Specifically, the State Bank of Vietnam (SBV) has approved HDBank (HOSE: HDB) to increase its charter capital by up to VND 3,493 billion through the issuance of shares for bond conversion, as per the capital increase plan approved by the Annual General Meeting of Shareholders.

In the event of converting international bonds, SBV requires HDBank to notify in writing to SBV via the Foreign Exchange Management Department, in accordance with Article 9, Clause 2, Point e of Circular 10/2022/TT-NHNN dated July 29, 2022, guiding foreign exchange management for issuing bonds in the international market by non-government-guaranteed enterprises.

On October 13, HDBank announced the completion of share issuance for bond conversion. Consequently, HDBank’s charter capital increased from VND 35,101 billion to VND 38,594 billion.

The bank issued over 349 million conversion shares at a conversion price of VND 10,600 per share, equivalent to 100% of the total expected shares. The number of converted bonds is 1,600. The expected share delivery is scheduled for 2025 until the end of Q2/2026, following the completion of issuance procedures with relevant authorities.

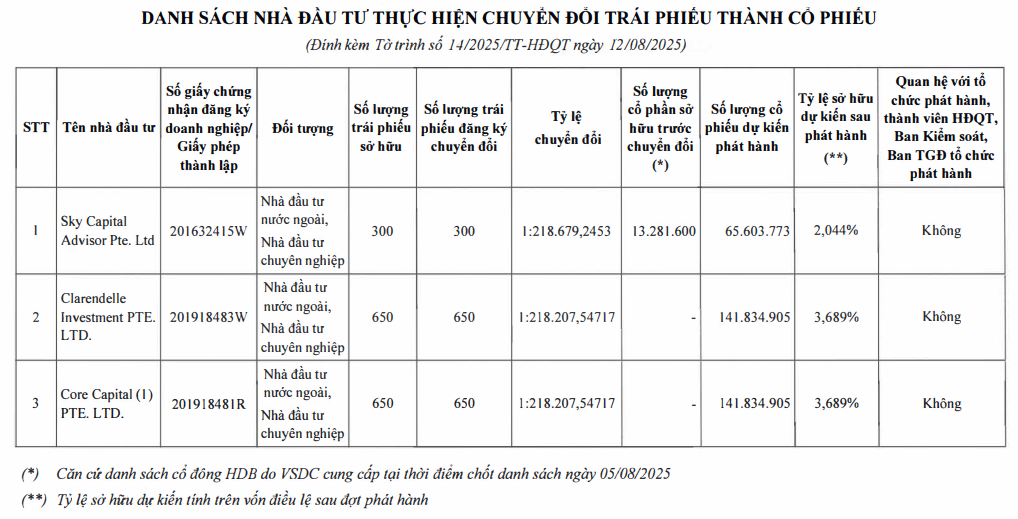

The three organizations executing the conversion are: Sky Capital Advisor Pte. Ltd (registered 300 bonds), Clarendelle Investment Pte. Ltd (650 bonds), and Core Capital Pte. Ltd (650 bonds).

As a result, Sky Capital Advisor Pte. Ltd increased its ownership from 13.3 million shares to nearly 79 million shares, equivalent to 2.044% of the capital. Clarendelle Investment Pte. Ltd and Core Capital Pte. Ltd both raised their ownership to 3.689%.

The foreign ownership ratio at HDBank thus increased from 16.569% to 24.149%.

On HOSE, HDB shares are trading at around VND 32,950 per share (as of October 15), up more than 29% since the beginning of the year. Average liquidity is over 14 million shares per day.

| HDB share price movement since the beginning of the year |

– 13:58 15/10/2025

Central Bank Issues New Circular on Gold Trading Activities

On October 9, 2025, the Governor of the State Bank of Vietnam signed and issued Circular No. 34/2025/TT-NHNN, providing guidance on several provisions of Government Decree No. 24/2012/NĐ-CP dated April 3, 2012, regarding the management of gold trading activities. This circular incorporates amendments and supplements introduced by Decree No. 232/2025/NĐ-CP.

Assessing the Impact of Storms, Rain, and Floods on Borrowers’ Loan Status

The State Bank of Vietnam has mandated that credit institutions and branches in affected areas urgently review and assess the status of borrowers to implement support measures for overcoming the aftermath of Typhoon No. 10, ensuring that financial resources reach the intended recipients effectively.