According to the announced information, the bond issuance totaled VND 450 billion, issued on December 31, 2020, with a 36-month term and an annual interest rate of 10.5%. The purpose was to expand operational capital and invest in real estate. At maturity, the remaining principal debt was VND 346.5 billion, with a total payment value (including principal and interest) exceeding VND 356.98 billion.

Cen Land’s proactive and timely fulfillment of its financial obligations to bondholders not only demonstrates the financial responsibility and credibility of a listed company but also signals strong cash flow management and financial health amidst a gradually recovering market.

A Cen Land representative stated that the corporate bond market is showing signs of improvement due to legal unblocking policies and the recovery of cash flow in the real estate sector. Cen Land has prepared an acceleration strategy for the upcoming period, positioning itself to capitalize on the market’s new recovery cycle. The focus will be on affordable housing and mid-range products, which are considered pillars of sustainable growth.

23 Years of Upholding the “GEN Nguồn” Spirit of Passion and Kindness

Over 23 years of establishment and development, Cen Land has solidified its position as Vietnam’s leading real estate distribution company, offering a comprehensive real estate service ecosystem. Beyond its role as a “sales agent,” Cen Land is a pioneer in restructuring and revitalizing numerous projects, delivering real value and community vitality to urban areas.

The company is intensifying its focus on affordable housing in dynamic markets such as Hai Phong and Quang Ninh, notably with projects like An Zen Residences and Quang Yen Centro, catering to real residential needs.

Quang Yen Centro is a flagship project, marking a significant milestone in Cen Land’s expansion strategy into high-potential regions.

Additionally, Cen Land is set to launch the College of Economics and Technology – Cen EcoTech, the first college in Northern Vietnam offering a practical Bachelor’s program in Real Estate Business Administration. Students will learn in an industry-aligned environment, trained by leading experts and businesses, with a guaranteed 100% employment rate upon graduation within the Cen Group ecosystem and strategic partners.

In 2025, marking its 23rd year of establishment and growth, Cen Land continues to affirm its internal strength and the “GEN Nguồn” spirit—Passion and Kindness—as the guiding principle in all its activities. The company aims not only for growth in scale or revenue but also for sustainable development, creating tangible value for customers, communities, and society.

2025 opens a new chapter in Cen Land’s development journey—a journey of robust transformation, building a comprehensive living and well-being ecosystem. It underscores the company’s stable financial capabilities, listed credibility, and long-term vision within Vietnam’s real estate ecosystem.

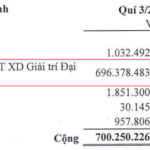

Record-Breaking Q3 for HDC: Nearly 550 Billion VND Profit After Selling Dai Duong Vung Tau Company

Despite a sharp decline in real estate revenue and shrinking profit margins, Hodeco achieved record-high profits, driven by a nearly 700 billion VND gain from the sale of its stake in Dai Duong Vung Tau Company.

Credit Policies, Tax Regulations, and Housing Inequality in Vietnam

Property prices not only reflect the physical balance of supply and demand but also serve as a mirror to the equity of opportunity distribution. When credit and tax policies disproportionately favor those who already possess assets, the system perpetuates inequality, turning real estate into a hotbed for both financial risk and eroding trust.

Vietnam’s Largest Auto Distributor Reports Q3 Profit Surging 59x Year-on-Year, Stock Hits Daily Limit Up

In the first nine months of the year, the company achieved a remarkable net revenue of 20,547 billion VND, marking a 27% increase compared to the same period in 2024. The parent company’s post-tax profit soared to 450 billion VND, an astounding 8.7-fold growth year-over-year.

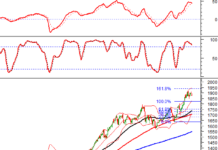

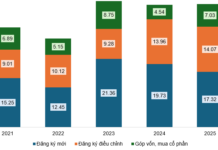

Over 4 Million Trillion Dong in Real Estate Credit: What Could Happen Next?

As of the end of August 2025, real estate credit outstanding debt has surpassed 4 million trillion VND, accounting for nearly a quarter of the total debt in the economy. This substantial capital inflow is anticipated to stimulate market recovery, yet it also raises concerns regarding capital efficiency and the potential risk of an asset bubble.