In the 2026 strategic report titled “The Dawn of Ambition”, SSI Securities (SSI Research) assesses that Vietnam’s stock market enters 2026 with a robust foundation and multiple strong drivers for its next expansion phase.

The analytical team believes that, following two years of stable recovery, the market is transitioning into a more sustainable growth cycle. This shift is supported by a solid macroeconomic base, attractive valuations, and comprehensive economic reforms.

Vietnam’s economy is expected to remain among Asia’s fastest-growing, with the government targeting an average annual GDP growth in the double digits by 2030, as outlined in the new development strategy.

This ambitious goal is built on three key pillars: (1) increased public investment, (2) leveraging the dynamism of the private sector, and (3) maintaining stable FDI inflows. Externally, the anticipated shift by the U.S. Federal Reserve toward a more accommodative monetary policy is expected to stabilize the VND exchange rate and keep domestic capital costs low.

In this context, the State Bank of Vietnam (SBV) is well-positioned to maintain supportive monetary policies, fostering credit growth and market liquidity. Despite significant price increases in 2025, market valuations remain attractive.

VN-Index Poised to Reach 1,800 Points in 2026

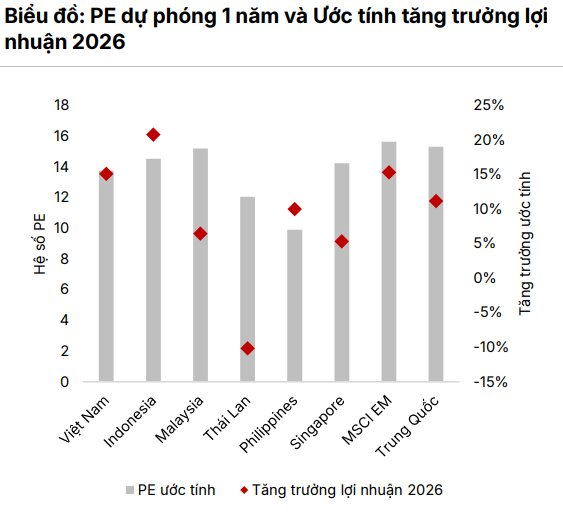

Regarding the stock market, the VN-Index is currently trading at a projected P/E of 13.9 for 2025 and 12 for 2026, below the 10-year average of 14 and the 15-16 range seen during previous market peaks. Compared to regional markets, Vietnam stands out with its combination of high growth rates and reasonable valuations, indicating the market is in the early stages of a new growth cycle. SSI Research maintains a 1,800-point target for the VN-Index in 2026.

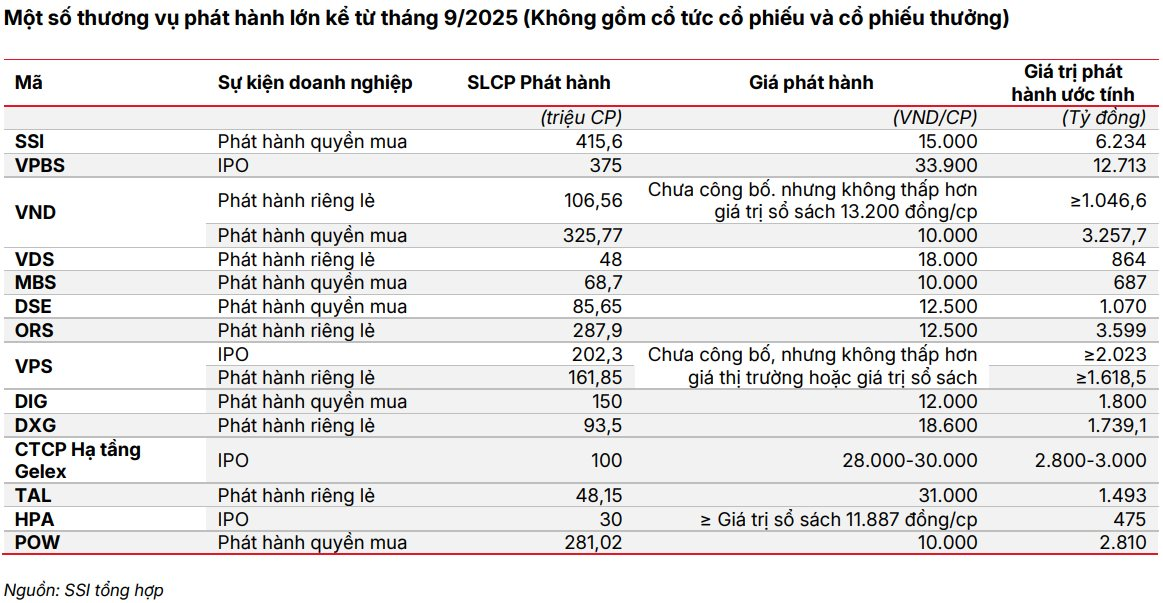

Liquidity growth and a resurgence in IPO activity are key themes for 2026. Domestic investors continue to be the market’s primary support, while large-scale listings such as TCBS, VPS, and Gelex Infrastructure reflect renewed corporate confidence. This new issuance cycle is expected to drive growth and deepen the market.

Historically, Vietnam’s strong market rallies typically last around two years, delivering cumulative returns exceeding 130% before entering a correction phase. The current uptrend, which began in April 2025, remains in its early stages.

If history repeats itself, SSI believes 2026 will mark the second phase of this rally, with leadership expanding from the banking sector to consumer and technology industries.

Regarding market upgrades, SSI analysts note that Vietnam’s elevation to Emerging Market status by FTSE Russell, and potential inclusion in the MSCI Emerging Market index, could attract approximately $1.6 billion in ETF inflows and significantly more active capital. This milestone would underscore Vietnam’s reform progress and deepen its integration into the global financial market.

Unlocking Opportunities: VPS Securities’ Vision with VCK Code – Three Pillars for Success

At the “VPS The Next Chapter” event, VPS Securities unveiled its anticipated stock code, VCK. During the event, Mr. Nguyễn Lâm Dũng, Chairman of the Board and CEO of VPS, shared insights into the leading brokerage firm’s future business strategies.

Foreign Block Net Sells Trillions in Week of October 6-10, Contrasting with 700 Billion Dong “Buy” of a Bluechip Stock

Foreign investors maintained their selling pressure, though the intensity eased compared to previous weeks.