The favorable context stems from FTSE Russell’s expectation to upgrade Vietnam’s stock market to “Secondary Emerging” status, officially announced on October 8th, with an effective date of September 2026. This upgrade opens up opportunities to attract an estimated capital inflow of $3-7 billion.

Market infrastructure has been enhanced with the official launch of the KRX trading system in May 2025. On the policy front, Decree 245, which reduces the listing time from 90 to 30 days, has created favorable conditions, enabling businesses to quickly access capital.

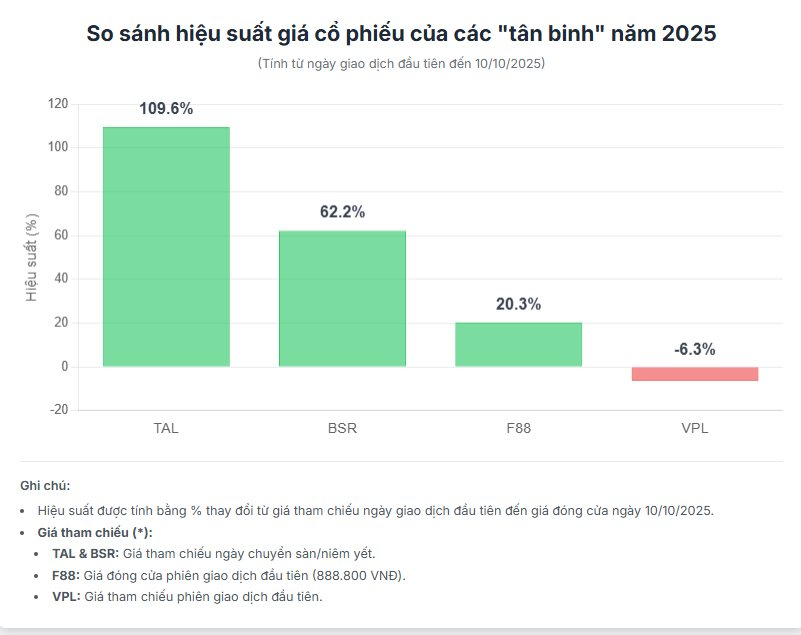

Performance of Newly Listed Companies in 2025

Looking back at some companies that have listed or transferred in 2025, there is a divergence in business results and stock price movements.

Taseco Land (TAL) has shown the most positive performance. Since transferring to HoSE on August 1st with a reference price of around VND 23,000 per share, TAL’s stock has surged over 100% in just three months, reaching VND 48,200 per share (as of October 10th). This price increase is driven by the first-half results, with after-tax profit rising 254% year-on-year to VND 60.6 billion, alongside the company’s increased investment in high-margin real estate projects.

Binh Son Refinery (BSR) has demonstrated a recovery. Since transferring to HoSE on January 17th with a reference price of around VND 18,000 per share, the stock price has risen to VND 29,200 per share (as of October 10th). According to the company’s announcement, the first nine months’ after-tax profit exceeded VND 2 trillion. The stock price has also been supported by a planned 61.5% bonus share issue.

F88 (F88) reported a 3.1-fold increase in six-month profit compared to the same period last year, reaching VND 254.7 billion. Listed on UPCoM on August 8th, this stock attracted attention with the highest market price. From the closing price of the first session at VND 888,800 per share, F88 rose to VND 1,069,100 per share (as of October 10th). This price level is explained by the very low free-float, although the stock has adjusted after the initial hot rally.

In contrast, Vinpearl (VPL) has experienced volatility. Listed on HoSE since May 13th with a reference price of around VND 95,000 per share, VPL is currently trading at VND 89,000 per share (as of October 10th), reflecting a slight decline. VPL’s six-month after-tax profit dropped 90% to VND 258.8 billion, mainly due to a one-time financial income in the same period last year. However, the core business segments of hotels and entertainment still recorded a 37.3% revenue growth.

Upcoming Large-Scale Listings

Upcoming IPO activities are expected to remain vibrant. Mr. Tran Hoang Son, Market Strategy Director at VPBankS, estimates that IPO and listing activities from now until 2027 will have a total expected value of approximately $47.5 billion.

In the financial sector, TCBS successfully IPOed in mid-September with a pre-IPO valuation of $3.7 billion, expecting to raise over VND 10.8 trillion.

VPBankS is also initiating a large-scale transaction. The company began its IPO on October 10th with plans to offer 375 million shares at VND 33,900 per share. At this price, VPBankS is valued at approximately $2.4 billion and is expected to raise over VND 12.7 trillion.

Hoa Phat leads the Australian beef market share in Vietnam. (Photo: HPG)

In the manufacturing sector, the trend of listing subsidiary “ecosystems” is becoming more pronounced. Hoa Phat Group has submitted the IPO application for Hoa Phat Agricultural Development JSC (HPA), expected to list on HoSE in December 2025.

HPA is Hoa Phat’s second-largest business segment, with superior performance compared to the industry (15% net profit margin, 32% ROE in 2024). The plan is to offer 30 million shares at a minimum price of VND 11,887 per share, raising nearly VND 357 billion. At this price, HPA’s P/E ratio is only about 2.1 times.

Another “ecosystem” is Gelex Infrastructure JSC, which also plans to IPO, expected to offer 100 million shares to raise approximately VND 3 trillion, with a potential billion-dollar valuation. The earliest listing timeline is January 2026.

This holding company owns core business segments of Gelex, accounting for 66% of the group’s total assets, including 50.21% of Viglacera (VGC) and 62.46% of Song Da Water (VCW).

Additionally, the transfer listings of large companies on UPCoM, such as Vietnam Airlines Corporation (ACV) and Masan Consumer (MCH)—with a market capitalization of up to $5.7 billion—are also attracting market attention.

The market upgrade opens up opportunities for Vietnamese companies to access international capital and revalue their enterprises. The stock market will gradually become a more important capital mobilization channel, helping businesses reduce their reliance on bank credit.

However, participating in a larger playing field comes with higher requirements. Listed companies, especially newly IPOed ones, must meet international standards in transparency and corporate governance to attract capital from professional investment funds.

VESAF Fund Lagging Market Performance Despite No Holdings in VIC Stocks

In September 2025, VinaCapital’s VESAF fund recorded a -5% return, while the VN-Index dipped by only 1.2%. Over the first nine months, the fund achieved an 11.4% gain, compared to the index’s impressive 31.2% surge.

VN-Index Hits New High Post-Upgrade: Why Are Many Investors Still Losing?

Last week, following the stock market upgrade, the VN-Index surged by over 100 points, yet many investors were left in tears.