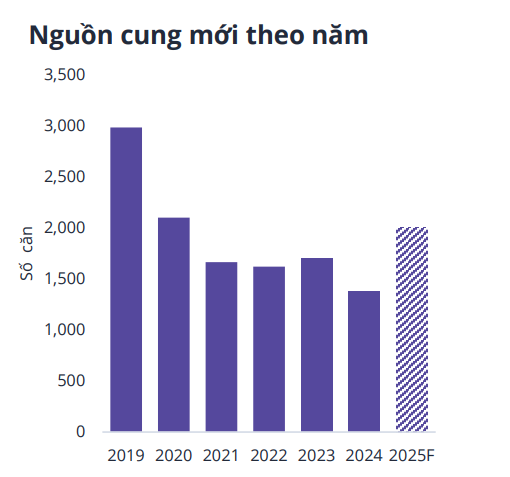

According to a recent report by Avison Young Vietnam, the villa and townhouse market in Ho Chi Minh City (HCMC) witnessed a notable new supply in Q3/2025, primarily from the Gladia By The Waters project—a collaboration between Khang Điền and Keppel Land. This development offers a total of 226 villas and townhouses.

Additionally, the market eagerly anticipates upcoming projects such as The Meadow – Phase 3 and Vinhomes Can Gio, which are expected to launch soon.

The western area of HCMC is emerging as a new development hub, with projects like Vinhomes Green City, Eco Retreat, Kinghill Residence, and LA Home strategically positioning themselves rather than directly competing.

HCMC’s villa and townhouse market sees new supply from Gladia By The Waters (226 units), while The Meadow Binh Chanh – Phase 3 and Vinhomes Can Gio are set to launch soon.

In terms of pricing, the villa and townhouse market in HCMC maintained high price levels in Q3/2025 due to limited new supply. Notably, the Thu Thiem area recorded ultra-luxury villas with asking prices nearing $37,700/m² (approximately VND 993 million/m²), setting a new benchmark for the luxury segment.

In other high-end projects, primary market prices ranged between $9,400–$11,300/m² (VND 247–298 million/m²), while secondary market prices were significantly lower, reflecting buyer caution.

New launches were concentrated in the eastern area, such as the Khang Điền and Keppel Land project in Binh Trung, offering over 200 units priced from $755,000 per unit (approximately VND 19.9 billion per unit). This project attracted both end-users and long-term investors.

However, overall liquidity remained sluggish due to high capital costs and a wait-and-see sentiment. Peripheral areas and neighboring provinces saw stronger demand thanks to more affordable prices and improved infrastructure.

Looking ahead, the high-end villa and townhouse segment in HCMC retains its appeal due to scarcity and potential value appreciation. However, significant growth will depend on infrastructure progress and policies balancing supply and demand.

Avison Young notes that following the merger with Binh Duong and Ba Ria – Vung Tau, HCMC’s landed property market is increasingly exhibiting a centrifugal development trend, with expanded land funds. Buyers are willing to relocate to suburban areas for more affordable prices.

Regarding the outlook for 2025–2026, Avison Young representatives stated that land prices will continue to rise by an average of 5–15%, depending on the area, primarily in suburban areas of major cities and provinces with favorable connectivity infrastructure.

In 2026, price growth is expected to slow due to high input costs and clear market segmentation. The market will see robust development of landed projects integrated with comprehensive amenities and services, while areas farther from the city center with incomplete infrastructure will experience lower liquidity. Overall, landed property remains a promising investment channel over the next two years, but requires careful selection of location, legal compliance, and long-term holding strategies.

“Dĩ An (Old) and Thuận An (Old) Apartments in High Demand: Investment Capital Shifts Away from Ho Chi Minh City Center”

Data from Batdongsan.com.vn reveals that due to soaring prices in central Ho Chi Minh City, investment capital is increasingly shifting toward areas with greater growth potential and more affordable pricing, such as former Thu Duc, Di An, and Thuan An districts.

Dutch Conglomerate Invests Hundreds of Millions to Acquire CJ and Masan Plants, Plans to Relocate Asia Headquarters to Ho Chi Minh City

A positive signal for Ho Chi Minh City’s investment environment emerges as De Heus, a global leader in animal feed production, expresses its intention to establish its regional headquarters in the city. This announcement was made during a meeting between the corporation’s leadership and Mr. Nguyen Van Duoc, Chairman of the Ho Chi Minh City People’s Committee, on October 2nd.