As of 3:30 PM, the global gold price reversed its trend and rebounded. After dropping to $4,090 per ounce, the spot gold price surged by $50 per ounce to reach $4,140 per ounce.

Earlier, on October 9th, gold experienced significant volatility, reaching a peak, plunging, and then recovering strongly. During the October 9th session, after hitting a high of $4,056 per ounce, gold unexpectedly fell by over 2%, dropping below $4,000 per ounce due to profit-taking by investors and a stronger U.S. dollar. However, it quickly recovered and continued to rise.

On the afternoon of October 14th, gold prices plummeted and then reversed to recover.

——————————————–

After rising by over $100 per ounce in a single day, the global gold price unexpectedly plummeted. In just over an hour of trading, spot gold “evaporated” by $90 per ounce, falling below $4,100 per ounce at 1:30 PM (October 14th, Vietnam time). By 2:00 PM, gold slightly recovered to $4,105 per ounce.

This sudden drop occurred after gold had consecutively surpassed key levels of $4,000 and $4,100 per ounce. Earlier on October 14th, spot gold prices soared to an all-time high of $4,180 per ounce, approaching the $4,200 mark.

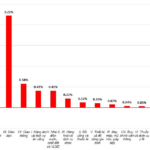

Since the beginning of the year, global gold prices have surged by 56% as investors sought refuge in gold to avoid concerns about various “bubbles,” including technology stocks, public debt, and escalating inflation.

According to Reuters, global trade tensions and geopolitical risks could justify the surge in physical gold purchases as a “safe haven” or diversification tool following U.S. President Donald Trump’s return to the White House in January. However, the “gold frenzy” persists even as stock markets have rebounded strongly from April lows and volatility indices have somewhat cooled.

In reality, loose fiscal and monetary policies worldwide, including threats to the independence of the U.S. Federal Reserve (Fed) and other central banks, have heightened concerns about global inflation, reducing real interest rates and making gold—a non-yielding precious metal—more attractive.

Even as gold reached a new record of $4,100 per ounce this week, Goldman Sachs forecasts a 20% price increase by the end of next year. Société Générale believes gold hitting $5,000 is “almost inevitable,” while JPMorgan views long-term gold positions as one of their most reliable cross-asset investment strategies.

According to Bank of America’s monthly survey, global asset managers ranked “long-term gold positions” as the second most crowded trade in September, just behind U.S. mega-cap tech stocks. However, over one-third of them do not hold gold, and the average portfolio allocation for those investing in gold is only 4.2%.

Nonetheless, three signs in gold’s vertical price surge are causing investor concern: the rapid pace of increase, growing divergence from global volatility indicators, and detachment from correlations with real interest rates and the U.S. dollar.

JPMorgan notes that gold’s recent surge far exceeds what a 1-year decline in real interest rates could typically explain. Usually, lower real yields make gold more appealing compared to other “safe” assets.

Both JPMorgan and HSBC warn that if the Fed’s terminal rate unexpectedly rises again, gold’s upward momentum could be halted. Last quarter, when expectations for the Fed’s terminal rate dropped nearly 50 basis points to below 2.9%, gold prices surged. However, in recent weeks, these expectations have been creeping up, and the U.S. dollar has strengthened partly due to unexpected political developments in certain countries. HSBC also suggests that if global military or trade tensions ease next year, it could significantly hinder gold prices.

Afternoon of October 15: Ring Gold Prices Surge Past 151 Million VND per Tael

This afternoon, the price of gold rings at a leading gold trading enterprise in Hanoi was adjusted to a range of 148.1 – 151.1 million VND per tael.

Global Gold Prices Surge Past $4,000/Ounce: What’s Driving the Historic Rally?

For the first time in history, global gold prices have surged past the $4,000 per ounce milestone during today’s trading session.