According to data from Phu Quy Jewelry Corporation, silver prices surged today, with 999 silver (1 tael) listed at VND 1,944,000 per tael (buy) and VND 2,004,000 per tael (sell). Over the past month, buyers have seen a 19.8% profit, and a remarkable 77% gain over the past year.

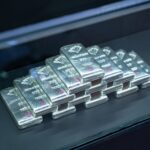

Meanwhile, 1kg 999 silver bars also experienced a significant increase, priced at VND 51,839,870 per bar (buy) and VND 53,439,866 per bar (sell), as of 08:59 on October 13th.

Globally, silver prices reached a milestone of $50.8 USD per ounce.

Silver prices concluded the trading week with an impressive rally, marking the 8th consecutive week of gains and surpassing the 2011 peak by reaching $50 USD per ounce. Despite a slight adjustment to $49.99 USD per ounce at the close, the precious metal still climbed 4% for the week and over 71% year-to-date – a rare surge not seen in more than a decade.

Meanwhile, Michele Schneider, Market Strategist at MarketGauge, revealed she has closed all gold and silver positions, warning of widespread “fear of missing out” (FOMO) sentiment. She predicts precious metals may soon enter a correction phase, similar to the 2011 peak pattern, and advises investors to exercise caution, awaiting clear accumulation signals before re-entering the market.

Why Are Major Brands Halting Silver Bullion Orders? Unraveling the Mystery

Soaring silver prices have sparked a frenzy among investors, leading to a surge in demand for silver bars and coins. This unprecedented rush has overwhelmed suppliers, forcing several major brands to temporarily halt new silver orders.