The Key to Macroeconomic Stability

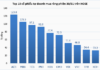

Over the past decade, Vietnam has emerged as a rare bright spot in the region, maintaining low and stable inflation at an average of just 2.8% per year, significantly lower than many emerging economies. This achievement is the result of flexible policy management and effective coordination between fiscal, monetary, and pricing policies, which have bolstered macroeconomic stability and created room for robust GDP growth.

The Consumer Price Index (CPI) data for the first nine months of 2025 continues this trend.

According to Ms. Nguyễn Thu Oanh, Head of the Service and Price Statistics Department at the General Statistics Office (Ministry of Finance), the average CPI for the first nine months increased by 3.27% compared to the same period in 2024, remaining within the target set by the National Assembly for this year.

A decade of controlled inflation fuels sustainable economic growth. Photo: N.L

|

Ms. Oanh attributes the controlled inflation primarily to the abundant domestic supply of goods, particularly food and foodstuffs, which constitute a significant portion of the CPI basket. Vietnam not only meets domestic demand but also maintains stable exports, ensuring a balance between supply and demand and minimizing price fluctuations.

She further noted that to proactively address inflationary pressures, the government has implemented synchronized fiscal and monetary policies, maintained reasonable liquidity, flexibly managed interest rates, reduced input taxes, and effectively executed price stabilization measures.

In reality, upward pressure on commodity prices is an annual challenge. However, over the years, the government has introduced a series of fundamental solutions to prevent prices from spiraling out of control.

When global oil prices surged, the government repeatedly proposed to the National Assembly to reduce the environmental protection tax on gasoline, starting on July 11, 2022. This policy remains in effect and has significantly helped cool down commodity prices, as gasoline is often referred to as the “lifeblood” of the economy, influencing a wide range of goods.

Additionally, the government has flexibly and cautiously managed fiscal policy. It has repeatedly submitted proposals to the National Assembly to reduce the Value Added Tax (VAT) from 10% to 8%, and to defer or exempt taxes worth hundreds of trillions of VND for businesses and individuals during challenging times, thereby supporting production without causing a money supply shock.

Notably, despite implementing numerous tax and fee reductions, the budget balance has remained healthy and sustainable over the years.

The state budget mobilization rate over five years reached approximately 18.3% of GDP, while tax reductions and extensions amounted to about 1.1 quadrillion VND to support individuals and businesses during the global pandemic and economic recovery.

Investment spending increased from 28% to 32% of total state budget expenditures, with revenue growth and cost savings of around 1.5 quadrillion VND allocated to develop infrastructure, highways, national defense, security, schools, hospitals, and eliminate temporary and dilapidated housing. By drastically cutting administrative costs and restructuring organizational machinery, approximately 17% of the annual state budget has been dedicated to social welfare.

Minister of Finance Nguyễn Văn Thắng stated that financial and state budget management has continued to achieve comprehensive and outstanding results, meeting all 12 key financial and state budget targets for the 2021-2025 period.

The average budget deficit for the 2021-2025 period is approximately 3.1-3.2% of GDP, and public debt in 2025 is estimated at around 35-36% of GDP, well-controlled and contributing to the enhancement of the national credit rating.

According to the Ministry of Finance leadership, capital markets continue to develop safely, sustainably, and integratively, becoming a capital mobilization channel for the economy. As of September 30, 2025, the bond market size reached 3.76 quadrillion VND, equivalent to 32.8% of GDP, while the stock market capitalization exceeded 9 quadrillion VND, equivalent to 78.4% of GDP.

In 2025, Vietnam fully met the criteria to be upgraded from a frontier market to an emerging market by international standards, creating significant opportunities to attract medium and long-term capital from international funds and investors for economic development.

Boosting Public and Business Confidence

Speaking with reporters, Dr. Nguyễn Đức Độ, Vice Director of the Institute of Financial Economics (Academy of Finance), highlighted Vietnam’s success in controlling inflation below 4% over the past decade, with an average rate of approximately 2.8% per year.

According to Dr. Độ, this achievement significantly contributes to maintaining macroeconomic stability, increasing public and business confidence in the domestic currency, and fostering a favorable business environment.

The government has repeatedly reduced the Value Added Tax from 10% to 8%. |

“The State Bank has effectively controlled the money supply, with credit growth at a moderate level of nearly 14% per year, alongside maintaining positive real interest rates. These are fundamental factors that have kept inflation stable at a low level in recent years,” Dr. Độ analyzed.

Under government guidance, the State Bank of Vietnam (SBV) has been implementing monetary policy to direct credit institutions to synchronously deploy measures aimed at stabilizing deposit interest rates and reducing lending rates, thereby supporting businesses and individuals in production and business activities.

After aggressively cutting policy interest rates in 2023, the SBV has maintained key interest rates since 2024, enabling credit institutions to access low-cost capital from the SBV and promote economic growth. Concurrently, the SBV has regularly instructed credit institutions to reduce operating costs, enhance information technology application, digital transformation, and implement other measures to further lower lending rates.

The SBV has also organized direct meetings and issued documents requiring the entire credit institution system to stabilize deposit interest rates, reduce lending rates, and be prepared to share a portion of profits to support individuals and businesses in accessing bank credit.

As a result, interest rates have continued their downward trend. As of June 30, 2025, the average lending rate for new loans by commercial banks was approximately 6.9% per year, a 0.1 percentage point decrease compared to the end of 2024. The average deposit interest rate stood at 4.0% per year, also down by about 0.1 percentage points from the end of 2024.

“The key to controlling inflation and maintaining macroeconomic stability is to prevent the money supply and credit from growing too rapidly. Additionally, interest rates should remain positive in real terms. If these two conditions are met, macroeconomic stability is likely to be maintained in the coming years,” Dr. Nguyễn Đức Độ emphasized.

Nguyễn Lê

– 19:34 15/10/2025

Prime Minister Announces 2025 Public Investment Target of 1.11 Million Billion VND, Aiming for 100% Disbursement

On the morning of October 18th, Prime Minister Phạm Minh Chính chaired the National Conference on Accelerating Public Investment for 2025. This marks the fourth conference of the year focused on public investment, held in a hybrid format—in-person at the Government Office and virtually connecting with 34 provinces and cities nationwide.

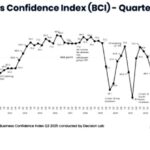

European Business Confidence in Vietnam Reaches Three-Year High

The EuroCham Business Confidence Index (BCI) for Q3/2025 soared to 66.5 points, marking its highest level in three years. This surge reflects the growing optimism among European businesses operating in Vietnam, driven by administrative reforms, green transition initiatives, and resilience amidst global challenges.

Credit Policies, Tax Regulations, and Housing Inequality in Vietnam

Property prices not only reflect the physical balance of supply and demand but also serve as a mirror to the equity of opportunity distribution. When credit and tax policies disproportionately favor those who already possess assets, the system perpetuates inequality, turning real estate into a hotbed for both financial risk and eroding trust.