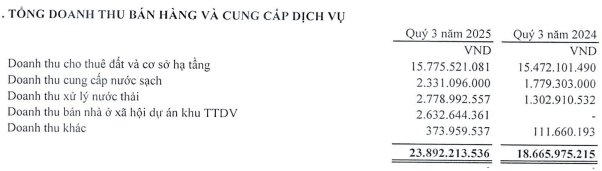

Specifically, in Q3, BAX’s net revenue reached nearly VND 24 billion, a 28% increase year-over-year. This growth was driven by approximately VND 3 billion in revenue from the sale of social housing units within the service center project. Additionally, revenue from wastewater treatment and clean water supply activities surged by 2.1 times and 31%, respectively.

|

Breakdown of BAX’s net revenue in Q3/2025

Source: BAX

|

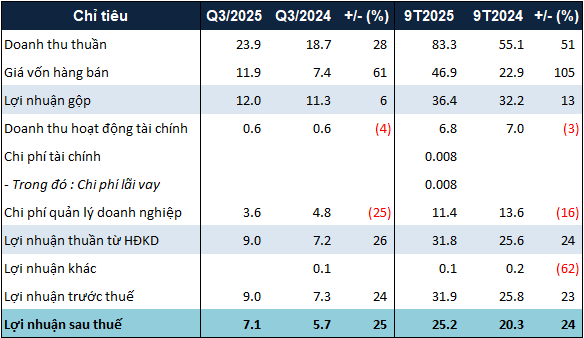

On the cost side, the company incurred no financial or sales expenses. Management costs decreased by 25% to nearly VND 4 billion, thanks to significant reductions in raw material and outsourced service expenses.

As a result, the company’s post-tax profit exceeded VND 7 billion, a 25% increase. The performance for the first nine months of 2025 mirrored Q3, with post-tax profits surpassing VND 25 billion, up 24% year-over-year.

With this post-tax profit, BAX achieved nearly 95% of its annual profit target of VND 26.6 billion after just nine months.

|

Business results for the first nine months of 2025 for BAX. Unit: Billion VND

Source: VietstockFinance

|

As of September 30, 2025, BAX’s total assets stood at nearly VND 735 billion, unchanged from the beginning of the year. However, the company’s short-term cash holdings increased by 14% to nearly VND 254 billion. Conversely, construction in progress costs for the Bàu Xéo Industrial Park service center decreased by 16% to over VND 129 billion.

Total liabilities remained relatively stable at nearly VND 507 billion. The largest portion was unearned revenue, totaling over VND 475 billion, which includes advance payments for land and infrastructure leases.

– 14:13 16/10/2025

Bình Minh Plastics (BMP) Reports Record Profits Under Thai Ownership, with Nearly 70% of Total Assets in Cash

In the first nine months of 2025, Binh Minh Plastic reported a net revenue of VND 4,224 billion, marking a 19% increase compared to the same period in 2024. The company’s after-tax profit reached VND 967 billion, reflecting a notable 27% growth year-on-year.

VPD Boosts 2025 Profit Target by 59%

On October 9th, the Board of Directors of Vietnam Power Development Joint Stock Company (HOSE: VPD) approved adjustments to its 2025 business plan, increasing its commercial electricity output target from 461 million kWh to nearly 579 million kWh, representing a growth of over 25% compared to the previous target.