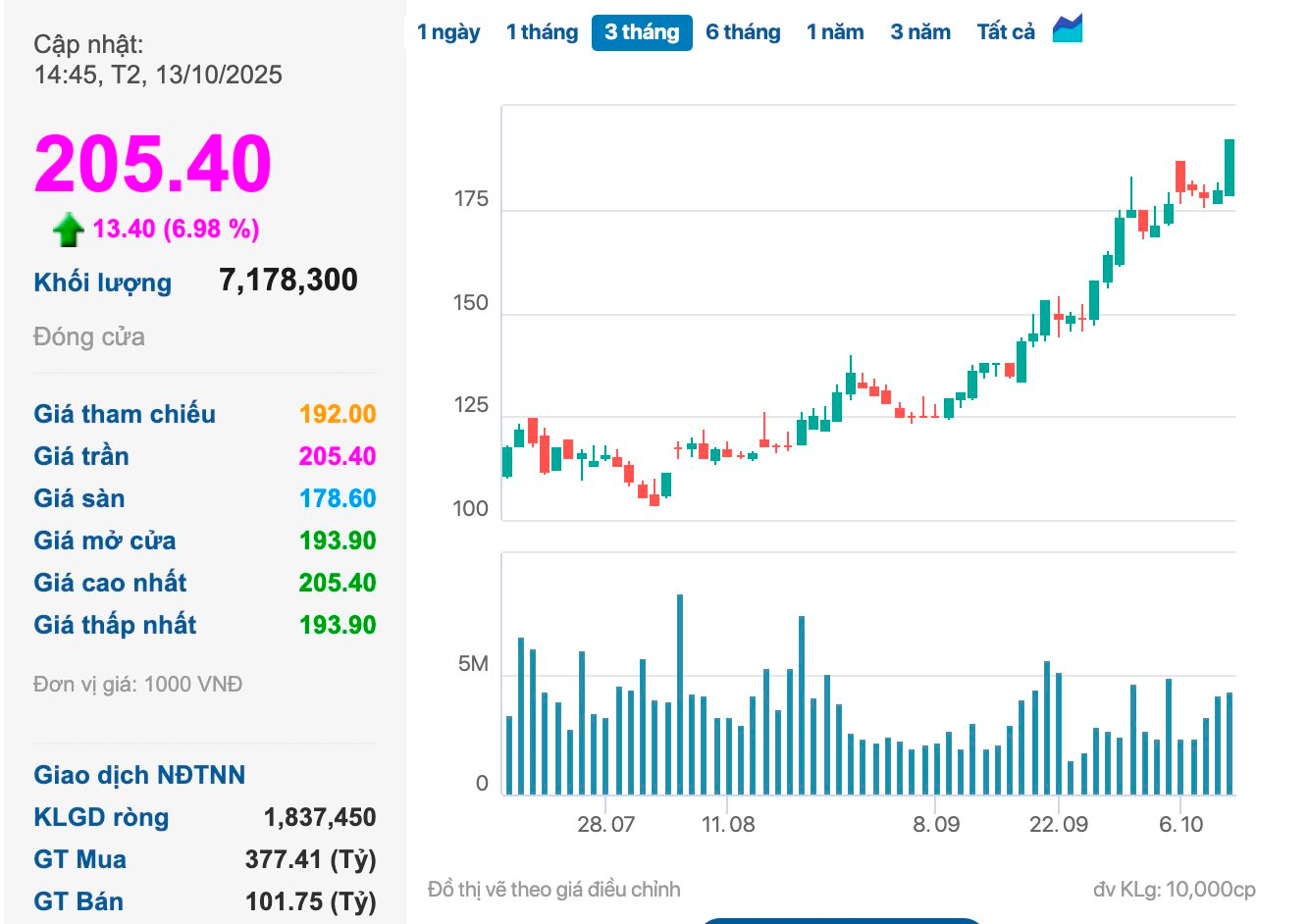

On October 13th, Vingroup’s (VIC) shares took center stage, surging nearly 7% to a record high of VND 205,400 per share. This milestone marked the highest price since its listing, pushing Vingroup’s market capitalization close to VND 800 trillion. With this peak, Vingroup is widening its lead over other blue-chip stocks like Vietcombank, Vinhomes, and VietinBank.

