At Sacombank-SBJ Jewelry Company, silver prices are quoted between 2,022 – 2,073 million VND per tael (buy – sell); meanwhile, Phu Quy Group announced a price range of 1,963 – 2,024 million VND per tael, marking a 2.2% increase from the previous day. In just one month, silver prices have surged by 22%.

This trend mirrors the global silver market, which is currently hovering near its peak at approximately 51.07 USD/ounce, a level not seen since 2011. This upward momentum has fueled speculative sentiment, as many investors anticipate further price increases in line with the rising gold market.

As observed by reporters at Sacombank-SBJ’s headquarters in Ho Chi Minh City on the afternoon of October 14, a long queue of customers awaited their turn to purchase silver. Ms. Minh Hạnh, a resident of Gia Dinh Ward, expressed her intention to buy 10 taels of silver but was informed by staff that the stock was depleted. Customers are required to pre-order and pay in full, with delivery expected within 3-6 months. Early payments are rewarded with discounts ranging from 12,000 to 30,000 VND per tael.

Another customer, Mr. Thanh Duy from Ho Chi Minh City, placed an order for 300 taels of silver, totaling approximately 628 million VND. He views silver as a viable “storage option” due to the scarcity and purchasing difficulties associated with SJC gold bars.

Customers pre-paying for silver purchases receive discounts ranging from 12,000 to 30,000 VND per tael.

A representative from Sacombank-SBJ stated that the company does not impose limits on pre-orders for silver. However, due to the limited daily production capacity of a few hundred taels, customers must await delivery according to the scheduled plan.

Meanwhile, Phu Quy Group’s stores have resumed accepting silver orders after a temporary halt due to stock depletion. Each customer is permitted to register for a maximum of 5 kg of silver per day. Nevertheless, the company reserves the right to cease accepting orders within the day if production targets are met.

Amid the rush to buy silver despite supply shortages, a financial expert warns that silver prices tend to fluctuate more dramatically than gold, thereby carrying significantly higher risks. He notes that while gold prices have risen by approximately 50% since the beginning of the year, silver prices have soared by 80%. “When the market reverses, silver will be sold off more rapidly, often resulting in deeper price declines than gold,” he remarked.

Financial expert Phan Dũng Khánh analyzes that silver investment has only recently gained attention due to the high price of gold. However, he cautions, “If gold prices cool down or reverse, silver prices could plummet more swiftly. Furthermore, the silver market is currently dominated by a few producers and distributors, leading to poorer liquidity compared to gold and thus higher risks.”

According to Mr. Khánh, short-term silver investments may yield profits, but long-term investments are fraught with risks, especially given the current historically high prices. Buyers should remain rational and avoid succumbing to the “silver frenzy” emotionally, lest they fall victim to a bubble effect similar to those observed in gold and cryptocurrency during previous market peaks.

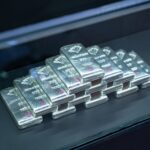

Silver Prices Surge Past 2 Million VND per Tael

Silver prices surged today, both domestically and globally, marking a significant upward trend in the precious metals market.

Silver Prices Remain Steadily Elevated

Silver prices today, both domestically and globally, have continued their upward trajectory in recent days.