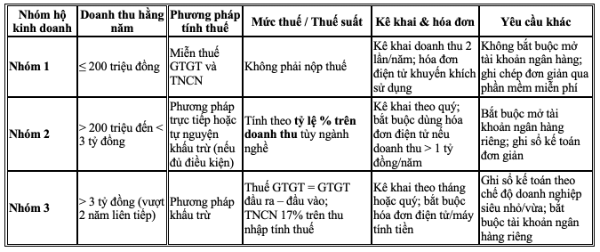

Under the new regulations, individual businesses are categorized into three groups based on their annual revenue. Here’s a detailed breakdown:

Group 1 includes individuals and households with annual revenue not exceeding 200 million VND.

Businesses in this group are fully exempt from value-added tax (VAT) and personal income tax. Instead of frequent declarations, they only need to declare revenue twice a year—at the beginning, middle, or end of the year—to determine their tax obligations. According to the Ministry of Finance, while electronic invoices with codes are not mandatory, they are encouraged, especially for transactions with consumers. Revenue recording is simplified, supported by free software provided by tax authorities. Additionally, this group is not required to open a bank account for business activities.

Group 2 comprises individuals and households with annual revenue ranging from over 200 million VND to under 3 billion VND.

For VAT, businesses in this group pay directly, calculated as a percentage of revenue, or can voluntarily register for the deduction method if they meet the conditions. Specific VAT rates for the direct method are 1% for distribution and supply of goods; 5% for services and construction without material contracts; 3% for production, transportation, services linked to goods, and construction with material contracts; and 2% for other business activities.

Personal income tax is also calculated as a percentage of revenue, depending on the industry. Tax declarations are made quarterly, four times a year, with final settlement at year-end. For businesses in this group with revenue over 1 billion VND/year and operating in retail or direct consumer services as defined by Decree 70 of 2025, electronic invoices must be issued from cash registers connected to tax authorities. Other businesses with revenue under 1 billion VND/year are not required to issue invoices but are advised to record revenue.

Businesses with revenue exceeding 3 billion VND/year for two consecutive years, as monitored by tax authorities, will be moved to Group 3 in the third year.

Group 3 consists of individuals and households with annual revenue exceeding 3 billion VND. This group is required to apply the deduction method when calculating VAT.

For personal income tax, businesses in this group are subject to a 17% tax rate on total profit, where Profit = Revenue minus reasonable expenses. According to the scheme, businesses with revenue over 50 billion VND/year must declare taxes monthly; those with revenue between 3 and 50 billion VND declare quarterly and settle at year-end. The use of electronic invoices with codes or invoices generated from cash registers is mandatory for this group. Additionally, they must maintain accounting records as per the regime for micro or small enterprises and open a separate bank account for business activities.

Classification of the three business groups. Source: Scheme for “Transforming the Model and Tax Management Method for Household Businesses When Abolishing Presumptive Tax”

Vietnam currently has approximately 5.2 million household businesses, generating nearly 9 million jobs, equivalent to the private enterprise sector. The Ministry of Finance acknowledges that many household businesses have long been accustomed to presumptive tax, making the initial transition challenging. However, the Ministry emphasizes that this is a crucial step toward enhancing transparency and fostering private sector growth.

Finance Ministry Withdraws Proposal for Immediate Taxation on Stock Dividends

The Ministry of Finance has opted to maintain the existing tax payment method for dividends and bonuses in the form of securities, requiring payment at the time of transfer rather than upon receipt, as previously suggested. Immediate taxation upon stock distribution is deemed impractical, as investors lack the actual cash flow to pay taxes, while businesses, if required to withhold taxes, would face additional financial strain, potentially impacting their production and business operations.

Finance Ministry Aims to Slash Land Tax Payment Notification Time to Maximum 7 Days

The Ministry of Finance has proposed amendments and additions to regulations concerning land use fees, supplementary payments by households and individuals, and personal income tax on real estate transfers.

Finance Ministry Proposes 0.1% Income Tax on Gold Bar Sales

Following consultations with the State Bank of Vietnam, the Ministry of Finance has submitted a proposal to the Government, incorporating it into the draft Law on Personal Income Tax. This proposal mandates the imposition of personal income tax on transactions involving the transfer of gold bars. The initially suggested tax rate stands at 0.1% of the transfer value.