The Board of Directors of Becamex Investment and Industrial Development Corporation (Becamex Group, HOSE: BCM) has approved the plan for the second private bond issuance in 2025, with a maximum total value of VND 2,000 billion.

The bonds are non-convertible, unsecured, and asset-backed, issued in the domestic market through book-entry form.

BCM plans to divide the issuance into a maximum of 5 tranches, each with a minimum value of VND 100 billion, and maturities ranging from 3 to 5 years. The issuance is scheduled for October to December 2025.

The collateral includes land use rights and assets attached to the land (existing or future) owned by Becamex Group and/or third parties, securing the bond obligations.

Notably, BCM pledges the highest priority lien to bondholders for all rights and interests related to the collateral, including both initial and any additional or replacement assets.

The company aims to use the proceeds for debt restructuring and funding various investment projects throughout 2025.

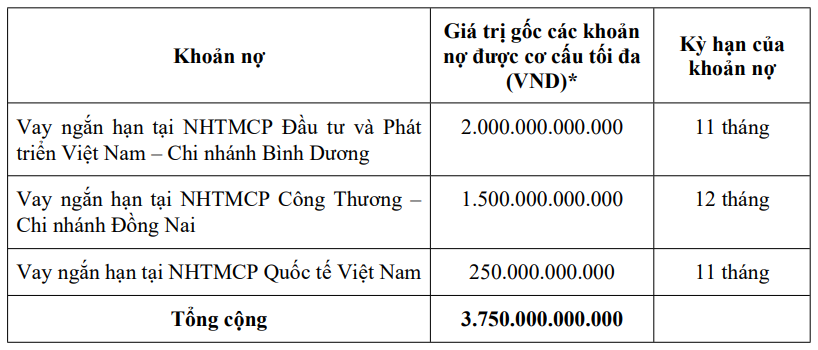

Specifically, Becamex Group intends to allocate the funds to repay bank loan principals and interest.

|

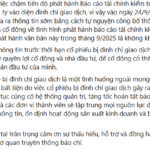

Details of BCM‘s debt restructuring at each bond issuance tranche

Source: BCM

|

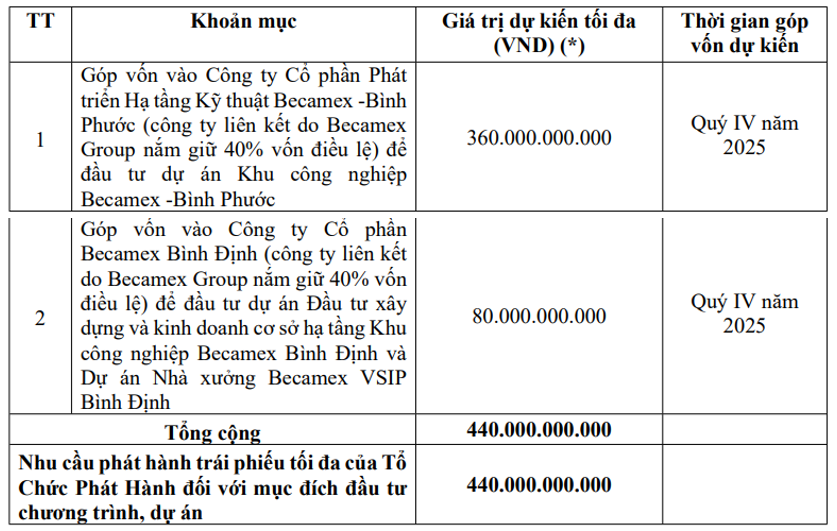

Additionally, the group plans to invest VND 440 billion in affiliated companies: VND 360 billion in Becamex Binh Phuoc Infrastructure Development JSC for the Becamex – Binh Phuoc Industrial Zone project, and VND 80 billion in Becamex Binh Dinh JSC for infrastructure development and factory projects in Binh Dinh.

|

Affiliated companies receiving BCM‘s capital from the bond issuance

Source: BCM

|

In August, BCM successfully raised VND 2,500 billion through bond issuance for debt restructuring, including bond and bank loan repayments. As of September, the total outstanding bond debt exceeded VND 13,900 billion.

BCM raises VND 2,500 billion from bonds in August

– 15:18 17/10/2025

VBMA: Over VND 19.5 Trillion in Bonds Repurchased Prematurely in September

As of September 30, 2025, data compiled by the Vietnam Bond Market Association (VBMA) from the Hanoi Stock Exchange (HNX) and the State Securities Commission (SSC) reveals that 27 corporate bond issuance rounds have been conducted, totaling over 23.7 trillion Vietnamese dong.

Assessing the Impact of Storms, Rain, and Floods on Borrowers’ Loan Status

The State Bank of Vietnam has mandated that credit institutions and branches in affected areas urgently review and assess the status of borrowers to implement support measures for overcoming the aftermath of Typhoon No. 10, ensuring that financial resources reach the intended recipients effectively.