Vietnam’s coffee exports surge in September 2025, reaching 81,000 tons valued at $462 million, marking a 58% increase in volume and 61% in value compared to September 2024.

In the first nine months of 2025, Vietnam’s coffee exports totaled nearly 1.24 million tons, valued at $7 billion, reflecting an 11.7% rise in volume and a 62.2% surge in value compared to the same period in 2024. This exceeds the $5.62 billion recorded for the entire year of 2024. The average export price of coffee reached $5,655 per ton, a significant 45.2% increase year-over-year.

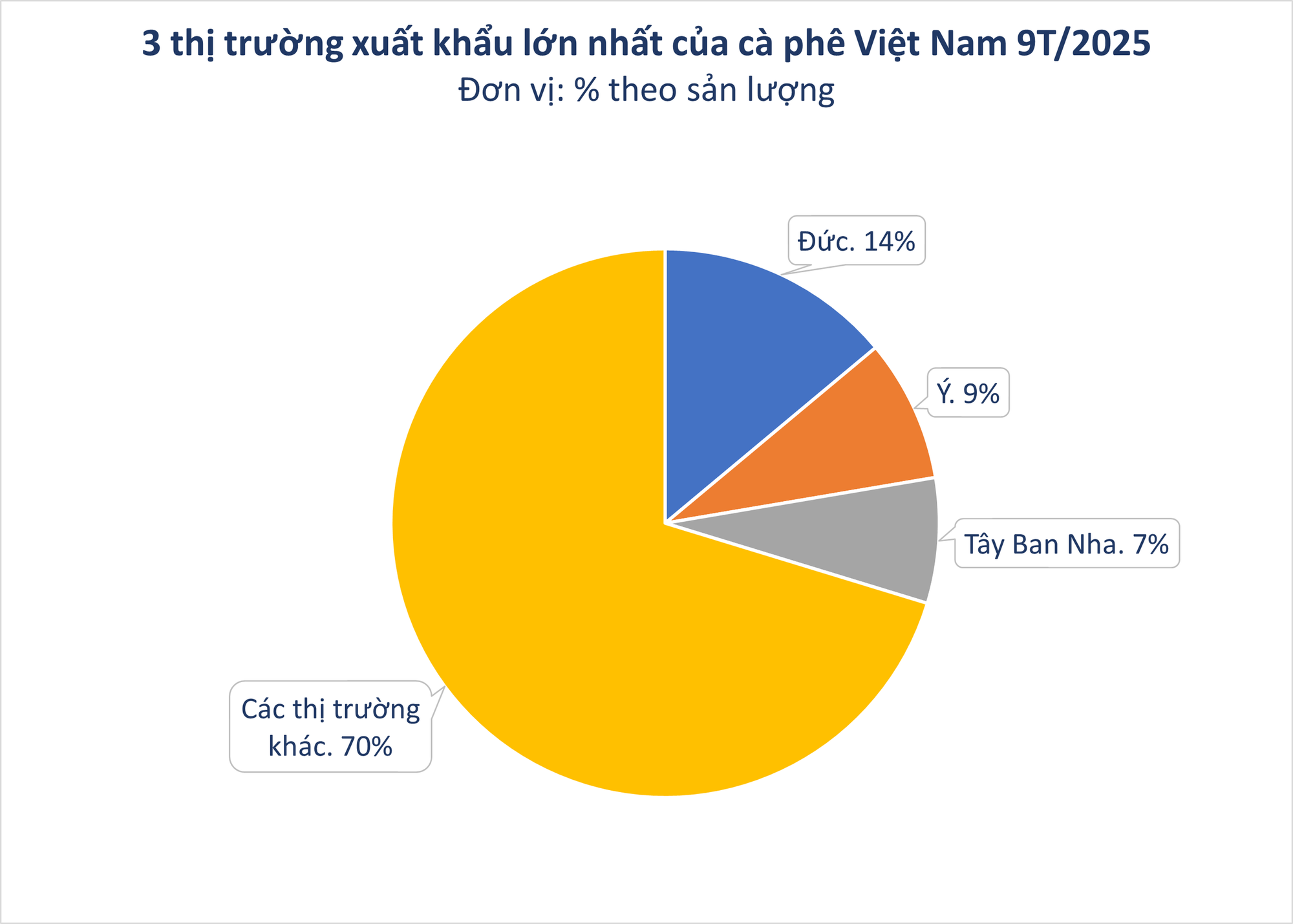

Key markets such as the EU and the U.S. remain the primary drivers of growth, while emerging markets like Algeria and Mexico have seen dramatic increases, expanding opportunities for Vietnamese coffee exports. Notably, Cambodia has emerged as a significant buyer, with a 264% increase in volume and a 327% rise in value in September alone. Over the nine-month period, Cambodia’s purchases grew by 144% in volume and 183% in value, with an average export price of $4,081 per ton, up 16% year-over-year.

Vietnam’s coffee exports in the first nine months of 2025 have thrived due to high global coffee prices, driven by supply disruptions caused by weather conditions in Brazil and Indonesia. Vietnam’s stable production and shifting demand from major markets have further bolstered its position.

Experts and businesses highlight the 50% tariff on Brazilian coffee as a golden opportunity for Vietnam and other non-tariffed countries like Colombia, Honduras, and Ethiopia. Rising costs are prompting U.S. importers to seek alternative suppliers. Historically, high shipping costs and consumer preferences limited U.S. imports to Brazilian Arabica, but the new tariffs are shifting demand toward Vietnamese and Indonesian Robusta.

In Europe, the EU Deforestation Regulation (EUDR) has been postponed to late 2026. Vietnam, one of the few coffee exporters prepared to meet the new standards, is strengthening its market position. As the world’s leading producer and exporter of Robusta coffee, Vietnam’s harvest season beginning in October has drawn international attention. Coffee plantations in the Central Highlands remain stable, with minimal damage from recent storms.

The increasing share of processed coffee products is also enhancing the industry’s export value. In the final months of 2025, global coffee demand is expected to rise sharply due to holiday seasons and winter in many countries, creating favorable conditions for Vietnam to boost exports. With global coffee prices remaining high, Vietnam’s 2025 coffee exports are projected to exceed 1.6 million tons, valued at approximately $9 billion.