Trading volume reached nearly 7.2 million shares, with transaction values exceeding VND 1.4 trillion. Foreign investors also injected a net inflow of nearly VND 272 billion, solidifying VIC’s role as a market pillar during this volatile session.

VIC shares hit a historic high, surpassing VND 200,000 per share.

This surge in VIC shares followed news that Vingroup Chairman Pham Nhat Vuong completed the transfer of over 60 million VIC shares, equivalent to 1.55% of the group’s charter capital, to contribute to VinEnergo Energy Joint Stock Company.

According to the Ho Chi Minh City Stock Exchange (HoSE), Mr. Vuong submitted a report to the State Securities Commission, HoSE, and Vingroup regarding this internal share transaction. Valued at over VND 600 billion, these shares were transferred to support investments in the energy sector through VinEnergo.

In today’s trading session, the VN-Index closed up 17.57 points, reaching 1,765.12 points. The HNX-Index gained 1.73 points to 275.35, while the UPCoM-Index rose 1.09 points to 112.70.

Market activity was vibrant, with total trading value across all three exchanges nearing VND 48.7 trillion. HoSE accounted for VND 44.5 trillion, with over 1.3 billion shares changing hands.

The stock market continues its rally, with the VN-Index setting a new record high.

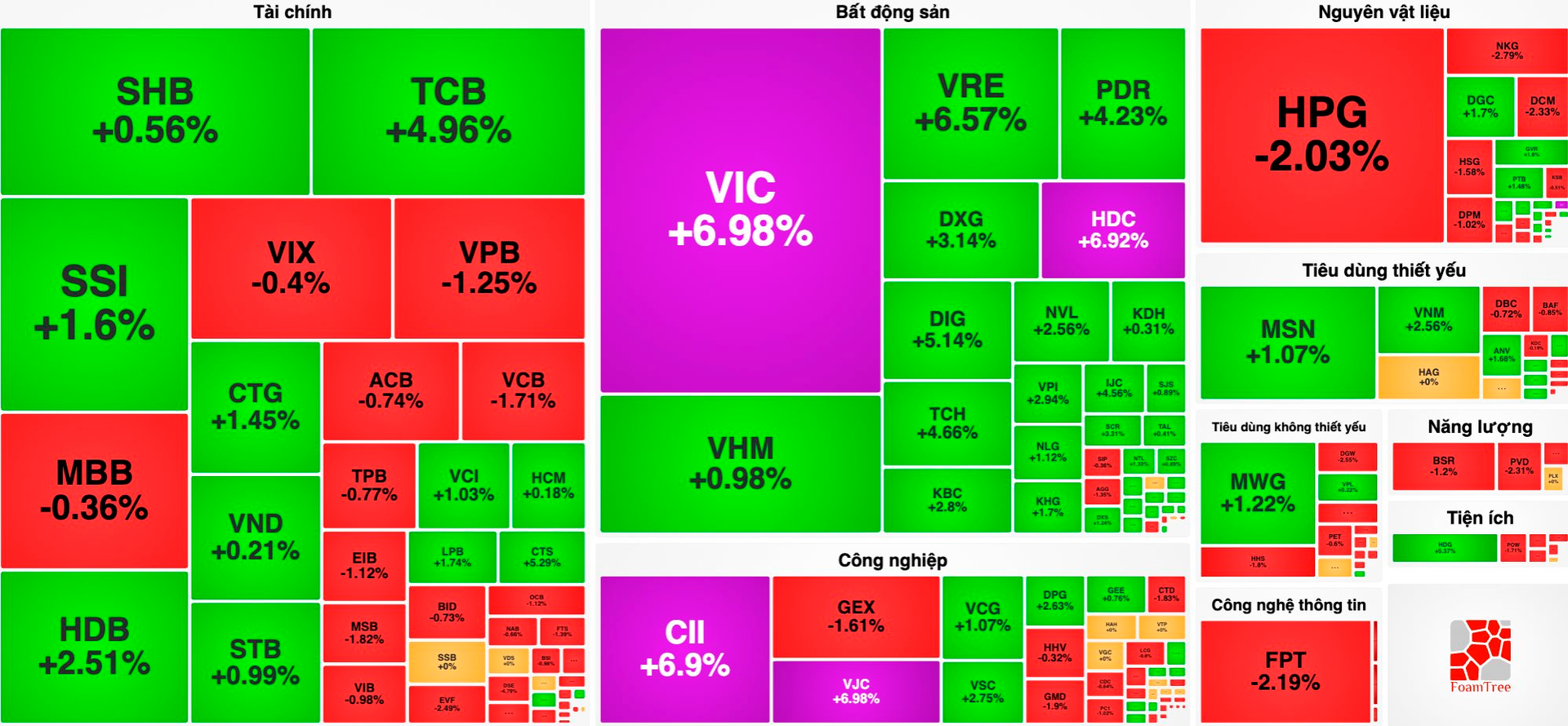

Trading activity was particularly robust in real estate stocks, led by VIC’s ceiling-hit performance. Other related stocks, including VHM (+0.98%) and VRE (+6.57%), also performed well. CRV continued its ceiling-hit streak in its second session since listing on HoSE on October 10th.

Several real estate stocks saw significant gains, such as NVL (+2.56%), KBC (+2.8%), PDR (+4.23%), DXG (+3.14%), TCH (+4.66%), DIG (+5.14%), and VPI (+2.94%). CEO and HDC also hit their ceilings. Conversely, SIP, SNZ, NTC, and CRE faced capital outflows.

