Becamex Group (Industrial Investment and Development Corporation, stock code: BCM, listed on HoSE) has recently announced a resolution by its Board of Directors approving the plan for issuing and utilizing proceeds from the second private bond offering in 2025.

The plan involves issuing up to 20,000 bonds with a face value of VND 100 million each, aiming to raise a total of VND 2,000 billion.

These non-convertible, asset-backed bonds will be issued domestically without warrants. The bonds will be recorded through bookkeeping, with a maximum of five issuance phases, each having a term of 3 to 5 years. The issuance is scheduled between October and December 2025.

The primary objectives of this bond issuance are debt restructuring and funding various investment projects throughout 2025.

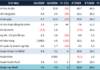

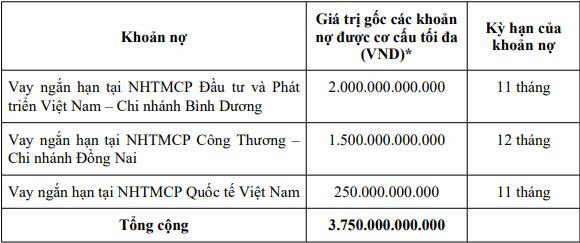

Specifically, Becamex Group plans to allocate the proceeds to settle principal and interest payments on the following debts:

Source: BCM

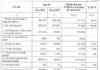

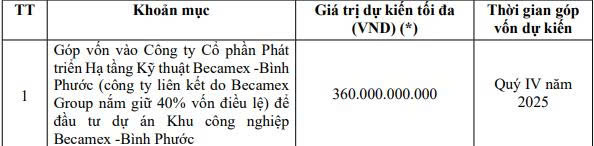

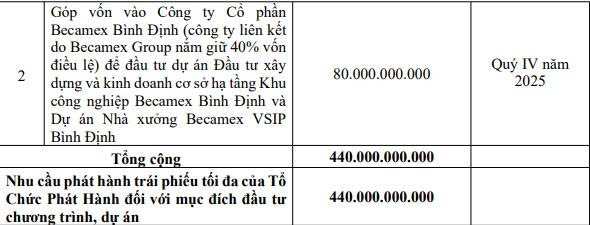

Additionally, the company intends to use the funds for investment programs and projects, including capital contributions to affiliated companies to increase their chartered capital for project development. Details of the recipient companies are as follows:

Source: BCM

In a separate development, Becamex Group previously announced its intention to exercise the right to purchase IJC shares in the offering of over 251.8 million shares by Becamex IJC (Infrastructure Development Corporation).

The share purchase ratio is set at 3:2, meaning shareholders holding 3 shares can purchase 2 new shares.

With its current ownership of nearly 188 million IJC shares, Becamex Group is eligible to acquire over 125.3 million newly issued shares. The transaction is expected to take place from October 1 to October 23, 2025.

At an issuance price of VND 10,000 per share, Becamex Group is anticipated to invest approximately VND 1,253.2 billion to acquire the registered shares.

If successful, Becamex Group’s ownership in IJC will increase from nearly 188 million shares to approximately 313.3 million shares, representing a 49.76% stake in Becamex IJC.

“Investment Opportunity Alert: October 4-10, 2025 – Two Mega Urban Projects Worth Over $9.2 Billion and Four Wind Power Plants with a Combined Capacity of 950MW”

During the week of October 4–10, 2025, six provinces and cities in Vietnam launched investment calls for eight major projects, totaling over 64.3 trillion VND in capital. Highlights include four wind power plant projects with a combined capacity of more than 950MW in Quang Tri and Ha Tinh, as well as two urban development projects valued at over 21.1 trillion VND in Da Nang and Khanh Hoa.

Assessing the Impact of Storms, Rain, and Floods on Borrowers’ Loan Status

The State Bank of Vietnam has mandated that credit institutions and branches in affected areas urgently review and assess the status of borrowers to implement support measures for overcoming the aftermath of Typhoon No. 10, ensuring that financial resources reach the intended recipients effectively.