According to the recently released Q3 2025 financial report, SmartInvest Securities Corporation (stock code: AAS) recorded a post-tax profit of VND 112 billion, a sevenfold increase year-over-year (YoY), surpassing 200% of its annual profit target in just nine months. This remarkable growth was primarily driven by its proprietary trading segment.

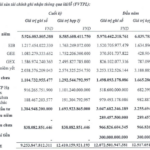

Specifically, the company’s total operating revenue for the period reached VND 230 billion, a 142% YoY increase. Financial assets measured at fair value through profit or loss (FVTPL) contributed VND 215 billion, 2.5 times higher than the previous year. Conversely, losses from FVTPL assets stood at VND 35 billion, a slight increase compared to Q3 2024. After deducting minimal proprietary trading expenses, the company’s net profit from this segment reached VND 180 billion, 3.4 times higher YoY.

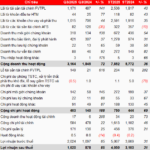

As of the end of Q3 2025, SmartInvest Securities allocated VND 991 billion to FVTPL assets, a 38% decrease from the beginning of the year but a 30% increase from the end of Q2 2025. The company primarily invested in bonds (VND 493 billion), though this investment decreased by over VND 1 trillion compared to the start of the year.

AAS achieved strong profits, completing nearly 200% of its annual profit target in just nine months.

Conversely, AAS increased investments in listed stocks (over VND 192 billion at cost) and unlisted stocks (over VND 191 billion at cost). The largest investment was in SHB, valued at nearly VND 120 billion (with a provisional profit of nearly VND 4 billion), followed by HPG at VND 66.5 billion (provisional profit of nearly VND 8 billion).

Beyond its FVTPL portfolio, SmartInvest Securities holds over VND 260 billion in available-for-sale financial assets (AFS), comprising listed stocks, and over VND 203 billion in held-to-maturity investments (HTM).

In the first nine months of 2025, AAS achieved VND 468 billion in operating revenue, a 36% YoY increase, with post-tax profits reaching VND 160 billion, a 122% YoY increase.

For 2025, the company set a target of VND 520 billion in operating revenue and VND 82 billion in post-tax profit, representing 27% and 11% YoY growth, respectively. After nine months, AAS has achieved 90% of its revenue target and nearly 200% of its profit target.

Prior to SmartInvest, several securities firms reported strong Q3 2025 profits compared to the same period last year.

Technological Securities (TCBS, stock code: TCX) recorded VND 1.62 trillion in post-tax profit, an 85% YoY increase. In the first nine months, its post-tax profit reached VND 4.05 trillion, a 31% YoY increase.

VIX Securities (stock code: VIX) achieved VND 2.449 trillion in post-tax profit, nine times higher YoY. Its nine-month post-tax profit reached VND 4.123 trillion, 7.5 times higher YoY.

VPBank Securities reported VND 1.892 trillion in Q3 2025 post-tax profit, seven times higher than the VND 272 billion recorded in Q3 2024. Its nine-month post-tax profit reached VND 2.614 trillion, nearly four times higher YoY.

MB Securities (MBS) recorded VND 333 billion in Q3 2025 post-tax profit, an 86% YoY increase. Its nine-month post-tax profit reached VND 823 billion, a 42% YoY increase.

VPS Securities estimated a nine-month post-tax profit of VND 2.5 trillion, with Q3 alone contributing VND 1 trillion, a 65% YoY increase.

Overall, securities firms’ business segments, including margin lending, brokerage, and proprietary trading, performed robustly. This was supported by a vibrant stock market in Q3 2025, with liquidity surging to VND 60-70 trillion per session.

Q3/2025 Financial Report Update: Automotive Firm Lists Losses, Shareholder Equity Dips to -62 Billion VND

At present, the majority of companies that have released their Q3/2025 financial reports belong to the securities sector. Additionally, businesses in real estate, healthcare, construction materials, and electrical equipment have also disclosed their quarterly statements.

TCBS Reports Significant Profits in First Nine Months, Achieving 88% of Annual Plan

Technological Commercial Joint Stock Bank Securities (TCBS, HOSE: TCX) has released its Q3/2025 financial report, revealing a remarkable net profit of nearly VND 1.62 trillion, an 85% surge compared to the same period last year. This impressive performance has propelled the company’s nine-month cumulative profit to over VND 4.05 trillion, marking a 31% year-on-year growth. TCBS’s core operations, including proprietary trading, brokerage, and lending, have all demonstrated robust growth, solidifying its position as a leading player in the industry.

Surprising Profit Surge: 4 Vietnamese Companies on the Stock Market Making Headlines

GELEX Electric’s after-tax profit for Q3/2025 soared by 329% year-over-year, reaching an impressive 1.791 trillion VND.