Despite the index’s strong performance, declining stocks outnumbered gainers on the board. In the banking sector, most stocks fell, including VCB, BID, VPB, MBB, ACB, VIB, EIB, TPB, and MSB. Positive performers included CTG (+1.45%), TCB (+4.96%), HDB (+2.51%), LPB (+1.74%), and PGB (+2.34%).

Elsewhere, the industrial sector saw ceiling hits in stocks like VJC and CII, while securities stocks SHS, VND, HCM, and CTS traded in the green. In the materials sector, HPG, NKG, and DCM faced heavy selling pressure, with prices dropping over 2%.

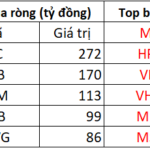

Foreign investors maintained a net sell position of over VND 1.2 trillion, with HPG being the most heavily sold stock at VND 365.5 billion. VRE, VHM, and MBB also saw significant outflows of over VND 300 billion each, while MSB and VPB were sold for VND 218.5 billion and VND 217 billion, respectively.

On the buying side, foreign investors poured nearly VND 272 billion into VIC, VND 170 billion into SHB, VND 113 billion into VNM, VND 98 billion into HDB, and over VND 80 billion into MWG and CII. Other notable buys included TCB, HDG, BSR, and TCH, with net purchases exceeding VND 50 billion.

Stock Market Shatters All Records

The opening session of the week (October 13th) marked a historic milestone for Vietnam’s stock market, as the VN30-Index breached the 2,000-point threshold for the first time ever.

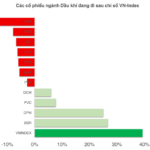

Where Are Oil & Gas Stocks Amid a Soaring Market?

Following the Vietnamese stock market’s ascent to new heights and its official upgrade to secondary emerging market status, investor focus is shifting towards stocks with unique narratives, particularly within the energy sector. However, several energy stocks are currently lagging significantly behind the broader market’s momentum.