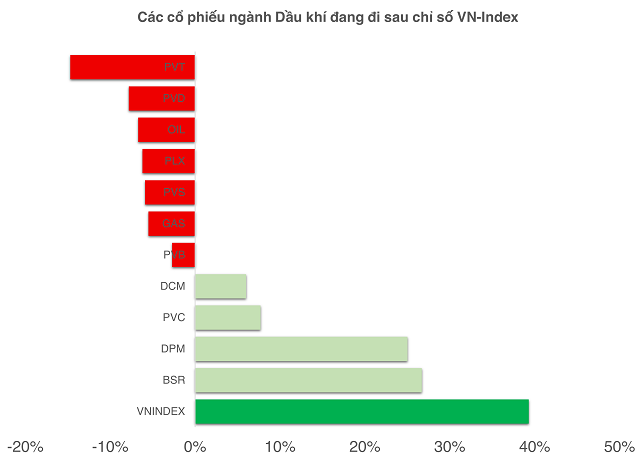

Modest Performance Compared to VN-Index

As of October 13, 2025, no oil and gas stocks have outperformed the VN-Index, which has surged by +39.3% year-to-date.

Leading the pack is BSR, the stock of Binh Son Refining and Petrochemical JSC, with a +26.7% gain, nearing its all-time high of 31,450 VND per share.

All oil and gas stocks are trailing the VN-Index (as of October 13, 2025).

|

BSR’s appeal stems from its potential inclusion in the VN30 index, comprising the 30 largest and most liquid stocks on the HOSE exchange. In the July 2025 review, BSR met most criteria, except for the 6-month listing requirement (met by January 17, 2025). Q1 2026 is expected to mark its entry into the blue-chip index, attracting ETF inflows and boosting foreign investor interest.

Other stocks like DPM (+25%), PVC (+7.7%), and DCM (+6%) have seen more modest gains. This contrasts with 2024, when six out of eleven oil and gas stocks outperformed the VN-Index despite the market’s peak challenges.

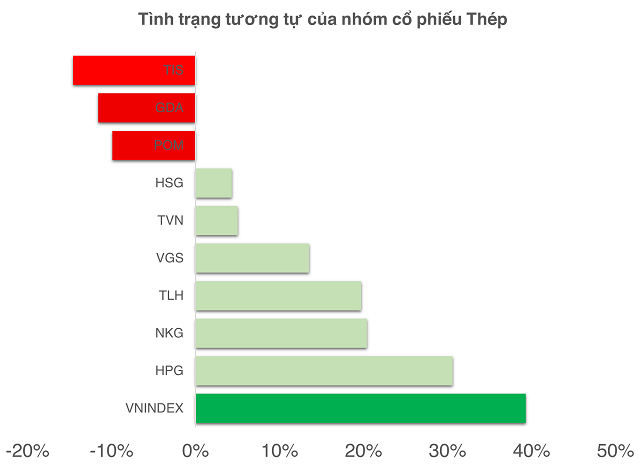

Similar underperformance in the steel sector (as of October 13, 2025).

|

Currently, oil and gas stocks mirror the steel sector’s lag behind the VN-Index, despite strong fundamentals.

Key Drivers for the Oil and Gas Sector

MBS Securities forecasts BSR’s 2025 net profit at 2,043 billion VND (+223.7% YoY) and 3,799 billion VND in 2026 (+86%), driven by stable crack spreads, improved margins, and higher output.

Beyond VN30 inclusion, the Dung Quat Refinery Upgrade Project (NCMR), slated for Q3 2028 completion, is pivotal. Post-NCMR, BSR’s gross margin could reach 7.2% as it shifts to higher-value petrochemical products, aligning with global energy trends.

Vietnam’s energy sector is undergoing transformative reforms, supported by new electricity and gas pricing policies. Vietcap Securities notes that the two-tier retail electricity pricing will eliminate cross-subsidies, ensuring higher IRRs for renewable energy projects.

“The new mechanism will attract green funds, FDI, and long-term capital, while DPPA agreements empower consumers to choose providers,” Vietcap adds.

The state retains grid control, while private investment in LNG and gas-fired power is encouraged. From 2024 to 2038, Vietnam plans to invest ~20 billion USD in key oil and gas projects.

2026 is critical, with final investment decisions (FIDs) expected for Nam Du – U Minh (0.8 billion USD), Khanh My – Dam Doi (0.3 billion USD), and Thien Nga – Hai Au (0.3 billion USD).

Key oil and gas projects in Vietnam (Source: Vietcap).

|

Concurrently, the B – O Mon block will start generating revenue, while the Ca Voi Xanh field and offshore wind exports to Singapore are set to advance.

These projects will strengthen the domestic oil and gas supply chain, benefiting upstream, midstream, and downstream players, ensuring sustainable mid-term profit growth.

According to Dinh Thi Thuy Duong, Deputy Director of Research at Vietcap, “Oil and gas stocks’ lackluster performance reflects oil price indifference among investors. However, the sector remains central to Vietnam’s energy security, keeping its fundamentals intact.”

– 08:08 14/10/2025

Historic Stock Market Peak: Is a Major Wave Following the Upgrade?

The VN-Index has just experienced its most robust weekly gain in history, consistently reaching new highs following the market upgrade catalyst. However, analysts caution that the rally is primarily driven by a handful of blue-chip stocks, with market liquidity showing signs of divergence. After the initial reaction to the upgrade news, the market is expected to refocus on fundamental factors.

VN-Index Hits New High Post-Upgrade: Why Are Many Investors Still Losing?

Last week, following the stock market upgrade, the VN-Index surged by over 100 points, yet many investors were left in tears.

Market Pulse 13/10: Real Estate Sector Attracts Inflows, VN-Index Extends Winning Streak to 4 Consecutive Sessions

At the close of trading, the VN-Index surged by 17.57 points (+1.01%), reaching 1,765.12 points, while the HNX-Index climbed 1.73 points (+0.63%) to 275.35 points. Despite this, the overall market breadth tilted toward the red, with 409 decliners outpacing 273 advancers. In contrast, the VN30 basket was dominated by green, boasting 17 gainers, 10 losers, and 3 unchanged stocks.

Vietstock Daily October 14, 2025: Will the Uptrend Continue?

The VN-Index has formed a Three White Soldiers candlestick pattern, accompanied by trading volume consistently above the 20-session average, signaling prevailing market optimism. The index is closely tracking the Upper Band of the Bollinger Bands, while the MACD indicator continues its upward trajectory following a buy signal. This confluence of factors underscores a positive short-term growth outlook.