Regal Group, a leading real estate developer established in 2011, is headquartered in An Hải Ward, Da Nang City. Mr. Trần Ngọc Thành serves as both the CEO and legal representative of the company.

With a chartered capital of 1.8 trillion VND, the company’s ownership structure includes 55% held by its parent company, Dat Xanh Real Estate Service Corporation (HOSE: DXS), 15% by Mr. Trần Ngọc Thành, and 5.17% by Mr. Lương Trí Thìn.

Originally known as Dat Xanh Central Joint Stock Company, Regal Group rebranded in March 2023. Concurrently, the Dat Xanh Central brand was transferred to Vietnam Smart Urban Development Joint Stock Company, formerly a subsidiary of Regal Group.

The restructuring reflects Regal Group’s commitment to focusing exclusively on its role as a primary developer of urban complexes and mixed-use projects. Notable developments include Regal Legend (Dong Hoi), Regal Capital (Hue), Regal OneRiver, Regal Victoria, Regal Complex, Regal Pavillon (Da Nang), Regal Heritage (Hoi An), and Regal Maison (Tuy Hoa).

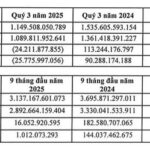

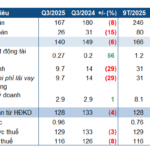

According to the 2025 semi-annual audited consolidated financial report, Regal Group achieved a net revenue of over 357 billion VND in the first half of the year, a 5% increase year-over-year. This growth was primarily driven by apartment and townhouse sales. Financial revenue also surged to nearly 2 billion VND, 27 times higher than the same period last year, entirely from interest income.

After expenses, the company reported a net profit of nearly 83 billion VND, a 43% increase. This represents 41% of the 200 billion VND profit target set for 2025.

Regal Group attributes its first-half growth to strong real estate sales, particularly from key projects like Regal Legend and Regal Maison, which met revenue recognition criteria.

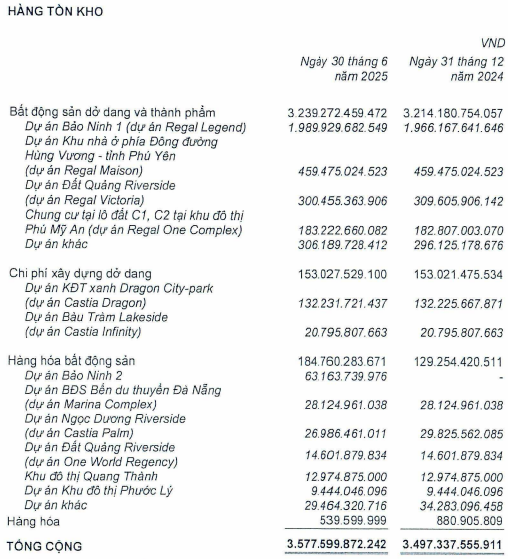

As of June 30, 2025, Regal Group’s total assets exceeded 4.8 trillion VND, a 2% increase from the beginning of the year. Inventory, the largest asset category, rose by over 2% to nearly 3.6 trillion VND. Conversely, short-term cash holdings decreased significantly from 68 billion VND to approximately 6 billion VND.

|

Inventory breakdown of Regal Group as of June 30, 2025

Source: 2025 Semi-Annual Audited Consolidated Financial Report

|

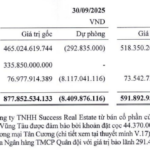

Total liabilities remained stable at nearly 2.4 trillion VND. However, outstanding loans decreased by 10% to over 1.2 trillion VND, primarily comprising bank loans for project financing and working capital. An additional 13 billion VND was borrowed from Ha An Real Estate Investment and Trading Joint Stock Company, a subsidiary of Dat Xanh Group (HOSE: DXG). Notably, customer deposits surged by 84% to over 218 billion VND.

Prior to its stock trading approval, Regal Group was recognized as a public company by the State Securities Commission on December 5, 2024. On January 9, 2025, the Vietnam Securities Depository and Clearing Corporation assigned the stock code RGG to Regal Group’s shares.

– 16:13 15/10/2025

North Ha Hydro Power Rebounds Strongly in Q3

North Ha Hydropower JSC (HNX: BHA) reported a decline in post-tax profit for Q3/2025 compared to the same period last year, primarily due to lower water levels in the reservoir, which impacted revenue. However, this quarter marks a significant recovery for the hydropower company when compared to the previous two quarters.

Bình Minh Plastics (BMP) Reports Record Profits Under Thai Ownership, with Nearly 70% of Total Assets in Cash

In the first nine months of 2025, Binh Minh Plastic reported a net revenue of VND 4,224 billion, marking a 19% increase compared to the same period in 2024. The company’s after-tax profit reached VND 967 billion, reflecting a notable 27% growth year-on-year.

Fertilizer Company Reports Staggering 1,000% Profit Surge in Q3 2025

The company attributes its revenue growth primarily to increased sales volume and a higher average selling price compared to the same period last year. Specifically, the average selling price for this period stood at 17.74 million VND per ton, marking a significant increase of 4.56 million VND per ton over the previous year.